- Solana has continued rising, creating new support levels.

- The DEX volume continues to see record spikes.

Solana’s [SOL] blockchain has been buzzing with activity, registering a sharp increase in decentralized exchange (DEX) volumes and token burns.

This signaled a strong surge in user activity and network engagement, which has caught the crypto community’s attention.

As SOL’s price continues to climb, questions arise about whether this momentum can be sustained or if a pullback is on the horizon.

Solana DEX volume surges

Over the past few weeks, Solana’s DEX volumes have skyrocketed, with platforms such as Raydium [RAY] and Phoenix leading the charge.

The total volume recently surpassed $10 billion, per data from Dune Anlaytics, marking one of the network’s busiest periods in recent history.

This upswing reflected a clear rise in demand for Solana-based decentralized finance (DeFi) applications.

The surge in activity underscored the growing liquidity and participation within Solana’s ecosystem.

These factors are essential for long-term network growth and underline its status as a formidable competitor to Ethereum [ETH] and other Layer-1 blockchains.

As liquidity flows into Solana’s DEXes, the implications for SOL’s demand—and, by extension, its price—are significant.

Token burns: Strengthening Solana

Beyond DEX volumes, Solana’s token burn mechanism is playing a pivotal role in the network’s economic model.

With 50% of transaction fees being burned, the supply of SOL continues to contract, creating scarcity in the market.

Recent data reveals that Solana has burned over $6 million of transaction fees, a record-breaking milestone showcasing the network’s bustling activity.

This burn mechanism not only curtails supply but also enhances the perceived value of SOL. As activity intensifies, so does the rate of burns, reinforcing a deflationary trend that benefits long-term holders.

This reduced supply dynamic provides a strong tailwind for a token already gaining momentum.

Can SOL break through resistance?

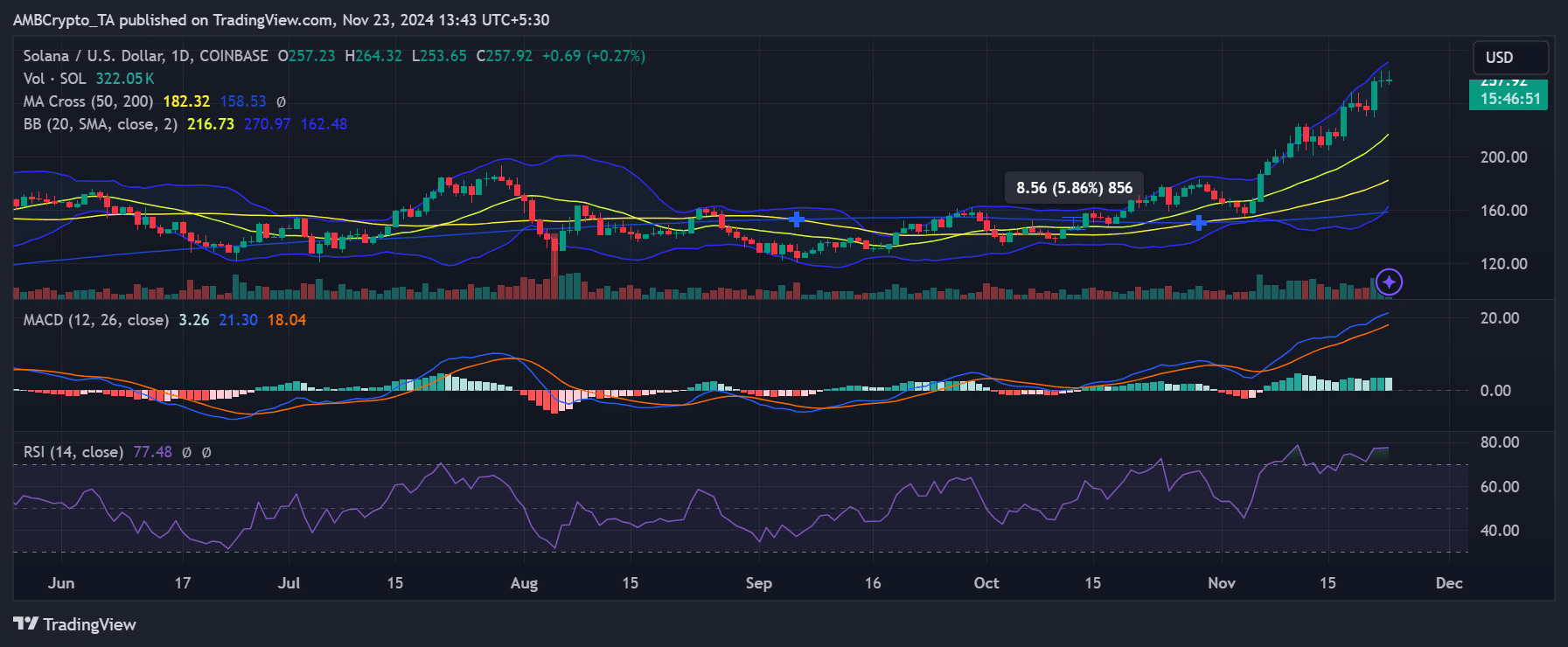

SOL’s price has been on a tear, recently trading above $250, and is close to testing its yearly highs. AMBCrypto’s analysis revealed a mix of signals.

Notably, the RSI indicated overbought conditions, suggesting a possible consolidation period, while the MACD maintained a bullish stance, hinting at further upside potential.

The next major resistance level sits at $275—a point that could either trigger a breakout or act as a barrier.

A sustained rise in on-chain activity, coupled with steady DEX volumes and token burns, could provide the momentum needed to break this resistance.

However, failure to clear this level might cause SOL to retrace to key support at nearly $230.

Is your portfolio green? Check out the SOL Profit Calculator

The surging DEX volumes and escalating token burns reflect strong adoption and activity.

While SOL’s price trajectory depends on market sentiment and broader crypto trends, the fundamentals suggest a bullish outlook. Whether the network can sustain this momentum remains to be seen.