Siemens Energy shares plunge as it seeks government support

Germany’s Siemens Energy are reportedly in talks with the Berlin government to secure billions of euros in state guarantees as it struggles to shore up its troubled wind-turbine unit.

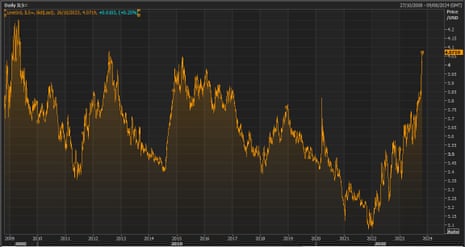

Shares in Siemens Energy have dropped by almost 29%, after news website Der Spiegel reported that the company’s CEO, Christian Bruch, is negotiating with the federal government for several billion euros in guarantees.

This funding would allow Siemens Energy – one of the largest makers of wind turbines -to continue financing new business despite the high losses in the wind turbine business.

According to @DerSpiegel, Siemens Energy, one of the world’s largest manufacturers of wind turbines, is in talks with the German government for state guarantees worth billions of dollars (otherwise known as a bail-out) https://t.co/tAm449j2Ww

— Javier Blas (@JavierBlas) October 26, 2023

Siemens Energy has confirmed this morning that it is evaluating various measures to strengthen its balance sheet, and is in “preliminary talks with different stakeholders”, including banking partners and the German government over fore more guarantees which are “necessary to facilitate the anticipated strong growth”.

It also warns that order intake and revenue at its wind business, Siemens Gamesa, are expected to be lower than market expectations for fiscal year 2024, and net losses and cash outflow are expected to be higher than market forecasts.

The company says:

In light of recent media reports regarding talks with the German government, Siemens Energy AG states the following: Siemens Energy financial results for fiscal year 2023 are expected to be fully in line with guidance. The former Gas and Power businesses are expected to continue their excellent performance in fiscal year 2024 and are on track to achieve their mid-term targets (fiscal year 2025). The wind business Siemens Gamesa is working through the quality issues and is addressing the offshore ramp up challenges as announced in the third quarter communication for fiscal year 2023. As Siemens Gamesa is for the time being not concluding new contracts for certain onshore platforms and is applying strict selectivity in the offshore business, order intake and revenue are expected to be lower than market expectations for fiscal year 2024, and net losses and cash outflow are expected to be higher than market forecasts.

The strong growth in order intake, particularly in the former Gas and Power business areas, leads to a rising need of guarantees for long-term projects. Considering this requirement, the Executive Board is evaluating various measures to strengthen the balance sheet of Siemens Energy and is in preliminary talks with different stakeholders, including banking partners and the German government, to ensure access to an increasing volume of guarantees necessary to facilitate the anticipated strong growth.

Key events

Tension is building in the eurozone ahead of the European Central Bank’s interest rate decision, due in half an hour.

As covered in the introduction, economists broadly expect the ECB to leave borrowing costs unchanged at 1.15pm BST today.

But there is considerable interest in what the ECB might say about the path of interest rates in future.

Charalampos Pissouros, senior investment analyst at XM, explains:

When they last met, ECB officials raised interest rates by 25bps, but they signaled that this was probably the last hike in this tightening crusade.

Since then, several officials have argued that inflation could return to their 2% objective even without any additional hikes, while economic data continues to point to a wounded euro area economy. This convinced market participants no more rate increases will be delivered and allowed them to price in around 65bps worth of cuts for next year.

Therefore, the attention will fall on clues and hints on whether policymakers are indeed considering the reduction of interest rates at some point next year, with anything validating this notion having the potential to further hurt the euro.

Hipgnosis shareholders oppose catalogue sales plan

Newsflash: Investors in music rights fund Hipgnosis have staged a shareholder revolt today.

Hipgnosis shareholders have voted against a plan to sell $440m of music rights to a group backed by private equity firm Blackstone at an annual meeting today.

They have also refused to support a Continuation Resolution, which could lead to the fund being wound up. Thirdly, they opposed the re-election of chairman Andrew Sutch, who had already pledged to step down by next year’s AGM.

Hipgnosis says it will now put forward proposals for the reconstruction, reorganisation or winding-up of the Company to Shareholders for their approval within six months, adding:

These proposals may or may not involve winding-up the Company or liquidating all or part of the Company’s existing portfolio of investments.

Hipgnosis had pioneered the idea of buying up the rights to music from top stars, promising a revenue stream from popular back catalogues. It has acquired the rights to songs from artists including Barry Manilow, Blondie, the Red Hot Chili Peppers, Shakira, Metallica and Michael Bublé.

But rising interest rates have hampered its efforts, dampening interest in alternative assts, and prompting it to slash its dividend last week.

Britain’s retail sector remains in “a perilous position” as the festive period approaches, according to the latest survey from the CBI.

Its latest distributive trades survey has found that retail sales fell in the year to October, and at a faster pace than in September.

This marks the sixth month in a row in which annual sales have declined. Sales volumes are expected to continue falling next month, the CBI adds.

Back in the financial markets, Israel’s currency has hit its lowest in over a decade against the US dollar.

The shekel has fallen 0.25% today to 4.07 to the dollar, the weakest since 2012, as traders continue to anticipate a ground invasion in Gaza.

On 6 October, the day before Hamas’s surprise attack on Israel, the shekel had traded at 3.83 to the dollar.

Today’s losses come after Israel said its tanks had taken part in a “targeted raid” overnight in northern Gaza.

WirtschaftsWoche: Siemens Energy seeking €15bn of guarantees

Business news weekly WirtschaftsWoche reports that Siemens Energy is seeking up to €15bn of guarantees.

WirtschaftsWoche says the company is proposing that the federal government should guarantee 80% of the first tranche of €10bn, with its banks liable for 20%.

Under the peoposal, a second tranche of €5bn would be guaranteed by Siemens AG, which spun off Siemens Energy on the stock exchange three years ago and still holds 25% of its shares.

However, Siemens AG is currently showing little inclination to accept responsibility, WirtschaftsWoche says, citing information from“financial and government circles”.

A spokesperson for the German economy ministry has confirmed it is in talks with Siemens Energy, describing the discussions as “close and trustworthy”, according to Reuters.

Siemens Energy shares plunge as it seeks government support

Germany’s Siemens Energy are reportedly in talks with the Berlin government to secure billions of euros in state guarantees as it struggles to shore up its troubled wind-turbine unit.

Shares in Siemens Energy have dropped by almost 29%, after news website Der Spiegel reported that the company’s CEO, Christian Bruch, is negotiating with the federal government for several billion euros in guarantees.

This funding would allow Siemens Energy – one of the largest makers of wind turbines -to continue financing new business despite the high losses in the wind turbine business.

According to @DerSpiegel, Siemens Energy, one of the world’s largest manufacturers of wind turbines, is in talks with the German government for state guarantees worth billions of dollars (otherwise known as a bail-out) https://t.co/tAm449j2Ww

— Javier Blas (@JavierBlas) October 26, 2023

Siemens Energy has confirmed this morning that it is evaluating various measures to strengthen its balance sheet, and is in “preliminary talks with different stakeholders”, including banking partners and the German government over fore more guarantees which are “necessary to facilitate the anticipated strong growth”.

It also warns that order intake and revenue at its wind business, Siemens Gamesa, are expected to be lower than market expectations for fiscal year 2024, and net losses and cash outflow are expected to be higher than market forecasts.

The company says:

In light of recent media reports regarding talks with the German government, Siemens Energy AG states the following: Siemens Energy financial results for fiscal year 2023 are expected to be fully in line with guidance. The former Gas and Power businesses are expected to continue their excellent performance in fiscal year 2024 and are on track to achieve their mid-term targets (fiscal year 2025). The wind business Siemens Gamesa is working through the quality issues and is addressing the offshore ramp up challenges as announced in the third quarter communication for fiscal year 2023. As Siemens Gamesa is for the time being not concluding new contracts for certain onshore platforms and is applying strict selectivity in the offshore business, order intake and revenue are expected to be lower than market expectations for fiscal year 2024, and net losses and cash outflow are expected to be higher than market forecasts.

The strong growth in order intake, particularly in the former Gas and Power business areas, leads to a rising need of guarantees for long-term projects. Considering this requirement, the Executive Board is evaluating various measures to strengthen the balance sheet of Siemens Energy and is in preliminary talks with different stakeholders, including banking partners and the German government, to ensure access to an increasing volume of guarantees necessary to facilitate the anticipated strong growth.

Unemployment in Spain has risen, giving the European Central Bank’s policymakers something to ponder as they set interest rates today.

The Spanish jobless rate rose to 11.84% in the third quarter of the year, statistics body INE reports, up from 11.6% in Q2.

Wouter Thierie, economist at ING, suggests the uptick might be caused by seasonal factors.

Thierie says:

The labour market benefited from strong growth in the more labour-intensive service sector, which was underpinned by a strong tourist season. In addition, the labour market is also suffering from a structural supply shock.

For instance, the average number of hours worked per worker is still lower than before the pandemic, which means more labour is needed to cover the same amount of hours. This exerts downward pressure on the unemployment rate.

INE also reports that the number of employed people in Spain increased by 209,100 in the third quarter of 2023, a rise of almost 1%, to 21,265,900, suggesting demand for labour remained robust.

European stock markets are in the red as traders await today’s ECB interest rate decision at lunchtime.

The pan-European Stoxx 600 inded has lost around 1%, with Germany’s DAX down 1.3%.

Shares in Mercedes Benz Group are down over 5% after it reported a 6.8% drop in operating profits, and warned that the electric vehicle market was “brutal” due to a flurry of price cuts.

In London the FTSE 100 is down 62 points, or 0.85%, pulled down by Standard Chartered (now -12.9%), while Unilever are still down almost 3%.

A takeover battle over the owner of Wagamama is brewing.

The Restaurant Group has told the City that the owner of Pizza Express, Wheel Topco, have asked to see financial information so they can decide whether to make a takeover offer for the company.

It told shareholders:

The Board of TRG confirms that it will provide diligence information to Wheel Topco in accordance with its obligations under the Code.

If any proposal is provided by Wheel Topco, the Board of TRG will carefully consider its terms, in conjunction with its advisers.

Restaurant Group has already accepted a £506m takeover offer from the US buyout group Apollo, which values it at 65p per share.

Shares in TRG have risen 1.8% to 67.6p, as traders anticipate a possible bidding battle.