Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Private equity’s claim it has saved the life insurance and retirement annuities business justifiably invites scrutiny. But in this case, the Masters of the Universe might have a point. Brighthouse Financial could be an opportunity for them to prove it.

Financial institutions live or die on their store of equity capital, which absorbs losses, fuels growth and, ideally, facilitates buybacks and dividends. The 2008 financial crisis left plenty of life insurers short.

Many were incapacitated by the burden of policies written when interest rates, and the fixed-income returns used to determine their future policy payouts, were higher. The resulting poor profits in the 2010s hobbled stock prices and kept several insurers from raising new capital.

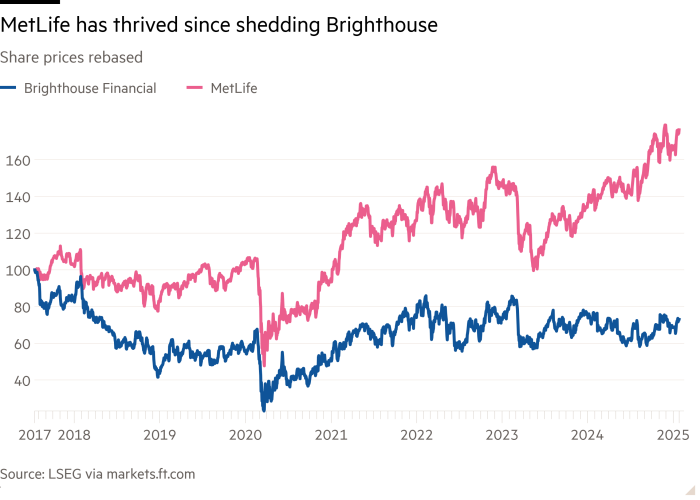

Private equity groups have since arrived in the industry with the ability to write large cheques. Brighthouse could use that. The company spun out of MetLife in 2017 is looking for a buyer, as the Financial Times has reported. Private capital firms are likely bidders.

MetLife detached Brighthouse for fear that its challenged annuities business would deter investors in the parent company. On that score the break-up was a success. MetLife’s market capitalisation has surged to $60bn, nearly doubling. Brighthouse shares are, however, down more than a quarter since the separation.

Brighthouse specialises in variable annuities, a more complex product than traditional fixed and fixed index annuities. The cost of this, including hedging, means it struggles to meet its required levels of capital — unhappily for shareholders expecting steady capital returns. Its $3bn market capitalisation, compared with $5bn of statutory book capital, betrays its weakness.

A private equity buyer, at the right price, could spy a mutually beneficial arrangement. Brighthouse’s brand, sales force and ability to write new, untainted business would be useful additions. Its $120bn investment account presents an opportunity for sophisticated asset managers to deploy yet more money in private credit markets.

And buyout shops have a record. Apollo, the foremost example of marrying life insurance and private markets, has calculated that $28bn of fresh equity capital has been raised since 2010 in the life insurance sector. The firm run by Marc Rowan says $20bn alone can be attributed to its insurer, Athene. Despite Apollo’s reputation for aggressiveness, Athene is conservatively managed.

Traditional insurers still have brand names, high credit ratings and broad experience through cycles in their favour. They can hire smart investment managers to keep up with Apollo, Brookfield and KKR.

Still, financial services remains an industry where balance sheet ratios matter. For those recovering from past misfires, there is nothing like a big equity infusion. It is a problem private equity was designed to solve.