- PolySwarm had a strong short-term bullish momentum and saw high demand.

- A pullback to the range highs would be an ideal buying opportunity.

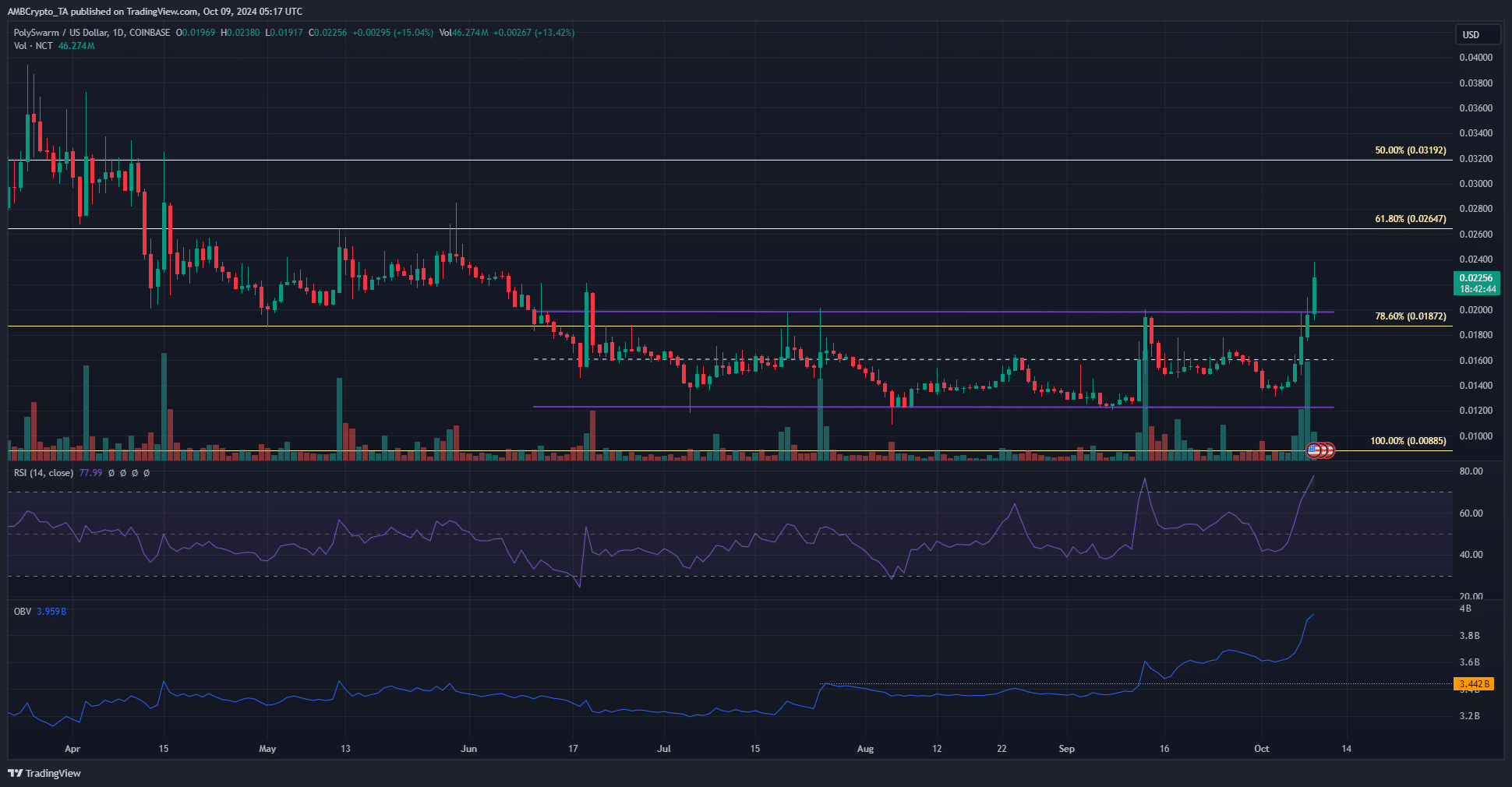

PolySwarm [NCT] broke past the four-month range highs at the time of this writing. The daily trading session hasn’t closed, but the high trading volume makes this move unlikely to fail.

AMBCrypto analyzed the on-chain activity and price action to understand the next bullish targets. As things stand, the long-term consolidation is ending.

Should buyers wait for a retest?

Generally, a range breakout is accompanied by a retest of the former highs as support. A positive reaction after such a retest a few days after the breakout would be a strong sign that a bullish continuation is possible.

This is the guideline that NCT investors would want to look out for. The breakout also has a chance of continuation, leaving patient investors sidelined.

The token has rallied 68% in five days, and the RSI reading of 77 showed overbought conditions.

That is no guarantee of a pullback, but investors can look to buy at $0.02 or $0.024 if the latter level is breached without NCT first moving to $0.02.

The Fibonacci levels are likely to act as key resistances on the way upward. Each level that is broken would add to the bullish conviction and could add more volume to the rally.

Dormant tokens show selling isn’t yet prevalent

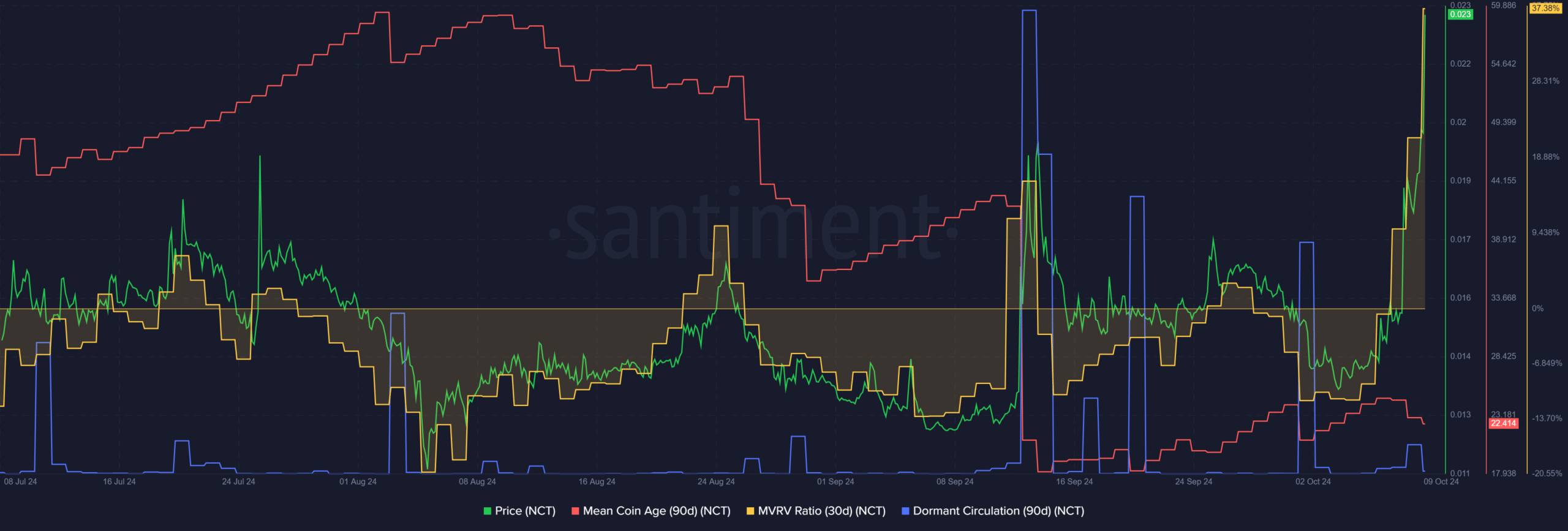

Source: Santiment

The 30-day MVRV was at 37.38%, meaning that short-term holders are at a 40% profit on average. Yet, the dormant circulation metric was relatively quiet.

Is your portfolio green? Check out the NCT Profit Calculator

This showed that a wave of profit-taking has not commenced.

It is likely to occur soon, since such high MVRVs have a tendency to reset toward zero. The mean coin age has been in a downtrend since August, showing a distribution phase even before the range breakout.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion