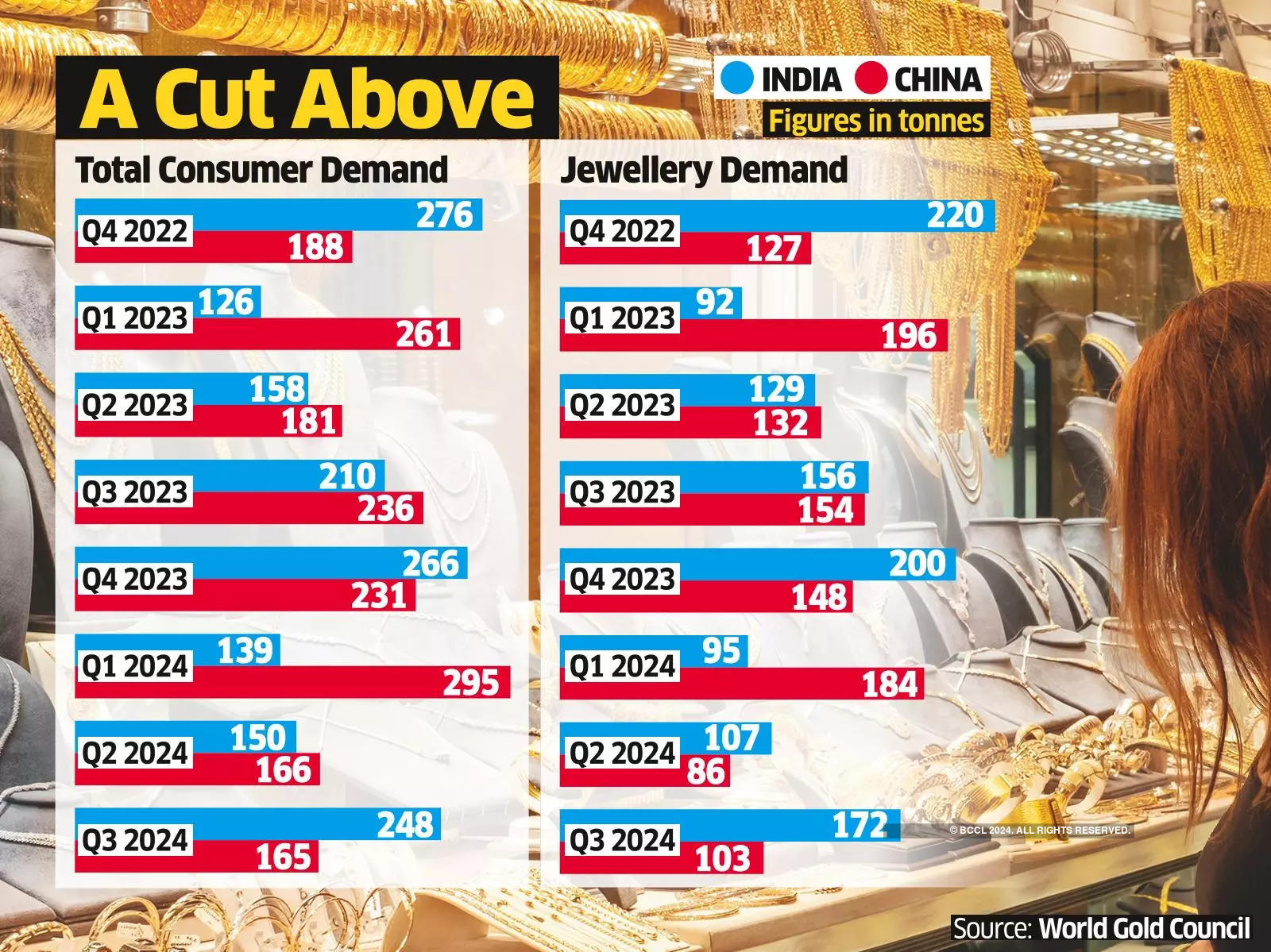

Indian consumers purchased 51% more gold compared to China between July and September led by higher purchases of gold coins and bars, as per latest World Gold Council data.

The data showed Indians purchased 248.3 tonnes of gold compared to China’s 165 tonnes. On a year-on-year basis, India’s demand for gold surged by 18% in July-September. This surge in demand is due to the drop in import duty on gold from 15% to 6% as announced in the budget on July 23 and revenge buying by consumers.

While India has earlier surpassed China twice in overall gold demand in the last eight quarters, it was due to gold jewellery purchases. This was in the October-December quarters of 2022 and 2023. Last quarter, as against 62 tonnes of gold coins and bars purchased by the Chinese, Indians bought 77 tonnes.

Sachin Jain, regional CEO (India) of World Gold Council, said the momentum in consumer demand picked up sharply in late July and remained strong till mid-September. “There was a 41% increase in investment demand. India’s bar and coin demand jumped to its high in July-September quarter since 2012. The July duty-led price correction accelerated investor optimism and bullish price expectations, which allowed many investors to enter market,” he said.

Gold jewellery demand in India in July-September quarter increased by 10% to 171.6 tonnes from the year-ago period. The confidence of Chinese consumers remains at a record low impacting the gold offtake in the country.

This rise in gold demand in the last quarter was despite the average price of gold being higher at ₹66,614 per 10 gm as compared to ₹51,259.8 per 10 gm in the same period last year. Gold is in a bull run in the backdrop of a volatile equity market. “India’s gold demand remains solid in Q4 due to Dhanteras and wedding demand, although with the continued rise in the gold price offsetting the impact of the duty cut, we may see an increased trend for investors to wait for price corrections as opportunities to add to their holdings. We expect full-year gold demand to be in range of 700-750 tonnes,” added Jain.