Receive free Lex updates

We’ll send you a myFT Daily Digest email rounding up the latest Lex news every morning.

Almost a century ago, the Municipal and General Securities Company set up the UK’s first unit trust. At the time, it was a groundbreaker. Now, M&G is a middling financial services company. After demerging from insurer Prudential, it wants to reclaim its glory as a top UK-based asset manager.

Chief executive Andrea Rossi proposes to do so organically rather than via acquisitions. This is going to require plenty of shareholder patience.

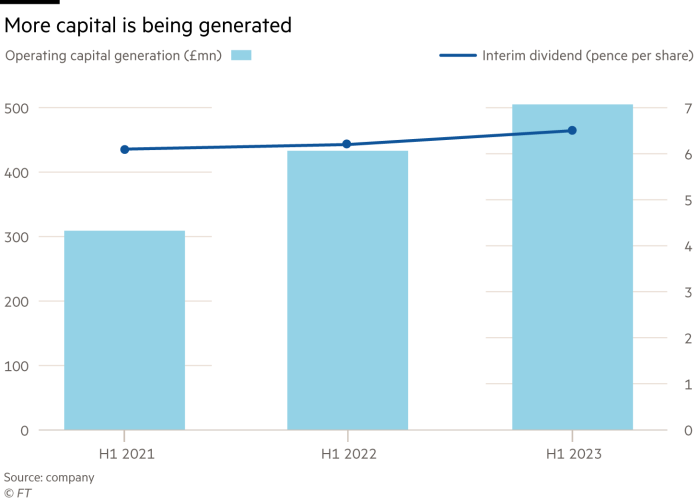

There is some evidence the strategy is working. Interim results published on Wednesday offered positive surprises. Adjusted operating profit for the period at £390mn exceeded analysts’ forecasts by 37 per cent. M&G has built up operating capital since 2021, which executives can distribute as needed.

Capital generation of £505mn was more than 50 per cent above market hopes. M&G has reached the halfway point on its target of accruing excess capital of £2.5bn by 2025.

This capital build-up helps to pay for a 9 per cent dividend yield. That in turn boosts total shareholder returns, up 12 per cent in the past year. This beat the FTSE All-Share index’s 10 per cent and has left peer Legal & General well behind.

M&G marries asset and wealth management to a mature insurance business. Rossi wants to grow the former two faster than the latter. Good idea. Regulators require insurance companies to keep plenty of rainy day funds aside for any premiums written.

For example, M&G has entered the bulk annuities market with two smallish deals worth £620mn. Though there is more business to be done, Rossi will not focus on this market. Watchdogs demand that insurers treat annuities as liabilities and put capital against them upfront. This is not part of Rossi’s plan.

However, building scale for the asset and wealth management units will take time. Together, they manage £240bn. This is not much compared with global competitors who manage four times that amount.

Investors seem hesitant to price in much hope. On a multiple of 10 times forward earnings, M&G trades almost a fifth below the floundering Abrdn. It will have to do more before the market is convinced that it is ready to reclaim its innovator role.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore