New York’s attorney general is seeking to recover more than $2 million worth of cryptocurrency stolen in a remote job scam.

The investigation alongside the U.S. Secret Service and the Queens County District Attorney’s Office delved into a well-known scheme where hackers flooded phones with text messages offering fake online job opportunities.

In a lawsuit filed on Thursday, prosecutors describe the fraudulent campaign to get people to purchase a type of cryptocurrency called stablecoins, which are typically pegged to fiat currency like the U.S. dollar. The owners of the most popular stablecoins — Tether’s USDT and Circle’s USDC — worked with the office of New York Attorney General Letitia James and others to freeze the illicit funds.

Through WhatsApp, unidentified scammers allegedly promised to pay victims if they opened a cryptocurrency account, deposited funds and began reviewing products on fictitious websites designed to look like legitimate brands. The scam ran from January 2023 to at least June 2024.

“Deceiving New Yorkers looking to take on remote work and earn money to support their families is cruel and unacceptable. Scammers sent text messages to New Yorkers promising them good-paying, flexible jobs only to trick them into purchasing cryptocurrency and then stealing it from them,” James said in a statement.

James said her goal is to not only claw back the cryptocurrency, which has been frozen by Circle and Tether, but to also get the scammers to pay penalties and restitution to New Yorkers impacted by the incident. The lawsuit said it is unclear where the scammers are based.

The scammers convinced people to take part in the scheme by saying their reviews of products would create “market data” that would lead to increased sales of the products they wrote about. In order to take part, they would have to open accounts on legitimate cryptocurrency platforms, the scammers told them, arguing the deposited money was needed in order to legitimize their reviews of products.

Most victims were told this was akin to a registration deposit and subsequent deposits would be needed to cover the cost of the products being reviewed but would be returned along with payment for the reviews.

In one case outlined in the lawsuit, a victim was told the price of one product would require a deposit of 1,220 USDT followed by a 3,889.12 USDC deposit three days later for the next deposit. The next deposit increased to 13,069.51 USDC.

That victim used credit cards to cover the cost of the deposits and even borrowed more than $12,000 from friends or family. After several weeks, the victim thought he had more than 50,000 coins, but when he sought to withdraw his money the scammers told him he needed to “upgrade” his account and deposit more in order to get his funds out.

He deposited $10,000 more worth of USDC but was told it was still not enough, prompting him to contact law enforcement.

Both USDT and USDC are legitimate digital currencies pegged to the U.S. dollar. Accounts were created on popular platforms like Coinbase, Gemini and Crypto.com.

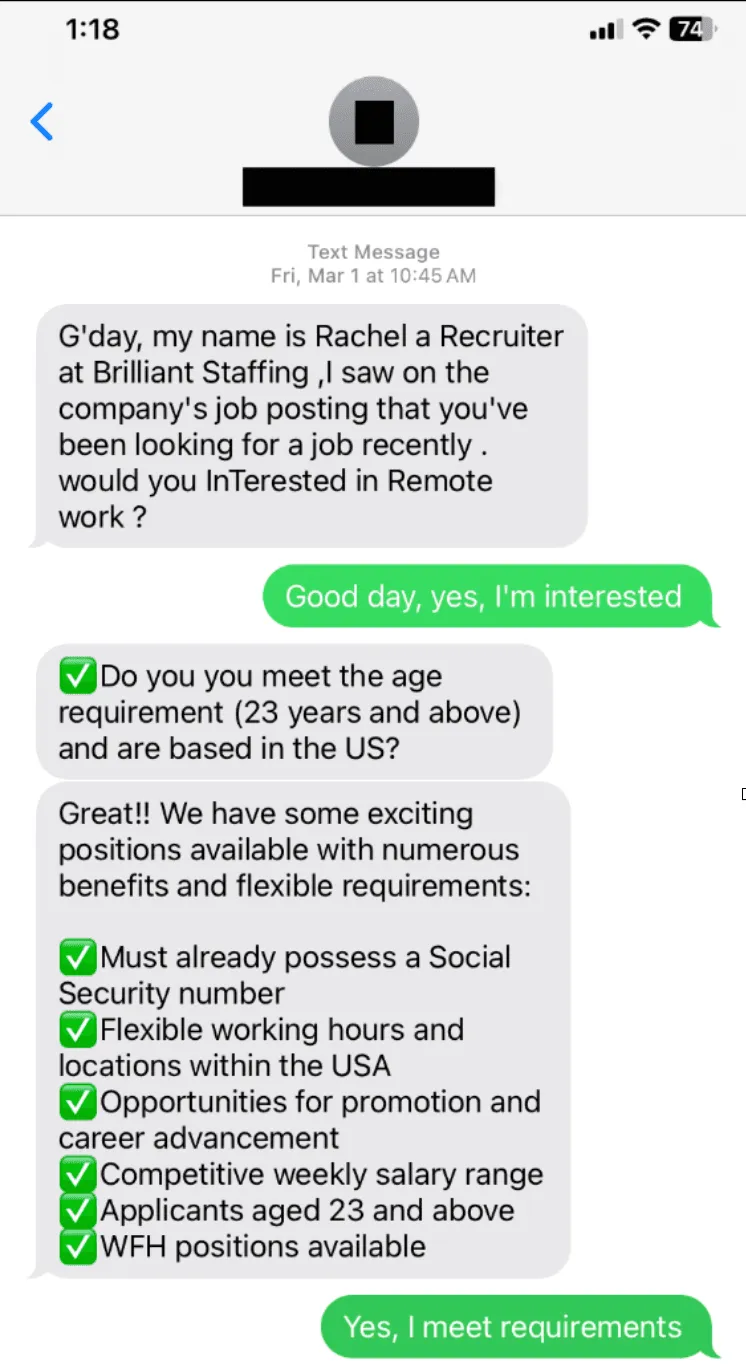

An example of text messages sent as part of the campaign.

After buying the cryptocurrency on those platforms, they sent the coins to other digital wallets controlled by the scammers, making it difficult to trace.

James said in some instances victims were urged to send U.S. dollars through platforms like Wise under the agreement that the cryptocurrency would be purchased for them.

At least one victim based in New York spent more than $100,000 through the scam. When victims raised concerns or tried to remove their money, the scammers claimed there were fictitious “fees” that needed to be paid before money could be extracted.

“Crimes of deception continue to evolve, driven by large windfalls stolen from unsuspecting victims,” said Patrick Freaney, special agent-in-charge at the New York office of the

Secret Service.

The New York Attorney General’s Office worked with Tether to freeze some of the stolen USDT and the Queens County District Attorney’s Office secured a search warrant to freeze stolen USDC.

Now that some of the funds have been frozen by the companies, it can be recovered through court orders.

James noted that one novel fact about the lawsuit is that her office will become the first government regulator to provide notice of litigation through a nonfungible token — also known as an NFT.

Regulators will deposit the NFT into the wallets the scammers used to steal the cryptocurrency, and when clicked it will take them to the attorney general’s website.

Queens District Attorney Melinda Katz said her office received a referral from the Secret Service that allowed them to trace the $2.2 million to specific digital wallets, which was then frozen.

The T3 initiative

The announcement comes just days after Tether said it had frozen more than $126 million in criminal assets globally through its T3 Financial Crime Unit initiative alongside other crypto firms.

The T3 initiative was launched in August and saw crypto companies partner with law enforcement agencies to analyze millions of transactions across five continents involving over $3 billion worth of USDT.

Tether CEO Paolo Ardoino told Recorded Future News that about $36 million of the $126 million in USDT that was frozen came from investment scams like the one described by New York officials. About $65 million came from money laundering efforts, while smaller amounts came directly from cybercrime, North Korean crypto thefts, drug sales, terrorism financing and other scams.

“We receive tips from users who can opt to provide data and screenshots about suspicious activity,” Ardoino said.

“These legitimate tips act as breadcrumbs that we can follow across the public blockchain to verify the information and uncover connected criminal activity. The transparency of blockchain data allows us to trace these funds globally and determine which law enforcement agencies are best positioned to take action.”

Ardoino said the funds typically remain frozen until law enforcement is able to complete investigations and prosecute the criminals behind the transactions. He added that T3 has been able to freeze funds within five days of being notified that coins were involved in a crime.

T3 also serves as a two-way street — they can develop leads for investigations, and agencies can come to them for advice on crimes or with evidence they have uncovered, as New York State did. They have already worked with agencies in the U.S., U.K, and Australia.

Other blockchain firms have also been working with law enforcement agencies to freeze funds. Canadian police departments said on Thursday that they were able to work with blockchain company Chainalysis to uncover $35 million worth of losses through cryptocurrency scams that affected more than 1,100 victims.

Police in Delta, Canada were able to freeze and seize hundreds of thousands of dollars worth of cryptocurrency that can now be returned to victims.