Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Florida has attempted to get its property insurance house in order. It looks like it may topple over anyway. Already reeling from two hurricanes in recent months, the monstrous Hurricane Milton pummelling Tampa could cause more than $60bn in insured losses.

The problems in the Florida homeowner’s insurance sector are well known. For a stretch of several years earlier this century, the state had avoided any major direct hurricane hits. But its luck has shifted and because of climate change, storms appear to have greater potency.

Florida has 1,350 miles of shoreline that is heavily developed and an overall population of more than 20mn. Moreover, property insurance claims historically have been highly litigated and prone to fraud in the Sunshine State, adding to costs.

The result was untenable enough that Florida enacted legislative changes to fix the legal process over insurance claims to discourage junk lawsuits and excessive fees to lawyers. Eight new private insurers recently entered the market and, according to the state insurance regulator, Florida insurers broke even on underwriting in 2023 after heavy losses in the preceding years.

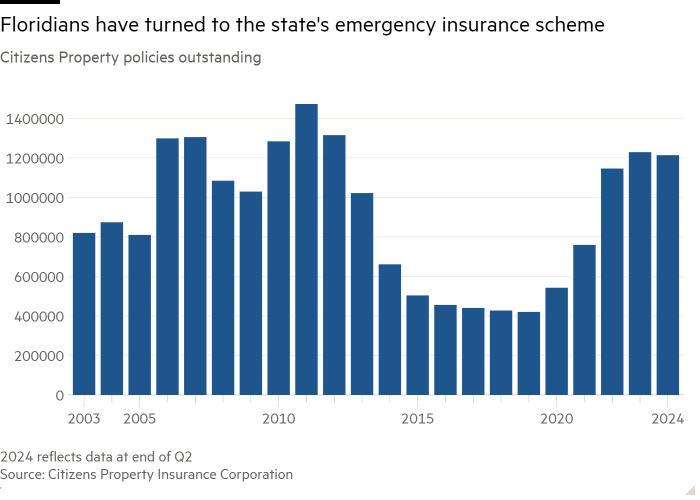

In the midst of all of this is Citizens Property Insurance Corporation, established by Florida in 2002 as a “last resort” insurer that has increasingly become the only option for many of the state’s residents. Despite efforts at “depopulation” — or attempts to shift its policyholders to private providers — Citizens’ book of business has swelled to more than 1.2mn out of more than 7mn total homeowner policies in Florida.

Its 2024 budget forecast hitting $1.5bn of net income and $6bn in surplus, one element that combined with reinsurance determines Citizen’s ability to pay claims. But a once in a 100-year event, it said, would lead to $18bn in losses and its surplus turning negative. Were Citizens to run through its surplus and other coverage, it must under Florida law levy surcharges on its customers and other policyholders in the state.

The world is awash in capital looking for returns. But it may be that a warming planet cannot be underwritten at any acceptable cost.

It is ironic that Florida may have become uninsurable just after its population has surged, bolstered by wealthy refugees who wanted warm weather as well as low taxes, limited regulation and a high-growth economy. Perhaps some among this accomplished group can design an insurance scheme that works in a changing climate.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here