The crypto market’s recent retracement is the direct opposite of the bull run expected by most investors. XRP and other top assets like Bitcoin continue to bleed despite the bullish predictions from market analysts.

Consequently, some observers believe that the bull run concluded after the March 2024 rally. However, some analysts remain optimistic, projecting that crypto assets will record massive rallies in the 2024/2025 market cycle.

I made a list of the top narratives this #bullrun and put them in high/intermediate/low risk tolerance.

📗 Super safe investments:

1: $ETH – 3x to 4x

2: $SOL – 5x to 8x

3: $INJ – 4x to 6x📔Intermediate, these projects can 5x to 25x and the risk VS rewards is good:

1: $XRP -…

— Altcoin Moe (@AltcoinMoe) June 28, 2024

Crypto trader Altcoin Moe forecasts a 6X surge for XRP to trade at $3.3327 in the coming bull run. According to Moe, this prediction will likely occur in the coming months.

Altcoin Moe Bullish on XRP’s Long-Term Price Gains

Altcoin Moe, a trader who says he’s been trading crypto since 2014, listed top assets based on their potential risk and returns during bull runs. He grouped the cryptocurrencies into three categories: super safe, intermediate, and risky investments.

Moe grouped XRP under the intermediate investment bracket, stating that it could rally 6X in the bull run. If the token surges 600% as Moe predicts, it will reach $3.3327, close to its 2018 all-time high of $3.84.

Interestingly, Moe believes this rally will happen in the next few months. XRP isn’t the only asset under Moe’s radar; he identified other assets, such as WIF and TRIAS, as high-risk assets that could yield investors up to 100X returns.

Top Crypto Analysts Predict XRP’s Possible Price Movement in 2024 and Beyond

Like Altcoin Moe, other analysts have shared bullish predictions for XRP in the past months. Armando Pantoja believes XRP will trade between the $8 and $20 range by 2026.

This analyst identifies factors such as massive institutional adoption, legal clarity, partnerships, and future financial services as conditions that will boost XRP’s price.

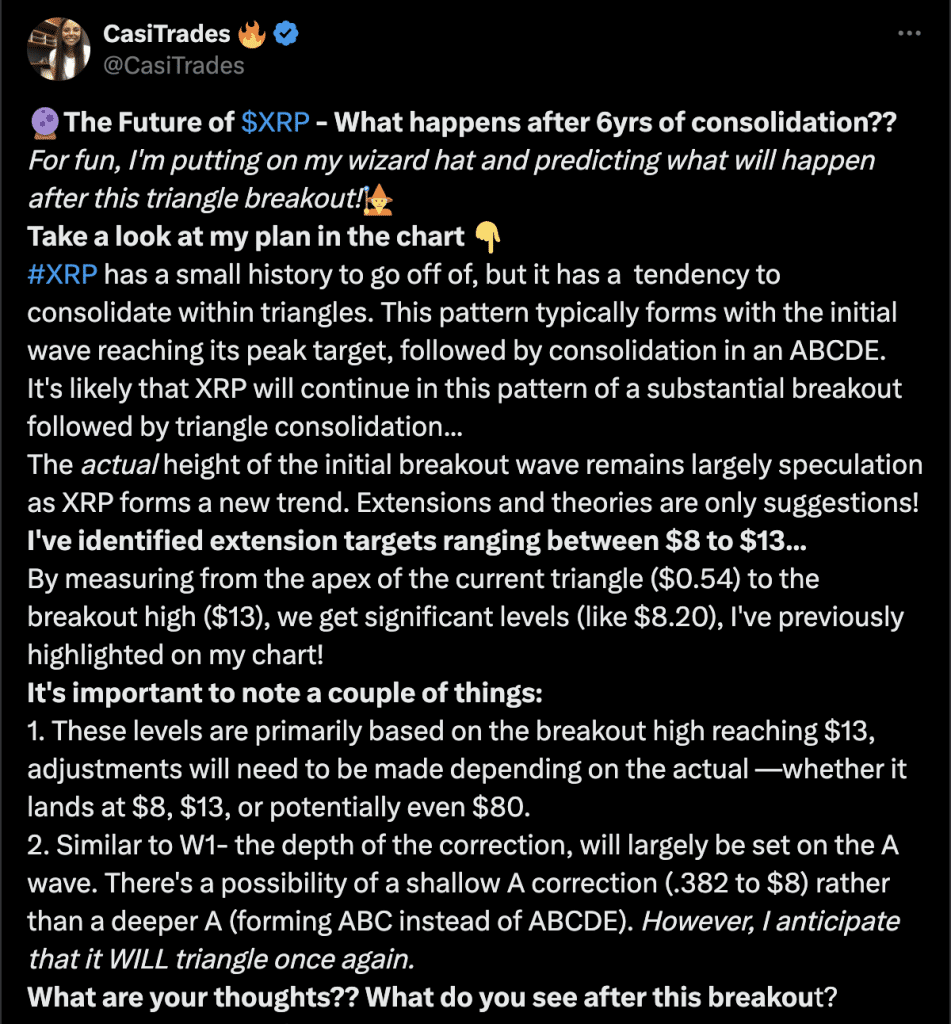

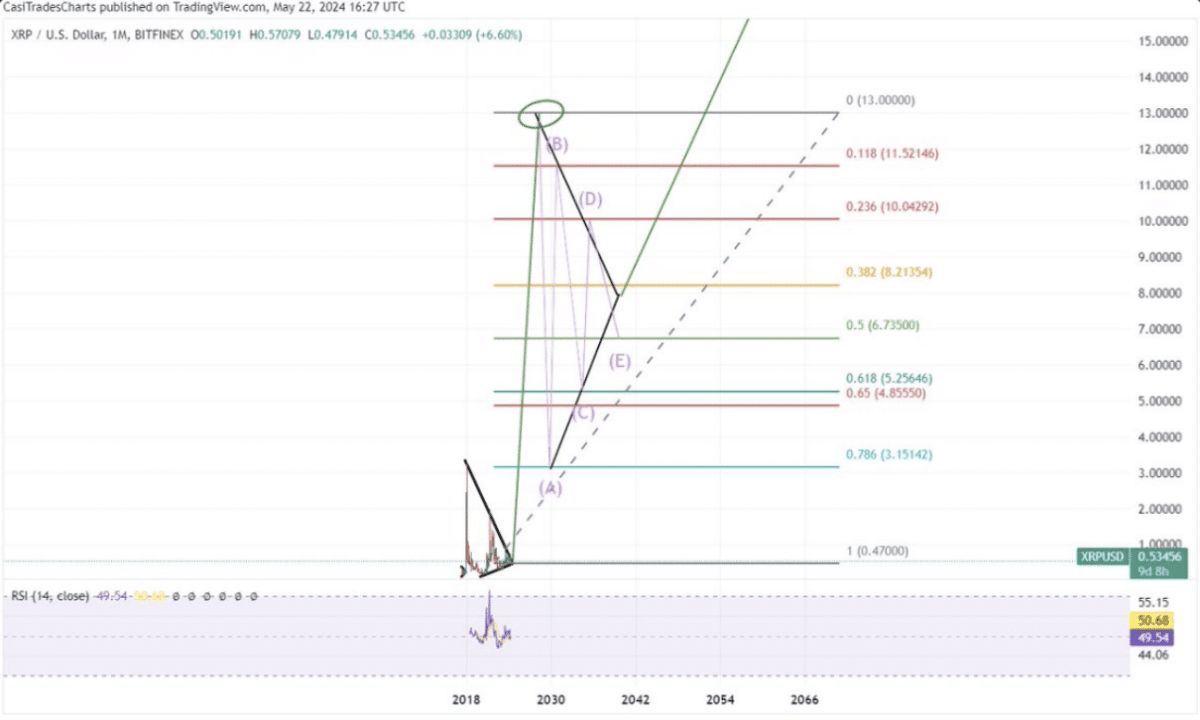

Another analyst, Casi, set a price target of $13 for XRP. Further, he stated that XRP must break out of its six-year consolidation phase to achieve this target. According to Casi’s chart, a correction to $0.382 is possible before the breakout to $8.

Also, Casi believes XRP will rally to the top of the current triangle ($0.54) before rising to a range between $6 and $13.

Meanwhile, popular market observer Jake Gagain shared a long-term prediction for XRP, saying the asset will reach $5 by 2025. Similarly, Dark Defender tipped XRP to hit $5.85 in 2024.

While Gagain and Dark Defender were conservative in their predictions, EGRAG CRYPTO tipped XRP to rally to $27 in this cycle.

According to EGRAG, XRP could repeat its historical price patterns to align with cycle A or B on its chart or create a new pattern. He believes XRP’s current trend mirrors cycle A, which could result in an aggressive price surge of $27.

However, he urged the XRPArmy to stay committed to the process, as impatience would defeat the goal. Nevertheless, several analysts have speculative predictions for these XRPs. The coin could record price gains if it gains regulatory clarity and increased adoption.

Disclaimer: The opinions expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their own risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile, high-risk asset class.