- The CMF on the daily chart of HBAR was above +0.05, highlighting heavy capital inflows.

- Sustained buying pressure is likely to drive the rally higher over the coming weeks.

Hedera [HBAR] has retested $0.176 as support as laid out in an analysis from February, but it took longer than anticipated.

The Bitcoin [BTC] move below the $92k support affected the altcoins, but some have begun to react positively after the recent losses. HBAR was one such token.

Hedera on a bullish trajectory, targets $0.284

The break above the recent lower high at $0.23 (blue) showed a bullish market structure break on the daily chart. This came on the back of the defense of the 61.8% Fibonacci retracement level at $0.175.

The CMF had dropped to -0.24 on the 24th of February. Over the past week, the CMF has reversed its course and was at +0.09 at press time, going from extremely bearish to sizeable bullish capital flows.

However, the Awesome Oscillator remained below the zero line to show bearish momentum remained prevalent.

The $0.255-$0.265 region had been a strong support zone in December, but failed in January. On the way upward, Hedera bulls would likely face firm opposition from sellers in the same region.

Therefore, despite the bullish structure break, a quick move toward $0.35 might not materialize. Instead, the fair value gap from $0.216-$0.242 might be revisited before another move higher.

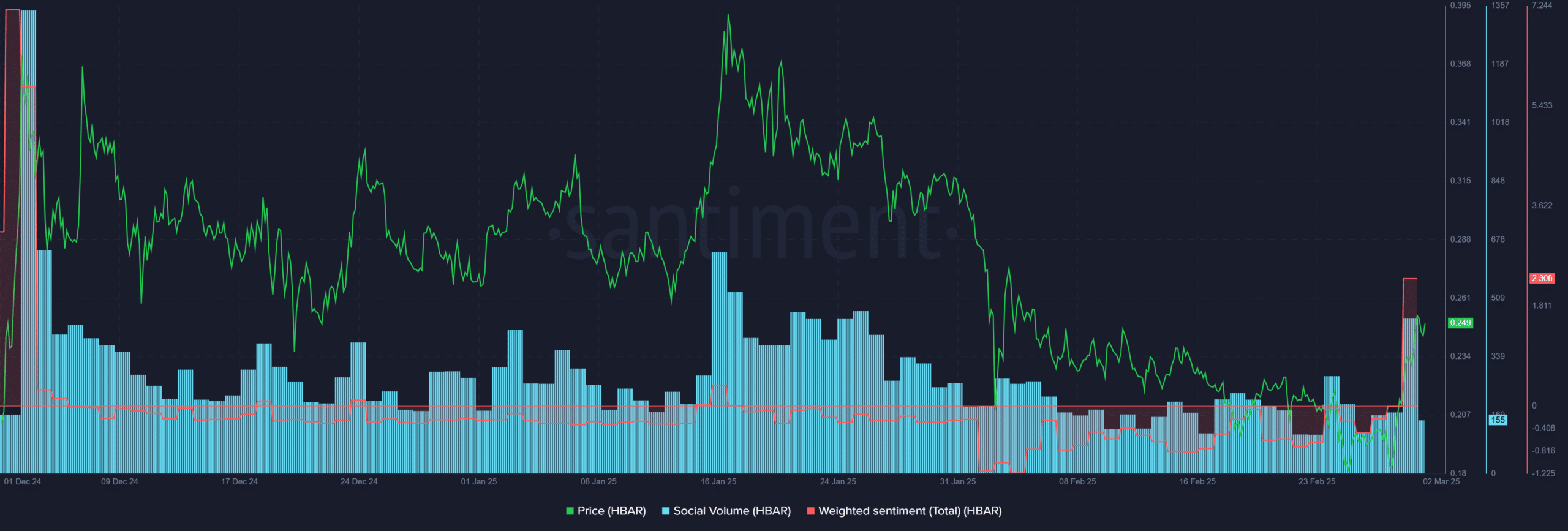

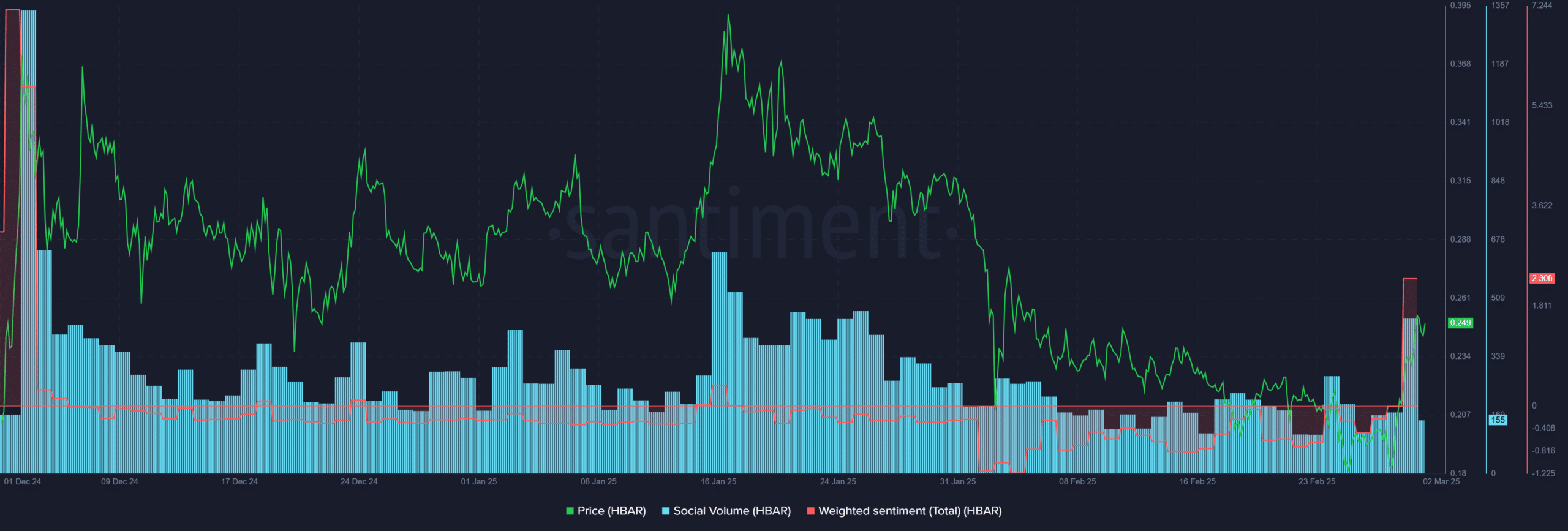

Source: Santiment

Santiment data showed that Social Volume had been trending downward alongside the price. The recent gains ended this trend.

The Social Volume has improved, and the Weighted Sentiment was in positive territory once again.

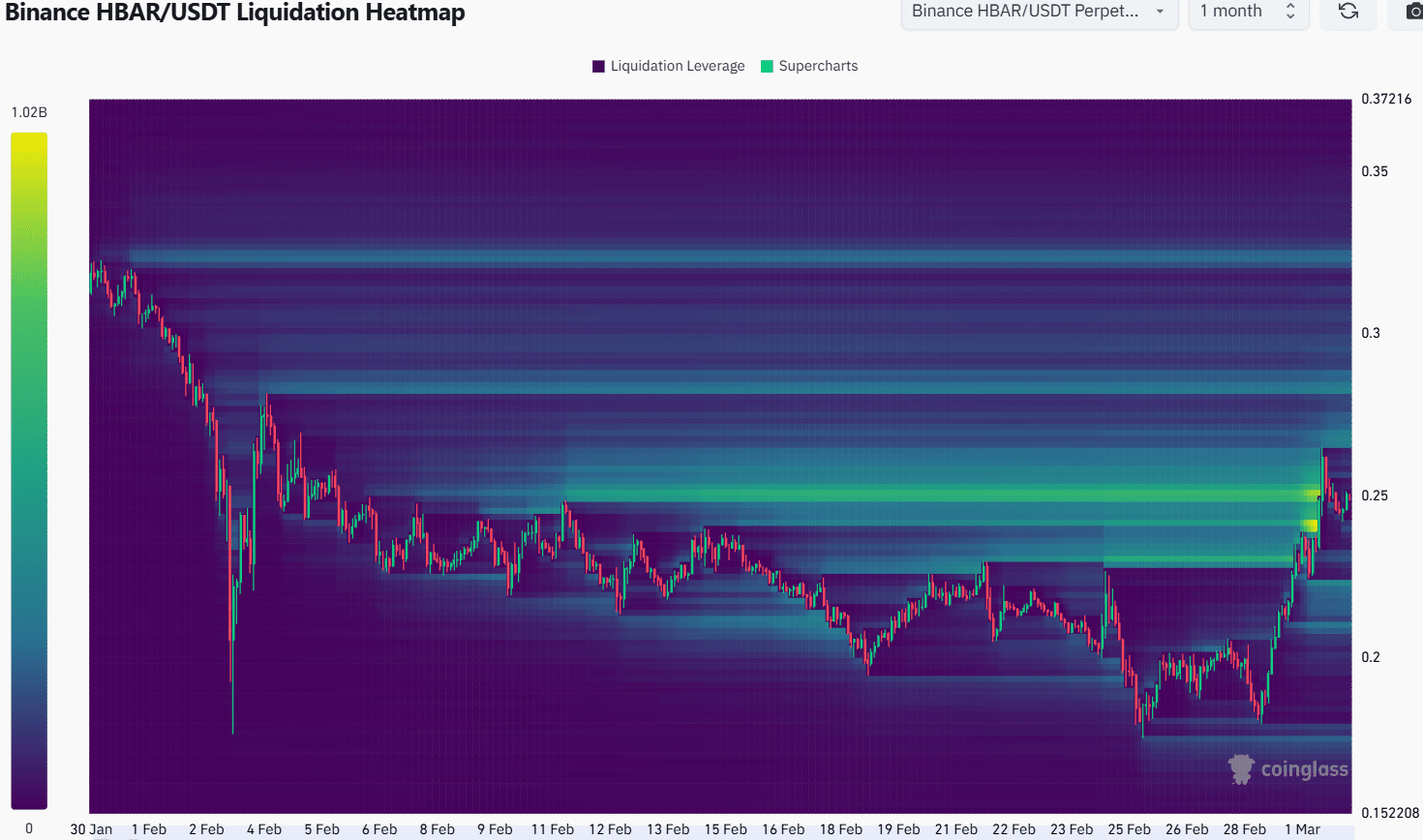

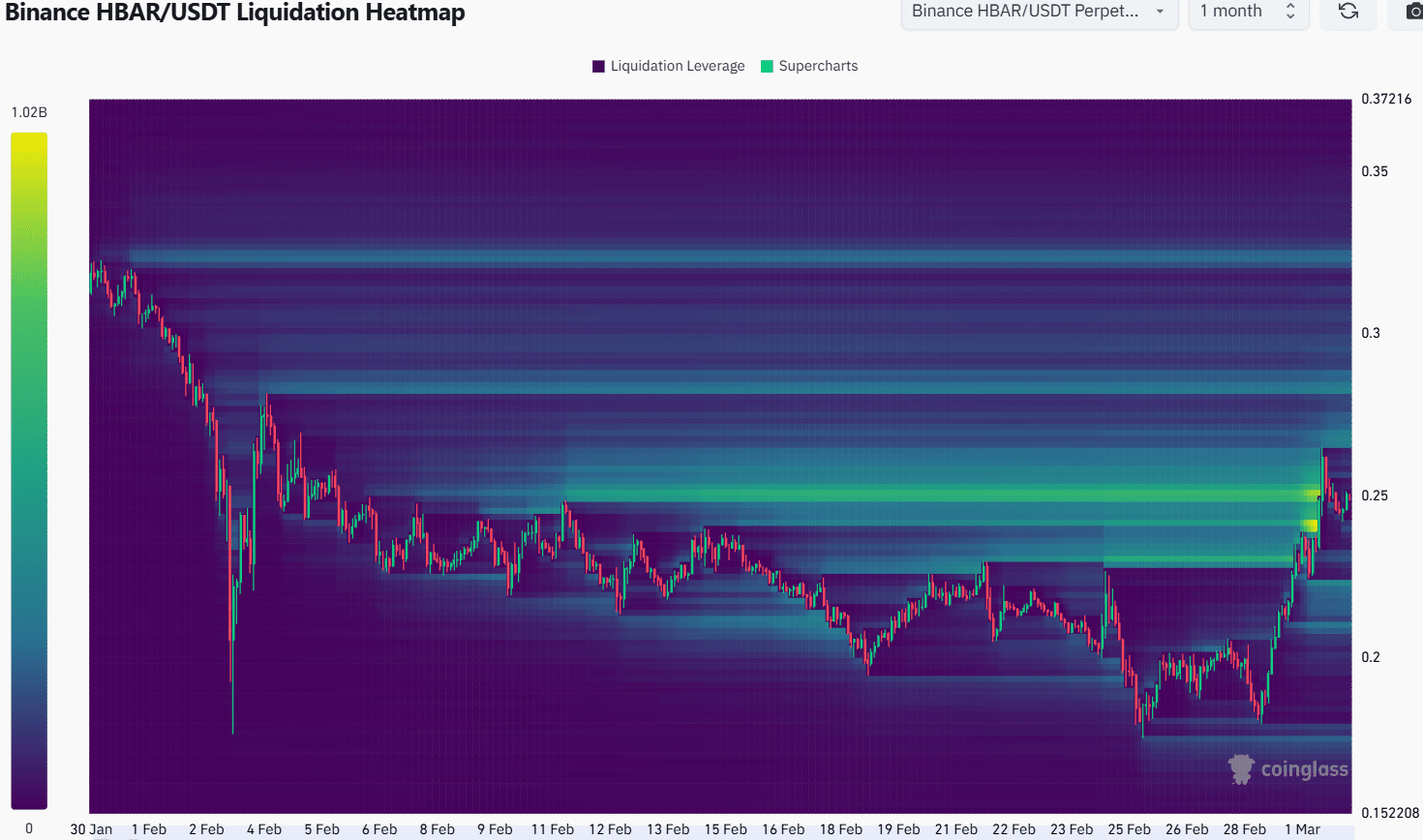

Source: Coinglass

The 1-month liquidation heatmap revealed that the liquidity pocket at $0.25 has been swept. The price could consolidate around the $0.24 region in the coming days, building up liquidity before hunting it down.

As things stand, the next upside targets were $0.267, $0.284, and $0.326.

To the south, the $0.224 and $0.24 levels saw a build-up of liquidation levels too. In a few days, a dip to these levels would likely present a buying opportunity for swing traders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion