Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The outgoing chair of Lloyd’s of London has thrown his weight behind the leading internal candidate to become chief executive of the insurance market, as the centuries-old institution prepares for a leadership transition in which three of its top jobs will change hands.

Bruce Carnegie-Brown, who will step down at the end of April, said that although external contenders would be considered in “a full process” to find a new CEO, Lloyd’s chief of markets Patrick Tiernan was a natural choice for promotion.

“Everybody knows him well, and there’s a huge amount of support for him,” Carnegie-Brown told the Financial Times. “We’re in a really positive place having somebody as strong as Patrick in situ.”

After eight years in the job, Carnegie-Brown will be succeeded on May 1 by Sir Charles Roxburgh, a veteran of both consultancy McKinsey and the UK Treasury, where he was second permanent secretary in charge of financial services from 2016 until 2022.

But the orderly succession was complicated in January when CEO John Neal announced that he would also leave this year to run the reinsurance arm of broker Aon.

Carnegie-Brown stressed that Roxburgh would lead the CEO appointment decision. Tiernan, who oversees underwriting at Lloyd’s in his current position, is widely expected to leave the corporation if he misses out on the role.

Adding to the turnover at the top of Lloyd’s, chief financial officer Burkhard Keese will also leave at the start of May, to be replaced by his deputy Alexandra Cliff.

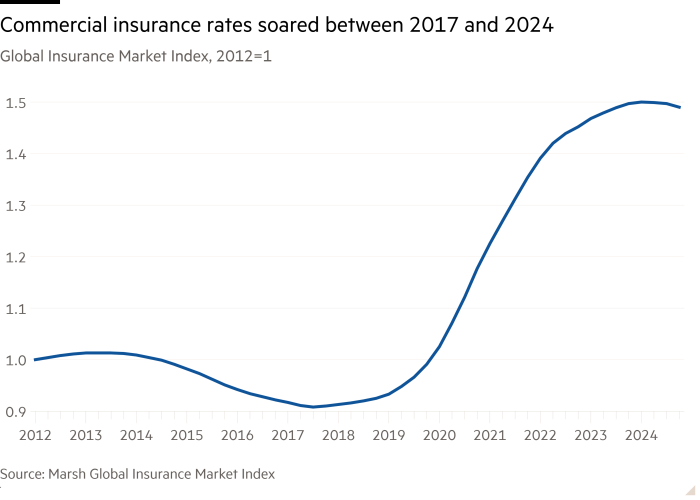

The triple departures come at what most analysts say is the top of the insurance market cycle, potentially handing their successors a tougher job.

Carnegie-Brown, Neal and Keese have steered Lloyd’s through a turnaround after a string of annual losses. The more than 50 insurers and reinsurers at Lloyd’s have posted four consecutive years of multibillion-dollar underwriting profits, buoyed by years of growing margins for the broader industry.

Although there were signs last year that resilient underwriting premiums had started to fall, Carnegie-Brown said the global upheaval caused by US President Donald Trump’s tariff policies, threatened land grabs and potential disengagement from the west’s long-standing collaborative defence arrangements could extend the bull run. “When risk is heightened, it provides an opportunity for insurance,” he said.

In normal times, a seven-year run of insurance price rises would lead to a sustained period of price cuts, as new capital providers compete for business. However, Carnegie-Brown said the combination of ongoing wars, extreme weather events and geopolitical shocks caused by the “Trump Two” administration would help underwriters buck the expected downturn.

“Historically, cycles have been caused by major events that have destroyed capital, causing prices to spike, and then new capital comes in, and the prices fall,” Carnegie-Brown said. Now, he said, “we’re not seeing capital form as quickly as it did in the past”.

Lloyd’s has nevertheless drawn in new, third-party funding, including from private equity groups Apollo, Blackstone and CVC Capital Partners. Wealthy individuals — the so-called Names who have traditionally backed insurers at Lloyd’s — have also invested more in the marketplace.

Lloyd’s has also boosted its fortunes by reviving its identity as a niche operator, according to Carnegie-Brown. After having “lost some differentiation” for a time, he said the market had recovered its competitive edge by eschewing more commoditised lines of business, and recruiting the most specialised underwriters of esoteric risks.

Assets insured at Lloyd’s have ranged from oil rigs and celebrities’ reputations to the tongue of the chief taster at the UK’s Costa Coffee.

Geopolitical tensions could damp some lines of business, Carnegie-Brown said, with a potential slowdown in international trade feeding through to the market for maritime insurance. Shipping insurance was the original raison d’être of Lloyd’s, which was formed in a coffee house in 1688.

Insurers are bracing for the results of a legal battle with aircraft lessors after they refused to pay billions of dollars of claims over planes stuck in Russia following the imposition of western sanctions in 2022.

Carnegie-Brown said the insurers had set aside sufficient capital and that it was now “for the courts to decide” whether the aircraft be treated as seized by Moscow or stolen by Russian airlines, adding that the market’s role was to convene the underwriters that operate at Lloyd’s.

“We don’t make the decisions for them, but [we’re] trying to push for a settlement,” he added. “It’s not a good look for the industry to be denying valid claims.”

One big item of unfinished business for Carnegie-Brown is modernising Lloyd’s decades-old back office IT system. The upgrade was first set out in 2019, and refined into a “Blueprint II” initiative the following year.

But it would not be completed before 2026, two years behind schedule, Carnegie-Brown said, adding that this was “disappointing”.