Introduction: Shell makes £7.66bn in Q1

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Oil giant Shell has racked up earnings of $9.65bn (£7.66bn) for the first three months of this year, beating forecasts, as energy producers continue to post eye-watering profits.

Shell’s first quarter adjusted earnings are higher than the $9.13bn it made in the first quarter of 2022 – when oil and gas prices surged after the invasion of Ukraine.

But, profits are lower than the $9.8bn it made in the final quarter of last year, following the recent drop in oil and gas prices from their highs last summer.

Shell says it benefitted from “improved operational performance, lower underlying opex and better results in Chemicals & Products driven by trading & optimisation offsetting the impact of lower oil and gas prices, and higher tax compared with Q4 2022”.

Shell plans to funnel billions of these profits back to shareholders, through a new $4bn share buyback programme announced this morning.

That’s on top of total shareholder distributions of $6.3bn in the first quarter of the year, including an earlier $4bn buyback programme.

BIG OIL 1Q EARNINGS: As it was the case with BP, Shell’s vast in-house trading business juiced the quarter, with stronger-than-expected earnings (allowing another $4bn in buybacks). Capex is running rather hot, trending toward $26-27 billion | $SHELL #OOTT https://t.co/OAEG1PUV35

— Javier Blas (@JavierBlas) May 4, 2023

This comes on top of a blowout 2022 for Shell. Last year, it made one of the largest profits in UK corporate history, at $40bn (£32bn).

Rival oil giant BP has also made a profitable start to 2023. On Tuesday, BP reported underlying profits of $5bn (£4bn) in the first three months of the year, beating analysts’ forecasts of $4.3bn.

That was BP’s second-best results for the first quarter it has notched up since 2012, when it made $4.7bn, behind last year’s $6.2bn.

Also coming up today

The European Central Bank could raise interest rates again today, as it continues to battle inflation.

Ipek Ozkardeskaya, senior analyst at Swissquote, says:

The strong decline in bank lending – as a result of bank stress, and signs of slowing inflation – despite last month’s rally in energy prices, hint that a 25bp hike could be more appropriate in Eurozone this week than a 50bp hike.

This being said, ECB Chief Christine Lagarde will certainly not announce the end of the rate hikes in the Eurozone. She will likely stay firm on the ECB’s determination to fight inflation, and insist that the economic data will determine the size of the upcoming ECB actions.

Last night, America’s Federal Reserve raised US interest rates to the highest level since 2007, to a 5%-5.25% range.

The Fed also hinted it could be nearing the end of its rate-hike cycle. Chair Jerome Powell told a press conference:

“There is a sense that, you know, we’re much closer to the end of this than to the beginning.”

But he warned that “future policy actions will depend on how events unfold”.

We also learn how UK and eurozone services companies fared last month, and also get the latest UK car sales data. Preliminary data suggests car sales rose 10% in April….

The agenda

-

7am BST: German trade balance for March

-

9am BST: Eurozone services PMI for April

-

9am BST: UK car sales for April

-

9.30am BST: UK mortgage approvals and credit approval data for March

-

9.30am BST: UK services PMI for April

-

1.15pm BST: European Central Bank interest rate decision

-

1.45pm BST: European Central Bank press conference

Key events

Full story: Shares in California lender PacWest plummet amid fears of new US banking crisis

Julia Kollewe

The California lender PacWest has sought to calm markets and said it is in talks with several potential investors as its shares plummeted as much as 60%, reigniting fears about a US banking crisis.

PacWest shares plunged in after-hours trading after Bloomberg News reported it was considering strategic options including a sale or fundraising round. It is the latest US regional bank to seek a lifeline after First Republic Bank was sold to JP Morgan after talks over the weekend.

The Los Angeles-based PacWest sought to reassure investors by saying it had not experienced out-of-the-ordinary deposit flows.

The bank added:

“Recently, the company has been approached by several potential partners and investors – discussions are ongoing,”.

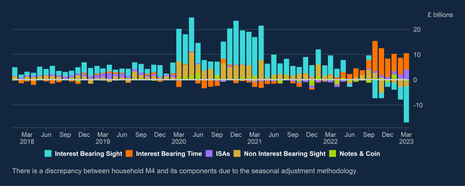

UK consumers increased their spending on credit cards in March, while also running down their savings at banks and building societies.

The Bank of England reports that consumers borrowed an additional £1.6bn in consumer credit in March, up from the £1.5bn borrowed during February.

That could show that households had to rely more on credit to make ends meet, given inflation remained in double-digit levels.

Households withdrew £4.8bn from banks and building societies in March, compared to net deposits of £2.6 billion in February.

Households moved £3.5bn into National Savings and Investment (NS&I) accounts during March, up from £2.0bn.

NS&I has been lifting its interest rates in recent months, such as on its Green Savings Bonds.

Ashley Webb, UK economist at Capital Economics, says the decline in bank deposits doesn’t look like a bank run:

March’s money and credit data showed that the collapse of the US bank SVB and the takeover of Credit Suisse in early March triggered a small withdrawal of funds from the overall UK banking system. Meanwhile, higher interest rates were a further drag on lending growth in March.

Total UK bank deposits fell by £18.1bn in March. Within that, deposits held by households fell by £4.8bn and businesses’ deposits fell by £5.8bn. Households’ deposits in instant access accounts fell by a further £5.1bn, but that was offset by a £6.5bn increase in deposits in higher interest-bearing time deposits. Households also increased their holdings in National Savings and Investment accounts by £3.5bn (which is outside of the banking system).

While total UK bank deposits fell in March as concerns over the banking sector rose, this is not big enough to constitute a bank run.

The pick-up in mortgage approvals could push up house prices this spring, predicts Charlotte Nixon, mortgage expert at Quilter.

Nixon explains:

Net mortgage approvals for house purchases have shown resilience in the face of these issues, increasing to 52,000 in March from 44,100 in February. This increase could be linked to a modest rise in consumer confidence, as individuals grow accustomed to mortgage rates around 4.5% and a predicted path to a base rate peak of 5%. This is also likely a result of the usual uptick in house purchases in spring.

However, with a base rate hike likely on the cards next week this new found optimism for buyers might be quickly dampened. Whether these increases are enough to completely rain on a usually more buoyant market in the spring and summer months is yet to be seen.

Today’s jump in mortgage approvals shows that the UK housing market continues its convincing rebound following the chaos of the mini-Budget, says Tom Bill, head of UK residential research at Knight Frank:

Price declines appear to be bottoming out and transactions clearly hit their low-point in January. Buyers have accepted the new normal for mortgage rates as stability returns to the lending market.

Boosted by savings accumulated during the pandemic, record levels of housing equity and a strong jobs market, we expect sales activity will be solid without being spectacular this year.

Properties that tick all the right boxes will hold their value but some of the “pandemic froth” is disappearing so asking prices will come under pressure, Bill says, adding:

After a general election, successive lockdowns, a stamp duty holiday and the mini-Budget, the UK housing market should have its most predictable year since 2018. Next year’s general election may shake things up again so switched-on buyers and sellers are acting while the backdrop is relatively uneventful.”

UK mortgage approvals jump to five-month high

UK mortgage approvals have risen to their highest since the aftermath of the mini-budget chaos last autumn.

UK lenders approved 52,000 new mortgages in March, up “significantly” from 44,100 in February, the Bank of England reports.

That suggests demand for property has picked up, after a sharp slowdown following the rise in UK interest rates and the turmoil in the bond markets.

That’s the highest number of new mortgage approvals since last October, although still lower than the 69,777 signed off a year earlier, in March 2022.

But net mortgage lending to individuals, which reflects mortgage approvals a month earlier, dropped to almost zero after net flow of £700m in February.

Moving money stories from the @bankofengland

– Borrowing of mortgage debt by individuals falls to the lowest level since July 21 from a net flow of £0.7 billion in Feb to net zero in March.

– Net mortgage approvals for house purchases rose to 52,000 in March, from 44,100 in Feb pic.twitter.com/6Xhs39VYk7— Emma Fildes (@emmafildes) May 4, 2023

The Bank’s data also shows how borrowers are facing higher interest payments, following the rise in mortgage rates.

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 17 basis points, to 4.41% in March, the BoE says.

Jason Tebb, chief executive officer of property search website OnTheMarket.com, says:

“With approvals for house purchases, an indicator of future borrowing, continuing to rise in March, stability and confidence is returning to the market after the upheaval of the autumn and the fallout from the mini-Budget.

While the base rate may rise again at this month’s Monetary Policy Committee meeting, there’s a growing expectation that we’re near the end of the increases and that the plan to reduce inflation is on track.

As the traditionally busier spring months kick into gear, it feels as though we’re getting back to where we were pre-pandemic, before the stamp duty holiday and race for space distorted the market. As more people get on with the business of moving, sellers who take advice from experienced agents and price realistically will be best placed to secure a buyer.”

UK service sector posts best growth in a year

Britain’s service sector has posted its strongest growth in a year, as the economy picked up pace last month.

Data firm S&P Global reports that business activity growth regained momentum during April, fuelled by the strongest upturn in new orders since March 2022.

With demand resilient, and business optimism rising, firms also took on more staff, their survey of purchasing managers says.

This has lifted the S&P Global / CIPS UK Services PMI to 55.9 in April, up from 52.9 in March, showing the fastest rise in service sector business activity for 12 months.

Firms reported stronger consumer spending, particularly in the travel, tourism and leisure sub-sectors.

Company costs also increaased, with many blaming higher wages.

The PMI report says:

Higher salary payments were by far the most cited reason for increased business expenses in April, followed by elevated energy prices.

Around 48% of the survey panel reported a rise in input costs, while only 3% signalled a fall. Moreover, the overall rate of input price inflation accelerated for the first time since last November.

Tim Moore, economics director at S&P Global Market Intelligence, explains:

A strong rate of service sector growth meant that the UK economy started the second quarter of 2023 in positive fashion. Overall private sector output expanded at the fastest pace for one year, despite another fall in manufacturing production during April.

Service providers experienced the steepest upturn in new work for 13 months as resilient consumer spending combined with a turnaround in demand for business services to boost overall order books. Survey respondents often cited an improvement in clients’ willingness to spend, helped by greater confidence with regards to the near-term economic outlook.

UK car sales rise, but electric car forecast cut

UK car sales have risen for the ninth month running, as easing supply chain problems helped autuo dealers to get hold of stock.

There were 132,990 new cars registered in the UK in April, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). That’s an 11.6% increase on April 2022, but still 17.4% below 2019’s volumes.

So far this year, car sales are 16.9% higher than in 2022, which has prompted the SMMT to lift its forecast for sales this year, for the first time since 2021.

It now expects 1.83m new vehicle to be sold, up from 1.79m predicted before, as supply chain disruption eases.

But, the SMMT has cut its forecast for growth in battery-powered electric cars, saying:

The sector is, however, less optimistic about growth in demand for BEVs, downgrading their expected 2023 market share from 19.7% to 18.4%, with high energy costs and insufficient charging infrastructure anticipated to soften demand.

Mike Hawes, SMMT chief executive, says:

The new car market is increasingly bullish, as easing supply chain pressures provide a much-needed boost.

However, the broader economic conditions and chargepoint anxiety are beginning to cast a cloud over the market’s eagerness to adopt zero emission mobility at the scale and pace needed.

To ensure all drivers can benefit from electric vehicles, we need everyone – government, local authorities, energy companies and charging providers – to accelerate their investment in the transition and bolster consumer confidence in making the switch.

We have another interest rate hike…. in Norway.

Norges Bank has just raised its policy rate by 0.25 percentage points to 3.25%.

And based on the “current assessment of the outlook and balance of risks”, the policy rate will most likely be raised further in June, Norges Bank adds.

European markets drop amid US banking worries

European stock markets are losing ground this morning, as investors worry about the jitters in the US banking sector.

Last night, shares in California lender PacWest tumbled by over half, as traders worried that it could become the next victim of the banking panic.

PacWest then revealed it was looking at “all options to maximize shareholder value”, and had been approached by potential partners and investors.

After the takeover of First Republic by JP Morgan this week, PacWest is the latest midsize bank under firm pressure.

Victoria Scholar, head of investment at interactive investor, explains why:

PacWest is the latest lender to fall victim to the turmoil in the US mid-cap banking sector with worried investors either cutting their holdings or adding to short positions which has punished its share price.

PacWest has a heavy focus on commercial real estate lending, which has suffered on the back of the Fed’s aggressive rate hiking path after the longstanding punchbowl of cheap money was removed.

Neil Wilson of Markets.com says it’s “all hands to the pumps” for PacWest.

Just as Jay Powell, the chairman of the Federal Reserve, was proclaiming the US banking system was “sound and resilient”, news was breaking that another embattled midsize lender was close to the edge.

After the Fed’s decision to raise rates by 25bps, reports emerged that PacWest Bancorp was exploring “strategic options”, including a possible sale. Shares in the bank tumbled 50% after-hours to take its YTD loss to almost 72%. Shares in Western Alliance, another embattled regional lender, slumped a further 22% in after-hours trading. KBW will open lower later after sliding almost 2% yesterday.

It’s all hands to the pumps now for PACW, which issued a statement saying it is looking at “all options to maximize shareholder value”. It also stressed that deposits are OK – core customer deposits have increased since March 31st with $28 billion in total deposits as of May 2nd, whilst the level of insured deposits has increased from 71% to 75%. You can’t ask JPM to come to the rescue again. “I think it’s probably good policy that we don’t want the largest banks doing big acquisitions,” Powell said.

No but that is what happened because it was the ‘best’ outcome for the banking system and FDIC…unintended consequences. The quicker the Fed gets to a point of cutting rates the better for these midsize banks but there is a lot more time and likely a lot more pain before we get there.

The prospect of another hike in eurozone interest rates this lunchtime is also hitting the mood on trading floors, with the ECB expected to lift borrowing costs by at least 25 basis points later today.

In London, the FTSE 100 has dipped to a near one-month low, currently down 18 points or 0.3% to 7,770 points.

Germany’s DAX and France’s CAC indices are both down around 0.4%.

Shell makes record first-quarter profits of nearly $10bn

Jillian Ambrose

Shell made record first-quarter profits of more than $9.6bn (£7.6bn) in the first three months of this year, even as oil and gas prices tumbled from last year’s highs, our energy correspondent Jillian Ambrose reports.

The better-than-expected adjusted earnings topped its previous first-quarter profit record set last year at $9.1bn for the same period, and were well above the $7.96bn predicted by industry analysts.

Europe’s biggest oil and gas company will now offer shareholders $4bn in share buybacks over the next three months.

The Anglo-Dutch energy company said profits rose thanks to its trading teams which were able to mitigate against the falling market price for oil and gas.

Global oil prices averaged $81.7 a barrel in the first quarter of this year, according to Shell, down from $102.2 a barrel in the same period a year earlier, when Russia’s invasion of Ukraine ignited a surge in oil and gas markets.

Shell’s new chief executive, Wael Sawan, said the company had delivered “strong results and robust operational performance, against a backdrop of ongoing volatility”.

More here: