Consumers and personal finance experts have hit back against proposals to cut tax breaks for cash Isas, the popular savings accounts that allow savers to earn tax-free interest.

During a meeting last month, City firms lobbied chancellor Rachel Reeves to scale back incentives for cash Isas, arguing that the money would be put to better use if it were invested in the stock market.

But for many savers, these products form an invaluable part of their personal finances, owing to their lack of volatility compared with investments, and the ability to withdraw money at short notice.

“You always know what you’re going to get, there are no fees and [cash Isas] are safe and stable,” says Andrew Hagger, founder of consumer finance site MoneyComms. Because personal savings limits have been frozen since their introduction in 2016, he says an increasing number of people have become liable for tax on interest earned outside wrappers such as Isas. People who need ready access to cash might be deterred from investing by stock volatility, he adds, citing the turbulence in markets in the past week following US president Donald Trump’s tariff threats.

Hagger says that cash Isas are especially popular with older savers, who use the products to supplement their pensions.

FT reader Ken, 78, a retired business owner, says he feels “safer” holding his money in cash Isas. “At my age, putting money into stocks and shares is just not on — you can’t guess what’s going to happen to you.”

Patrick Degenaar, an FT reader and professor at Newcastle University, says cash Isas provide him with a “buffer” for unforeseen expenses. “If you have your money tied up in stocks and shares, the danger is you’ll have to do a fire sale of them and you can lose lots of money that way.”

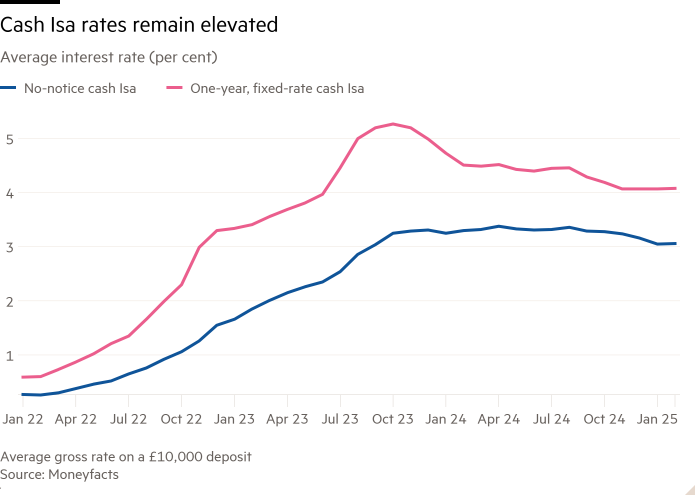

Cash Isas — which allow maximum deposits of £20,000 a year — have become more popular over the past two years as central banks have increased interest rates, raising the competitiveness of savings products.

Just under two-thirds of the UK’s 22mn Isa holders hold cash Isas alone, according to analysis of the most recent HM Revenue & Customs’ data by AJ Bell, a financial platform.

However, some financial services companies argue that encouraging investing could generate higher returns for savers over the long term and has the potential to bolster the UK’s flagging economy.

Andy Briggs, chief executive of the Phoenix insurance group, was one of the executives present at the chancellor’s meeting. He told the FT last week: “The state should not be giving a tax break for us all to park our money in cash.” He said he was “hopeful” the chancellor would “refocus Isa tax incentives to make them consistent with the government’s very welcome growth agenda”.

But some readers told FT Money they were angered by the proposals. “To see that it’s the people in the City pushing for this [is infuriating],” says a 51-year-old marketing executive, who asked not to be named. “You’re not doing great in giving me reasonably consistent returns and now you’re asking the government to send money to you — I’m outraged.”

Some in the retail banking industry question the logic of cutting back tax breaks on cash Isas to boost investing.

“This isn’t just about very wealthy savers putting [the full] £20,000 into their cash Isas each year,” says Tom Riley, director of retail products at Nationwide Building Society. “Given what’s happened with interest rates, we’re seeing quite a lot of uptake from people in lower economic bands who don’t have lots of disposable cash and cash Isas are very important for their income.”

Nationwide says that its average total Isa balance — often accrued by customers over several years — is £15,000.

The City firms’ overtures to Reeves come as financial advisers raise concerns that Britons aren’t investing enough and risk reaching old age with inadequate retirement income.

But “the idea that by changing the Isa, you’ll get people investing — we don’t think that’s true,” says Anne Fairweather, head of government affairs and public policy at Hargreaves Lansdown, which operates one of the UK’s largest savings platforms.

“Most people are PAYE earners and don’t know anything about tax returns or investing,” she says, explaining that people trust the Isa and appreciate its simplicity. “There’s a risk that if you chop and change the framework that people lose faith in it, and choose to spend the money rather than save it for the longer term.”

In the worst case, scaling back reliefs for cash Isas could damage the UK’s growth, says Nationwide’s Riley.

Building societies are required by law to fund at least half of their mortgage lending with members’ deposits. Riley says that a fall in the amount held in its cash Isas would cause Nationwide’s deposits to plunge, meaning they would be forced to issue fewer mortgages, which in turn could trigger a downturn in the housing market. Nationwide is one of the UK’s largest lenders to first-time homebuyers.

Dame Harriett Baldwin, a Conservative MP and member of the Treasury select committee, suggests that a better way to encourage investment is to reform rules on financial advice.

Advisers have complained that they are unable to provide sufficient support to customers who can’t afford bespoke advice. The Financial Conduct Authority is exploring a “targeted support” regime for pensions to allow authorised parties to give guidance to groups of people with similar financial circumstances.

Baldwin says there is “scope to make the advice-guidance boundary less strict so that savers do get informed about the higher rewards that are available to those who take a higher investment risk”.

Ultimately, says Baldwin, “anything that makes it harder to save free of tax [is] to be deplored.”