Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The unpronounceable has attempted to pull off the unimaginable. Swedish property group Samhällsbyggnadsbolaget (SBB) has too much debt and too little time. Yet a series of creative financings led by Leiv Synnes, the chief executive parachuted in last year, have kept the company ahead of its creditors.

In his latest move, SBB announced on Monday it would buy back €163mn of bonds at a 60 per cent discount. That should result in a profit of €245mn. The good news sent SBB shares up more than a tenth on Monday.

Its woes stem from a debt-fuelled buying spree of health, education and social housing properties during the low interest rate era. SBB’s market value has since plummeted 95 per cent since peaking in 2022. With net debt making up 87 per cent of its enterprise value, the property group has had to hustle to sell assets to strengthen its balance sheet.

To add to its misery, US hedge fund bondholder Fir Tree has initiated legal proceedings to push the company into default over allegations that it has breached its debt covenants.

With unsecured borrowing now closed to the company, SBB has had to seek alternative financing. For example, SBB borrowed via US private debt provider Castlelake for €450mn in February. Priced at 5 percentage points over Euribor, the lifeline is expensive and secured on property worth just under twice the loan’s value.

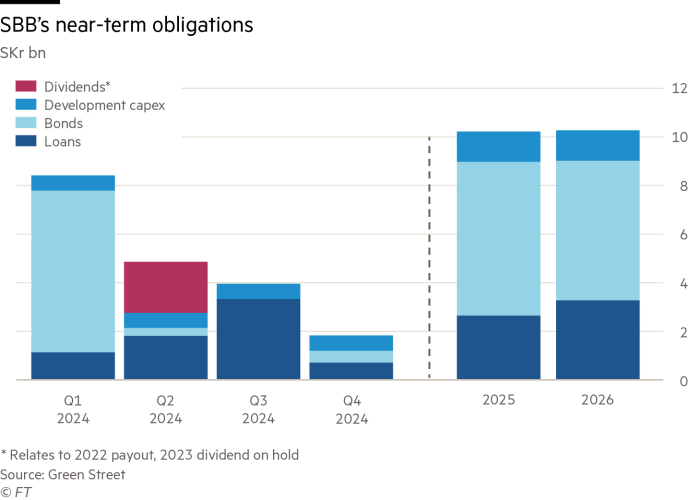

Much depends on the willingness of banks to roll over about €700mn of secured loans due this year. In its favour, SBB’s portfolio remains relatively attractive. Many of its health and education properties are occupied by government-backed tenants paying inflation-linked rents.

Buying back heavily discounted bonds with the proceeds helps. Apart from booking a profit, SBB in effect had swapped unsecured debt now yielding in the mid-teens for secured loans with a 9 per cent yield to maturity, said Edoardo Gili at Green Street.

Expect more of the same. While SBB reported an overall loan-to-value ratio of 54 per cent at the end of last year, its secured LTV figure was just 21 per cent. If it pursues more of this expensive, collateralised funding, SBB may have to raise equity from its residential portfolio, worth SKr29bn (€2.5bn), most likely by a private sale.

Failing that, SBB may have to raise equity using the group’s very depressed share price, another expensive option. Property investment always carries some risk, but SBB still offers too much for most investors.