Closing summary: Rees-Mogg’s investment firm to close

The investment fund co-founded by Tory politicians Jacob Rees-Mogg and Dominic Johnson is to close after losing one of its biggest clients.

It is unclear whether Rees-Mogg, who co-founded the fund in 2007 and remains a minority shareholder, will have effectively made a loss on his stake as a result, reports the Guardian’s Kalyeena Makortoff.

The Tory MP is reported to have pocketed at least £7.5m in dividends from Somerset since the EU referendum in 2016, including £500,000 in 2022. He also received about £15,000 a month from the firm on top of his MP’s pay until 2019, when he became a minister under Boris Johnson.

Here are some of the other business news highlights from today:

-

Spanish economy minister Nadia Calviño is likely to be the next president of the European Investment Bank, one of the most important jobs in the EU, it has emerged.

-

One of Spotify’s top executives cashed in more than $9m (£7.2m) in shares as the value of the world’s biggest music streaming service surged after it announced it was laying off almost a fifth of its workforce to cut costs.

-

McDonald’s is launching a new kind of restaurant, CosMc’s, a retro-style store with treats and customisable drinks including “s’mores cold brew”, “churro frappes” and “turmeric latte” that could rival chains such as Starbucks.

-

The BBC licence fee will rise by £10.50 to £169.50 a year, the culture secretary, Lucy Frazer, has confirmed.

-

UK house prices rose by 0.5% in November, according to data from lender Halifax.

-

South East Water, which left thousands of customers without running water this summer, has paid out dividends of £2.25m over six months while overseeing increased losses of £18.1m before tax.

-

The billionaire British hedge fund manager Sir Chris Hohn paid himself $346m (£276m) this year – more than £1m for every working day.

You can continue to follow our live coverage from around the world:

In the UK, Rishi Sunak defends Rwanda asylum policy as Tory split deepens

In our coverage of the UK coronavirus inquiry, Boris Johnson says no scientists attended meetings about “eat out to help out” scheme before it launched

In our Europe coverage, Greece and Turkey sign 15 deals during ‘groundbreaking’ Erdoğan visit to Athens

In the US, the DNC chair calls Republican debate ‘chaotic, petty and pathetic’

In our coverage of the Israel-Hamas war, 350 Palestinians killed in last 24 hours, Gaza health ministry says

In our coverage of the Russia-Ukraine war, nearly 20,000 children deported to Russia, Ukraine’s human rights commissioner says

Thank you for following our live coverage of business, economics and financial markets. Please do join us tomorrow for more. JJ

Key events

Spain’s economy minister frontrunner for European Investment Bank say diplomats

Lisa O’Carroll

Spanish economy minister Nadia Calviño is likely to be the next president of the European Investment Bank, one of the most important jobs in the EU, it has emerged.

Despite a late decision by Italy to back Denmark’s Margrethe Vestager, who left her job as a European commissioner to join the contest, Calviño remains the favourite in the impending selection involving votes by each member state, diplomats say.

The role will be discussed by finance ministers who are meeting in Brussels tomorrow. “It looks quite good for her, she is the frontrunner,” said one diplomat. The person added:

Italy alone will not be able to blow this up.

Either way it will mean that three of the top four international banking jobs will be held by women. The European Central Bank is headed by Christine Lagarde and Kristalina Georgieva is in situ as managing director of the International Monetary Fund.

The bulk of Elon Musk’s wealth is tied up in his share in Tesla, the electric car company he took over and grew into the world’s most valuable. But he has other irons in the fire.

Bloomberg reports that one of those, rocket company SpaceX, is to be valued at $175bn (£139bn) in its latest investment round.

It said the company could sell shares worth between $500m and $750m. That would be a premium to the previous valuation of $150bn in a fundraising during the summer.

SpaceX has upended the global space industry, pushing down the cost of rocket launches dramatically and building a pioneering low-earth-orbit constellation of satellites.

Musk is also the owner of X, the social network formerly known as Twitter, and the foudner of xAI, a company aiming to rival the likes of OpenAI and Meta in building artificial intelligence.

SpaceX did not respond to requests for comment, Bloomberg reported.

Kalyeena Makortoff

McDonald’s is launching a new kind of restaurant, CosMc’s, a retro-style store with treats and customisable drinks including “s’mores cold brew”, “churro frappes” and “turmeric latte” that could rival chains such as Starbucks.

The fast food company said it would open its first pilot site in a Chicago suburb near its headquarters this month, as part of efforts to “solve the 3pm slump”, when it gets fewer customers between the lunch and dinner rush.

The proposed menu features of a range of speciality lemonades, blended drinks and teas, with flavours such as “popping pear slush” and “tropical spiceade” that can be customised with tapioca pearls, flavoured syrups and energy or vitamin C shots.

You can read the full report here:

Sadly it appears that our prediction of wildly spraying champagne English sparkling wine did not come true at the listing of Chapel Down this morning.

But the company – occasionally described as a purveyor of “Brexit juice” – did at least have a moment in the London Stock Exchange lobby this morning, according to these pictures:

(It should be noted at this point that Jacob Rees-Mogg has claimed the mantle of “Brexit juice” for his Somerset-grown cider, rather than English sparkling wine.)

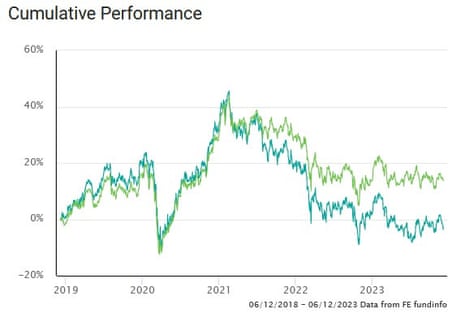

Somerset Capital Management’s funds had bet more money on Chinese companies than some of their rivals, the Financial Times reported. That hurt its performance as the world’s second-largest economy faltered.

The below graph shows the performance of the MI Somerset Global Emerging Markets fund collated by Trustnet. It shows how the Somerset fund (in blue) has been below a benchmark comprising other emerging markets funds (in green).

Underperforming a benchmark is a sure-fire way to have clients ask why they are paying expensive fees.

Jacob Rees-Mogg is not the only Tory politician involved with Somerset Capital: his co-founder Dominic Johnson stepped down as chief executive last year to serve as a minister under Liz Truss. He is now Rishi Sunak’s minister for investment.

Somerset Capital specialised in investing in so-called emerging markets – poorer countries. Investors have to balance the opportunities for economic growth with potential issues such as a shaky rule of law.

The firm was able to attract major clients, garnering assets under management of as much as $10bn (£8bn) at its peak. However, that had fallen to $3.5bn by November.

That left St James’s Place as its key client. When it withdrew $2.5bn it reportedly left Somerset with relatively high costs compared with its assets under management. Hedge funds or investment funds tend to take a percentage of assets as a management fee each year, so big outflows can be very financially damaging.

The Financial Times reports that: “SJP’s exit unsettled remaining clients, which include the State Board of Administration of Florida and the Civil Service Superannuation Board of Manitoba in Canada.”

Somerset Capital Management came under closer scrutiny than most investment funds because of Jacob Rees-Mogg’s part-ownership.

Sometimes the right-wing Conservative MP’s views appeared at odds with the views of the company. In 2018 Somerset described Brexit as a financial risk in a prospectus to a new fund it launched, at a time when Rees-Mogg was among the most prominent proponents of a “hard” Brexit in which the UK left the EU’s single market – a path that the Conservative government eventually chose.

The Guardian has previously reported that Somerset Capital Management was an investor in oil and coal mining. Rees-Mogg has been an advocate of continued extraction of fossil fuels.

Hedge fund co-founded by Jacob Rees-Mogg to close

The hedge fund co-founded by Conservative MP Jacob Rees-Mogg is set to wind down after its biggest client left.

Somerset Capital Management lost about £2bn in assets from its largest client, St James’s Place, leaving it managing only about £1bn, a level that is generally considered small in institutional hedge fund terms.

The firm said it was “closing its wider institutional business in London”.

Rees-Mogg co-founded the firm in 2007, and was actively involved for several years. He stopped receiving wages in 2019 when he became a minister under then prime minister Boris Johnson, but continued to receive dividends as an equity partner, including an estimated £500,000 for 2022.

Somerset had held talks about a potential sale of the firm valued at between £70m and £100m, but those fell through at the end of 2022.

Somerset’s UK funds and their managers were trying to find a new home that would allow them to retain the existing fund and third-party infrastructure, the firm said.

Oliver Crawley, a partner at Somerset, said:

It has been a privilege to manage capital for world-leading institutions and clients for over 16 years. I am incredibly proud of all we have achieved in that time through the hard work and skill of our dedicated team.

The current teams have delivered strong performance for their investors and continue to do so. We hope a transition can be secured which we believe will give the funds a bright future.

Kalyeena Makortoff

The Financial Conduct Authority is getting the wheels in motion to ensure there is “reasonable access to cash” for personal and business customers across the UK.

The consultation comes months after the government promise in August that it would introduce rules that would guarantee cash access within three miles of customers’ local communities.

While the new rules won’t prevent bank branch closures, the proposals will force high street banks and building societies to:

-

Launch cash access “assessments” when they make any changes or closures, to understand whether new services are needed to fill local gaps.

-

Respond to requests from local residents, community organisations and representatives to consider, assess and plug those gaps.

-

Deliver “reasonable additional cash services” if gaps are left by those changes.

-

Ensure they do not close cash facilities, including bank branches, until those gaps are closed.

-

Sheldon Mills, the FCA’s director in charge of consumers and competition said:

We know that, while there is an increasing shift to digital payments, over 3m consumers still rely on cash – particularly people who may be vulnerable – as well as many small businesses. It’s important that we support consumers impacted by recent innovations.

These proposals set out how banks and building societies will need to assess and plug gaps in local cash provision. This will help manage the pace of change and ensure that people can continue to access cash if they need it.

The consultation will run until 8 February.

Australian oil and gas companies in talks over £42bn merger

Two of Australia’s biggest fossil fuel producers are in talks to merge, in a potential A$80bn (£42bn) deal.

Woodside Energy and Santos are worth A$57bn, while Santos is valued at A$22bn.

In a stock market announcement in response to “media speculation” (it’s hardly “speculation” if it’s accurate), Woodside said:

Discussions remain confidential and incomplete, and there is no certainty that the discussions will lead to a transaction.

It would not be the first oil mega-merger in the last few years, as companies try to get as big as possible to stay profitable as the world tries to cut oil and gas use.

ExxonMobil bought US driller Pioneer in October, while Chevron bought smaller rival Hess.