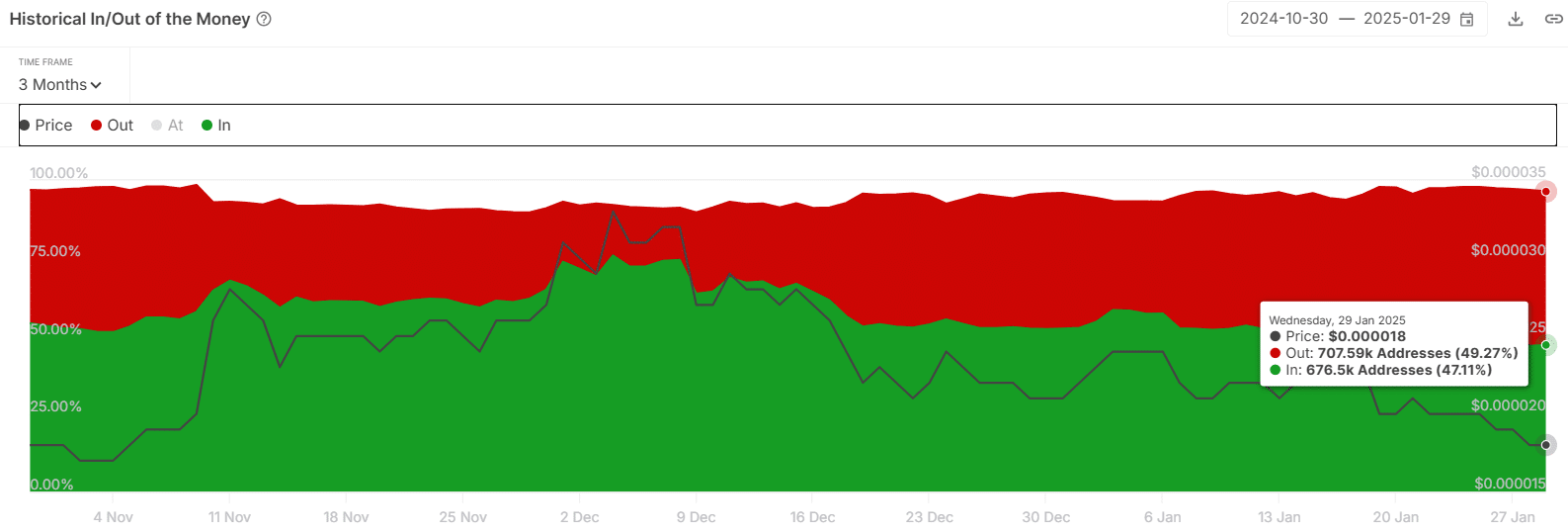

- The percentage of SHIB wallets that are in profits has dropped to 47%, marking the lowest level in three months.

- The declining MVRV ratio also indicated that traders were seeing reduced unrealized profits on their holdings.

Shiba Inu [SHIB] was trading at $0.0000186, at press time, after a slight 0.9% gain in 24 hours. Despite this, the meme coin remains down nearly 7% in the last seven days.

One factor affecting SHIB’s performance could be a decline in wallet profitability, which has dampened investor sentiment.

Wallets in profit hit a 3-month low

The number of profitable Shiba Inu wallets has dropped to 676,500 addresses, marking the lowest level in three months. At press time, only 47% of SHIB holders were profitable, while 49% were sitting in losses.

Going by past trends, SHIB’s price rally coincides with a rise in the number of profitable wallets. Therefore, if more traders experience losses, it could result in further dips for SHIB.

Traders looking to minimize their losses might also exert additional sell-side pressure on the meme coin, causing a pullback.

Is a declining MVRV good for price?

Shiba Inu’s Market Value to Realized Value (MVRV) ratio has dropped to 0.907, marking the lowest level since early November 2024. This drop indicates that the average holder is seeing fewer profits from their holdings.

A low MVRV could lead to reduced selling pressure, as declining profits mean there is less incentive to sell. However, this decline could also trigger further drops if demand from buyers remains weak.

SHIB price analysis

Shiba Inu’s daily chart shows that selling pressure has outpaced the buying pressure. In fact, the Relative Strength Index (RSI) had dropped to 36, which highlights a bearish momentum.

At press time, the RSI was tipping north, showing an uptick in buying activity. If it crosses above the signal line, it could strengthen buying momentum.

At the same time, the Average Directional Index (ADX) was rising, indicating the downtrend is still strong. Traders should watch for a shift in the ADX line to confirm a bullish reversal.

SHIB has tested resistance at the 0.786 Fibonacci level ($0.0000189). If it surpasses this level and extends gains, the next target for the meme coin is $0.0000212.

Realistic or not, here’s SHIB market cap in BTC’s terms

Open Interest rises again

Data from Coinglass shows a notable dip in Shiba Inu’s Open Interest(OI) to $351 million. At press time, this metric stood at $348 million after a slight 5% gain in 24 hours, indicating that traders were opening new positions.

If OI continues to rise, it will show rising speculative interest that could support an uptrend. Long positions also seem to be dominating the market due to the positive Funding Rates.