Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

True crime junkies have long been fans of podcasts. Most-listened rankings feature such grisly delights as Morbid, Small Town Murder and Bone Valley. But for producers, platforms and advertisers the genre has delivered its own plot twists.

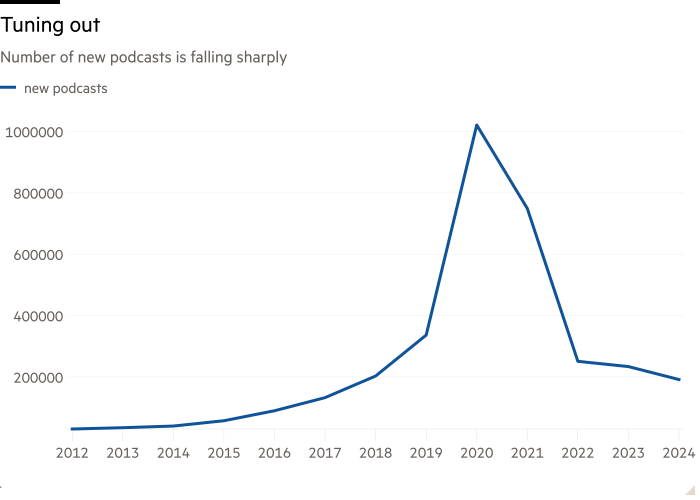

Podcasts briefly became a new front in the streaming wars in the early part of the decade, after distribution platforms such as Spotify made an aggressive push into what was previously a niche industry. But after the Covid-19 bump, the amount of new material wilted and advertisers proved circumspect. The Swedish music streamer took a €40mn hit on podcast asset write-offs and contract terminations in the second quarter of 2023.

Now, podcasts are entering their second season. Newcomers are joining. In February, Fox acquired right-wing podcast company Red Seat Ventures. Streaming giant Netflix is mulling a segue into the audio world, Business Insider has reported. The temptation is understandable: listener numbers are still growing. Some 550mn tuned in last year, and another 100mn could join by 2027, according to marketing consultancy Backlinko.

Two things are different this time. Video has given the podcast format a shot in the arm. By the end of last year more than 250mn users had watched a video podcast on Spotify. Some 13 per cent of UK listeners watch podcasts on a weekly basis, according to audience data from Rajar.

Meanwhile, supporting infrastructure has evolved. Platforms including Patreon, Acast and SubscribeStar facilitate monetisation via subscriptions, live events and merchandise.

Still, luring advertising spend is tricky. Some shows attract a neat, precisely targeted demographic — manosphere favourite The Joe Rogan Experience, say. Other audiences are more amorphous. Ads on one UK true crime show span workflow software, online therapists and rice.

Listeners, too, may be less receptive to audio advertising. Unlike web ads, there is no link to click, and podcast consumers are easily distracted. In the UK a third are wielding mops and cloths while tuning in to podcasts, according to Ofcom. That helps explain why total ad spend at $5bn is only roughly what Coca-Cola spends across all media.

The other problem with podcasting is that barriers to entry are low, which means what spoils there are scatter thinly. The average cost for an advertiser to reach 1,000 listeners (CPM) is $15-$30 for pre-recorded ads of up to a minute; those read by the podcast host garner an extra $10, says Acast. A few blockbusters — Rogan being one — gobble most of the ad pie.

Production globally has slowed sharply since 2020; last year wasn’t even a fifth of the peak 1mn new podcasts. Of course, novelty is not everything. Bookending the UK’s top 10 — which starts with Rogan’s show — is that decades old stalwart of Radio 4, The Archers. No ads for UK listeners there, at least for now.