Pound on track for worst day in 18 months

Today is turning into the pound’s worst day in over 18 months.

Update: at 12.20pm, sterling is down around 1.2% so far today against the US dollar at around $1.31, a drop of over 1.5 cents.

That would be its biggest one-day drop against the dollar since 7 March 2023.

The pound has been dropping steadily through the day, after the governor of the Bank of England told the Guardian it could become a “bit more aggressive” in cutting interest rates if inflation continues to cool.

Key events

Italy “aiming to get more tax from most profitable companies”

Italy’s stock market is having a bad day too, as investors react to the prospect of a new windfall tax.

According to Bloomberg, Italian Finance Minister Giancarlo Giorgetti has said Italy plans to raise taxes on the companies that benefitted most from the economic turbulence of recent years in order to help bring down the country’s budget deficit.

In an interview for Bloomberg’s Future of Finance event in Milan today, Giorgetti suggested that a number of industries could face new levies.

He says:

We will be approving a budget that will require sacrifices from everyone, which means taxing extra profits.

“It means taxing profits made and revenues made, and it is an effort that the whole country must undertake which means individuals, but also small, medium and large companies.”

Italy’s FTSE MIB share index is down 1.35% today, the biggest fall among major European markets today.

Pound’s worst day against the euro since December 2022

Back in the markets, the pound is on track for its worst day against the euro in almost two years.

The rapid repricing of the outlook for UK interest rates has pushed sterling down by over 1% against the euro.

It’s down 1.3 eurocents now, at €1.188.

This would be the biggest one-day drop, in both points and percentage terms, since 15 December 2022.

More than 300 people have been told they have had at least one conviction quashed under legislation passed to deal with the Post Office Horizon IT scandal, new figures released by the government show.

The Ministry of Justice reports that 335 letters had been sent to individuals so far (to the end of September).

The 335 letters cover a total of 1,030 convictions, suggesting many people are likely to have had more than one conviction quashed under the legislation.

All those people will be eligible for compensation under the Horizon Convictions Redress Scheme, which exonerated post office operators who had been convicted on charges including false accounting, theft and fraud.

If the individual is deceased their personal representative may be eligible to submit a claim, the MoJ says.

The MoJ said it aims to have written to the majority of affected individuals by early November 2024, and will be updating today’s data on a monthly basis.

A total of 459 individuals have had their cases assessed so far.

Back in the US, there’s been a small increased in the number of people signing on for unemployment benefit.

The number of initial claims for jobless support rose by 6,000 last week, to 225,000.

It’s a little higher than expected; Wall Street had forecast 221,000 new initial claims.

However, its a fairly low level by historic standards, suggesting US companies are still holding onto workers.

Jobless claims rose last week and were slightly higher than expected

🔹 Initial Jobless Claims: 225K vs. 221K est. (219K prior)

🔸 Continuing Claims: 1.826M vs. 1.830M est. (1.827M prior) pic.twitter.com/3QUNudebdo— CMG Venture Group (@CmgVenture) October 3, 2024

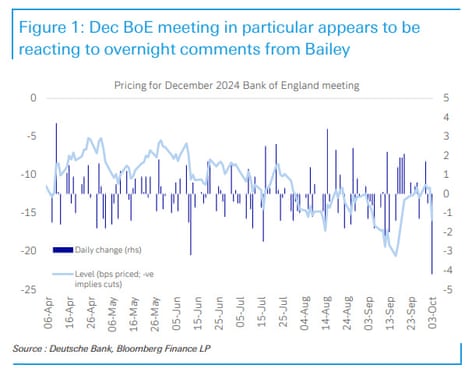

Deutsche Bank: Markets are repricing odds of December rate cut

Deutsche Bank have just published a research note on the market reaction to our interview with Bank of England governor Andrew Bailey.

In it, they point out that markets have been pushing up the chances of an interest rate cut in December, as well as at November’s meeting.

A cut in November now looks very likely, but could the Bank actually manage two cuts by Christmas?

Deutsche’s strategist Shreyas Gopal writes:

One simple interpretation of the Governor’s comments is that it could now take an upside surprise to inflation for the MPC not to cut rates back-to-back in November and December.

Previously the guidance suggested that the burden of proof was on inflation to surprise to the downside for such a shift away from the “gradual” pace of easing. Consistent with that interpretation, the rates market has notably increased its pricing for the December meeting. It’s the largest dovish repricing of this particular meeting in over six months, though in level terms we have simply reverted to levels seen just a couple of weeks ago.

The oil price is rising again today, as rising tensions between Israel and Iran worry the markets.

Brent crude is up almost 2% so far today at $75.30 per barrel.

Yesterday Brent touched a one-month high of $76 per barrel.

As analysts at Saxo put it:

The geopolitical risks in the Middle East will continue to underpin oil prices in the short-term.

The drop in energy prices earlier this year had helped to pull down inflation, which is why Andrew Bailey told us that the Bank of England would be watching the oil price “extremely closely to see the impact of the latest news”.

Over in the US, companies continued to cut jobs last month.

The recruitment firm Challenger, Gray & Christmas has reported that US-based employers announced 72,821 cuts in September.

Although that’s a 4% decrease on August’s layoffs, it’s a whopping 53% more than in September 2023.

And it means US companies have laid off more people so far this year, than in the first nine months of 2023.

Challenger explains:

For the year, companies have announced 609,242 job cuts, up 0.8% from 604,514 announced during the same period last year.

Though less than a percentage point separates them, this is the first time this year that year-to-date cuts are higher than those tracked during the same period in 2023.

This suggests the US labour market has lost some momentum, which may encourage the Federal Reserve to continue lowering US interest rates, as the markets already expect.

Challenger: For the year, companies have announced 609,242 job cuts, up 0.8% from 604,514 announced during the same period last year. pic.twitter.com/bhxR6QOH1M

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) October 3, 2024

The pound has been “whacked” as Andrew Bailey “shifts gears” on the outlook for UK interest rates, says Brad Bechtel, global head of foreign exchange at investment bank Jefferies.

Bechtel told clients:

The BoE’s Bailey spoke about becoming more aggressive on rate cuts if conditions warrant, in an article in the Guardian today.

The BoE had been expected to go slower than the Fed and ECB but ultimately arrive around similar levels down the road. Bailey’s comments came on the back of what he saw as continued improvement on the cost of living as inflation continues to move lower.

He didn’t commit to a faster pace, just mentioned it as a possibility but it was enough to send the GBP around 1.1% lower on the day and put it on the bottom of the leader board in overnight trade

Full story: Sterling drops after Bank of England boss hints at ‘aggressive’ rate cuts

Here’s our news story on the pound’s tumble today:

We also have evidence today that lower borrowing costs are leading to an uptick in the housing market.

Zoopla has reported that the lowest mortgage rates for 15 months is supporting a rebound in sales market activity across the UK.

They say that the number of agreed sales, and demand from buyers, are both up by more than a quarter over the last 4 weeks compared to the same period a year ago.

Households that have held off making moving decisions over the last two years are returning to the market, they reckon, following recent falls in mortgage rates.

Rate trims spur market activity, pushing prices back up in the North and West of England but the South of England remains bogged down by affordability issues and mushrooming stock (32%) from second homeowners and investors looking to hang up their bucket and spade now the profits… pic.twitter.com/LnUsO5Kz0g

— Emma Fildes (@emmafildes) October 3, 2024

Pound on track for worst day in 18 months

Today is turning into the pound’s worst day in over 18 months.

Update: at 12.20pm, sterling is down around 1.2% so far today against the US dollar at around $1.31, a drop of over 1.5 cents.

That would be its biggest one-day drop against the dollar since 7 March 2023.

The pound has been dropping steadily through the day, after the governor of the Bank of England told the Guardian it could become a “bit more aggressive” in cutting interest rates if inflation continues to cool.