Made Tech Group Plc (LON:MTEC) shareholders would be excited to see that the share price has had a great month, posting a 40% gain and recovering from prior weakness. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

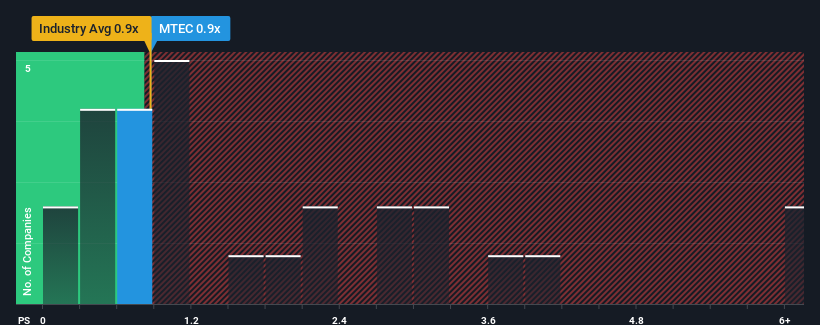

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Made Tech Group’s P/S ratio of 0.9x, since the median price-to-sales (or “P/S”) ratio for the IT industry in the United Kingdom is also close to 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Made Tech Group

How Made Tech Group Has Been Performing

The recently shrinking revenue for Made Tech Group has been in line with the industry. It seems that few are expecting the company’s revenue performance to deviate much from most other companies, which has held the P/S back. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren’t too pessimistic about the share price if the company’s revenue continues tracking the industry.

Keen to find out how analysts think Made Tech Group’s future stacks up against the industry? In that case, our free report is a great place to start.

Is There Some Revenue Growth Forecasted For Made Tech Group?

The only time you’d be comfortable seeing a P/S like Made Tech Group’s is when the company’s growth is tracking the industry closely.

Taking a look back first, the company’s revenue growth last year wasn’t something to get excited about as it posted a disappointing decline of 4.0%. Still, the latest three year period has seen an excellent 189% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 1.5% over the next year. With the industry predicted to deliver 7.0% growth, that’s a disappointing outcome.

With this information, we find it concerning that Made Tech Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort’s pessimism and aren’t willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Made Tech Group’s P/S

Made Tech Group’s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We’d say the price-to-sales ratio’s power isn’t primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that Made Tech Group currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It is also worth noting that we have found 3 warning signs for Made Tech Group (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Made Tech Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.