Introduction: Oil rises after Saudi Arabia announces output cut

Good morning, and welcome to our rolling coverage of business, the financial markets and the economy.

The oil price is rising this morning after Saudi Arabia decided to cut its crude output by one milllion barrels per day.

Saudi Arabia will make an additional voluntary cut of 1 million barrels of oil a day as part of a deal struck by the Opec+ group of producers, after hours of tense haggling in Vienna.

After a weekend of talks, Saudi Arabia announced its oil output will drop to 9 million barrels per day (bpd) in July from around 10 million bpd in May, the biggest reduction in years.

The reduction is part of an Opec+ agreement which will also see the United Arab Emirates increase its output target by 200,000 barrels a day from January.

But several African members will have their quotas reduced from next year, bringing them closer to their actual production capacities.

“This is a Saudi lollipop,” Saudi energy minister Prince Abdulaziz told a news conference last night, explaining:

“We wanted to ice the cake. We always want to add suspense. We don’t want people to try to predict what we do… This market needs stabilisation”.

News of the Saudi output cut has lifted the oil price. Brent crude, the international benchmark, has gained over 2%, and touched a one-month high of $78.73 per barrel, before dipping back.

Opec+ also agreed to extend the voluntary output cuts announced two months ago into 2024, as the group face the threat of flagging prices and a looming supply glut.

The group said it was acting to “achieve and sustain a stable oil market, and to provide long-term guidance for the market”.

Despite today’s rally, oil is still lower than in January, having started the year around $85 per barrel.

Consumers and businesses have been hoping that cheaper energy prices would ease the cost of living squeeze; some will be hoping that today’s jump is short-lived.

🛢️After yesterday’s OPEC+ surprise announcement on production level cut in 2024, #Brent crude oil futures price surged past $78/barrel in Asia trading hour, the highest level since start of May 2023, before retreating back to $77. pic.twitter.com/BjM8D3ikpu

— MacroMicro (@MacroMicroMe) June 5, 2023

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says:

The week kicked off with a jump in oil prices, after Saudi announced that it will cut its production by another 1mbpd starting from July, pulling its production to the lowest levels since years.

The UAE will be given higher quotas, as African countries – which repeatedly fell below their production quotas– will see their upper production limit lessened.

Saudi will continue doing the heavy lifting of production cuts, hoping that its efforts will reverse the falling price trend in oil markets and boost prices, but the gifts to some OPEC members in expense of the others hint that we could see further cracks within the cartel in the next few months, and that’s not a winning setup for OPEC, and oil bulls.

Also coming up today

UK car sales rose last month, according to industry data due out this morning, but are still below their pre-pandemic levels

The latest surveys of purchasing managers across the UK, eurozone and the US are due out today. They could show that private sector growth slowed in Europe last month, but picked up in the US.

The agenda

-

7am BST: German trade balance for April

-

9am BST: UK car sales figures for May

-

9am BST: Eurozone service sector PMI report for May

-

9.30am BST: UK service sector PMI report for May

-

2pm BST: ECB president Christine Lagarde testifies to European Parliament’s economic and monetary affairs committee

-

3pm BST: US service sector PMI report for May

-

3pm BST: US factory orders for April

Key events

Opec+’s decisions last weekend mean there is a growing possibility that energy prices will rise, warns Fatih Birol, the executive director of the International Energy Agency (IEA).

Birol s concerned that imbalances in the oil market will worsen this year, hurting developing countries the most:

🛢️ IEA CHIEF BIROL SAYS POSSIBILITY OF PRICES GOING UP A LOT MORE LIKELY AFTER OPEC+ DECISION ON SUNDAY#OOTT

— PiQ (@PriapusIQ) June 5, 2023

IEA EXECUTIVE DIRECTOR BIROL: THERE’S AN IMBALANCE IN THE OIL MARKET IN THE SECOND HALF OF THIS YEAR ALREADY, IT’LL WORSEN AFTER THE OPEC+ DECISION.

— Breaking Market News (@financialjuice) June 5, 2023

IEA EXECUTIVE DIRECTOR BIROL: THE COUNTRIES THAT SUFFER MOST WITH HIGH OIL PRICES ARE DEVELOPING COUNTRIES SUCH AS INDIA, AND THE CONTINENT OF AFRICA.

— Breaking Market News (@financialjuice) June 5, 2023

Drivers with fossil fuel-powered cars shouldn’t panic about Saudi Arabia’s planned oil production cut in July, says the RAC.

RAC fuel spokesperson Simon Williams says petrol and diesel prices should fall in the short-term, as retailers pass on recent drops in the wholesale price of oil.

Williams explains:

“While oil production cuts are intended to push up the barrel price which usually means bad news for drivers at the pumps there’s currently no cause for panic. Diesel is still seriously overpriced due to its lower wholesale price which hasn’t been fully passed on by the biggest retailers despite a record 12p a litre fall in May so should continue to come down. And the price of petrol is also slightly too high and should fall by a couple of pence in the next week or so.

“Pump prices are now back to what they were in October 2021 with unleaded at 143.26p which means it’s very close to dropping below the previous long-term record high of 142.48p set in April 2012, but of course the Government’s 5p a litre duty discount is a big part of this. Diesel is already below its former all-time high of 147.93p from the same time.

“Oil producer group OPEC+ has taken well over 3m barrels a day out of circulation so far this year, but due to the economic downturn forecourt prices have continued to fall. For that reason, we remain hopeful this won’t affect drivers for some time.”

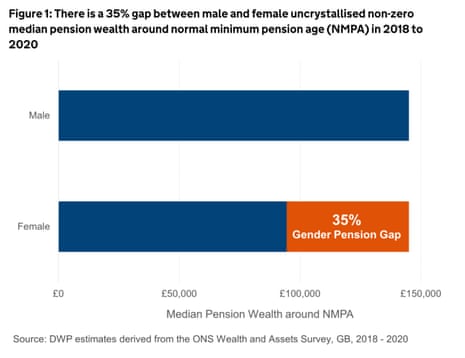

UK gender pension gap measured at 35%

UK women have 35% lower pension pots when they hit retirement age compared to men, new government data shows.

The Department for Work and Pensions (DWP) has calculated Britain’s gender pension gap (GPeG) is 35%, based on the uncrystallised median private pension wealth for men and women approaching retirement ago.

The GPeG is smallest for those aged 35-39 (10%) and then increases to 47% for those aged 45-49. The GPeG then decreases again in the later years of working life, the DWP reports.

For those eligible to be automatically enrolled on workplace pensions, the gap is slightly smaller, at 32%.

Last week, the TUC warned that women are more than twice as likely as men to miss out on being automatically put into a workplace pension, because they earn less than the £10,000 threshold.

The GPeG is also caused by the gender pay gap – because men earn more, they pay more into their pensions – and by the unequal division of caring responsibilities. Women are much more likely to take time out of work or work part-time to look after children, meaning less opportunity to pay into private pensions.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, warns that the gender pension gap “looks set to remain with us for some time yet,” despite the governmnet’s childcare reforms.

Morrissey says:

“The gender private pension gap is 35% – less of a gap, more of a gaping chasm! It is shrinking – it was once as high as 42%, but it is still way too high.

There is room for optimism though – for the auto-enrolment eligible population the gap is slightly smaller at 32% so we can hope that gap continues to close as more women save into workplace pension schemes. Participation rates are also high – in some cases higher than men and the real term increase in total female pension savings is £4bn higher than for men since the introduction of auto-enrolment.

Kate Smith, Head of Pensions at life insurance, savings and pensions group Aegon hopes that regularly measuring the gender pensions gap will help set pensions policy:

“While it is widely recognised that there is a persistent gender pensions gap, until now there has been no official means of measuring this. We warmly welcome Pensions Minister Laura Trott’s initiative to create an official definition, which is based on pensions wealth built up by the 55-59 age group.

It’s just not acceptable that the gap sits at 35%, meaning many women are lagging far behind their male counterparts when it comes to retirement provision.

Bloomberg: Why Saudi Arabia’s solo oil production cut is risky

Bloomberg’s energy expert Javier Blas has written about how Saudi Arabia “threw away its own rule book” last weekend, by announcing a unilateral cut to oil output rather than a deal in concert with Opec members.

And so far…. the strategy may not have worked, as oil is only up around 2% despite Saudi Arabia pledging to cut its production by 10% in July.

The cut is meant to be only for July, but the Saudis indicated it may be extended if needed. Oil traders reckon that’s likely. Prince Abudlaziz said the cut highlighted how the kingdom “will do whatever is necessary to bring stability to this market.” For stability, read higher oil prices.

Because Riyadh is forfeiting so much production, unless prices rally over the next few days it would end giving up an enormous amount of petroleum revenue. Everyone else inside the OPEC+ alliance would reap the benefits.

To keep earnings unchanged, Riyadh needs oil to surge by more than $10 a barrel to offset the drop in production from April to July. It’s impossible to know what would have happened to oil prices had the Saudis kept output unchanged. But for now, it doesn’t look like the strategy is paying off.

COLUMN: For years, Saudi Arabia has vowed to intervene in the oil market only in concert with OPEC bigwigs — and rarely, if ever, alone. On Sunday, it went solo in a high-reward, but extremely high-risk strategy

| #OOTT @Opinion https://t.co/tinRmUbx6b— Javier Blas (@JavierBlas) June 5, 2023

Eurostar has ended its service to Disneyland Paris today.

The final train from London St Pancras to Marne-la-Vallee, a station next to the theme park, departed at 10.34am as the operator focuses on its core routes to Paris and Brussels.

Eurostar’s direct trains to Disneyland Paris have been running in 1996; ending them will make it harder for British families to make the trip to the French Disneyland.

It has also emerged that Eurostar’s London-to-Amsterdam link faces being suspended for nearly a year.

Dutch media reported that infrastructure secretary Vivianne Heijnen has warned that no Eurostar trains will be able to run to or from Amsterdam Centraal, the capital’s main station, from June 2024 until as late as May 2025, while it is renovated.

The UK van market also grew last month, new SMMT data shows.

Registrations of light commercial vehicle registrations grew by over 15% year-on-year to 25,359 units in May, the fifth consecutive month of rising demand.

So far this year, there have been 135,296 new vans registered, which the SMMT attributes to easing supply chain disruptions and sustained demand for larger vehicles.

Sales of new battery electric vans grew by a fifth, to 1,041 units in May.

The SMMT is concerned that a ‘national plan’ is needed to help deliver the transition to the zero emission van transition.

It says:

This can be achieved via a supportive fiscal framework, simplified planning processes, faster grid connections and the provision of a nationwide network of reliable, affordable chargepoints.

In addition, regulated infrastructure targets that are commensurate with new vehicle registration mandates would help to reassure van operators that their specific business needs can be met with a battery electric van. Investment is undoubtedly coming for the car sector, but the van sector cannot be left behind.

Back in the property market, the cost of rent across England rose for the fifth consecutive month during May, according to PropTech firm Goodlord.

Letting Agent Today has the details:

During the month, voids also held steady – evidence that market demand remains strong heading into summer, traditionally the busiest time of year for the sector.

Six of the eight regions monitored by Goodlord saw rents rise over the course of May. The average cost of rent per property in England is now £1,111. This is up from £1,103 in April, a 1% increase.

Rents rose faster in the South West, where they rose almost 3% last month, while there were marginal drops in the East Midlands and the North East.

“6 of the 8 regions saw rents rise over May. The avg cost of rent per property in England is now £1,111. This is up from £1,103 in April, a 1% inc”

Biggest inc = south west at nearly 3%

Slight decline = East Midlands & North 0.47% & 0.19% @sogoodlord https://t.co/8PxvKT11gK— Emma Fildes (@emmafildes) June 5, 2023

UK widens lead as Europe’s top market for financial services investment

Despite angst about the damage caused by Brexit, the City of London is still managing to attract overseas investment.

The UK remains Europe’s most attractive destination for financial services investment, attracting a quarter of new projects last year, according to new data from EY published this morning.

EY reports that the UK attracted 76 financial services projects in 2022 – an increase of 13 projects from 2021. That helped Britain extend its lead over France, which secured 45 projects last year, a drop of 15.

Overall, there were 292 financial services foreign direct investment (FDI) projects across Europe last year, up 5%.

Germany and Spain were tied third with 31 projects each.

Anna Anthony, UK financial services managing partner at EY, explains:

“The strength of the UK financial market has meant that – even through challenging times – investors see it as the most attractive European financial services market. A lot has happened in the seven years since the EU referendum, and the UK has faced strong competition from its closest competitors. Our research shows that investors recognise the strength, gold-standard governance and resilience of the UK’s financial system and see it as the preferred destination for growth, innovation and access to top talent.

“Of course, we can’t be complacent. Industry and government focus on raising market attractiveness is key and should align with what matters to investors – such as levelling up, enhancing social infrastructure and upskilling local talent – to ensure UK financial services retains and continues to extend its leading role on the global stage.”

Saudi production cut: political reaction

A White House official said overnight that the Biden administration is focused on oil prices and “not barrels” after Saudi Arabia announced its plans to make a deep cut to its crude output.

The official, who declined to be named, told Reuters:

“We are focused on prices for American consumers, not barrels, and prices have come down significantly since last year.

As we have said, we believe supply should meet demand and we will continue to work with all producers and consumers to ensure energy markets support economic growth and lower prices for American consumers.”

Last year the US was pushing oil producers to increase output, rather than cutting, to bring down gasoline prices.

Last October, the White House expressed disappointment when OPEC+ cut production quotas. But since then, US crude has dropped to around $73 today from almost $90 in early October.

Over in Moscow, the Kremlin has said that the Opec+ group is an important format for providing stability on global energy markets.

Russia are part of Opec+, which pumps around 40% of the world’s crude.

Anxiety over the strength of China’s economic recovery is weighing on the energy market, reports Charalampos Pissouros, senior investment analyst at XM.

Pissouros says:

Regarding the energy market, oil prices opened with a large positive gap today, after Saudi Arabia said it will cut production by another 1mn barrels per day (bpd), starting in July. This was a decision on top of a broader OPEC+ consensus to extend the previous cuts into 2024 as the cartel seeks to offer support to prices.

Despite the surprising decision to cut supply back in April, the related gains were short-lived, with prices coming under pressure since then on concerns that the weakness of economic activity in China will weigh on demand.

UK services firms blame higher wages for price rises

UK service sector firms lifted their prices again last month, as they tried to pass on higher wage costs, according to the latest survey of purchasing managers.

Data provider S&P Global reports that service sector cost inflation hit a three-month high in May, due to higher payroll costs.

This prompted a jump in output prices, as companies tried to recoup these higher wages – although some firms found their clients were reluctant to accept higher prices.

Tim Moore, economics director at S&P Global Market Intelligence, says there were “intense wage pressures” in the service economy last month, even though employment growth moderated.

Moore added:

Higher salary payments more than offset lower fuel costs, which meant that overall input price inflation edged up to its strongest for three months in May.

Average prices charged by service sector companies nonetheless increased at the second-weakest pace since August 2021 amid some reports of greater price resistance among clients.”

Purchasing managers also reported robust rises in output and incoming new work in May, which helped the sector keep growing.

The S&P Global / CIPS UK services PMI dipped to 55.2 in May, down from April’s 55.9, but still showing solid growth (any reading over 50 shows an expansion).