- Sonic’s bearish breakout and declining Open Interest hinted at growing selling pressure and market uncertainty

- Increasing long liquidations and weakening social engagement alludes to further downside risk for the altcoin

At the time of writing, Sonic seemed to be facing bearish pressure as traders exited their positions and the sentiment weakened.

In fact, Sonic [S] broke out of a bearish flag pattern, signaling potential further downside. Open interest dropped by 2.93% to $73.81 million, indicating traders are stepping back according to Coinglass.

This decline pointed to reduced market confidence as investors scaled down their exposure. At press time, the altcoin was trading at $0.5305, reflecting a 10.19% drop in the last 24 hours. If this trend continues, Sonic may struggle to regain its bullish momentum in the short term.

Is Sonic’s breakdown a warning sign for traders?

Sonic’s recent price action confirmed a bearish breakout, falling below a key support level. This movement indicated growing selling pressure, with traders expecting more losses.

The chart underlined the resistance level at $0.6128, while the immediate support lay at $0.5145 and $0.4479. If selling pressure remains strong, Sonic could drop further to test lower price levels.

Additionally, the Relative Strength Index (RSI) stood at 54.61, suggesting that Sonic was neither overbought nor oversold at press time. Hence, this leaves room for more downside unless strong buying support emerges.

Market sentiment weakens as social engagement drops

Sonic’s social dominance and social volume have both declined, suggesting reduced retail interest. At the time of writing, social volume stood at 431, while social dominance dropped to 3.74%. This downtrend indicated that discussions around Sonic have been fading.

A drop in social engagement often hints at weakening momentum, making a price recovery less likely. If retail traders lose interest, Sonic may struggle to regain bullish momentum. However, if sentiment shifts and activity increases, a reversal could still be possible.

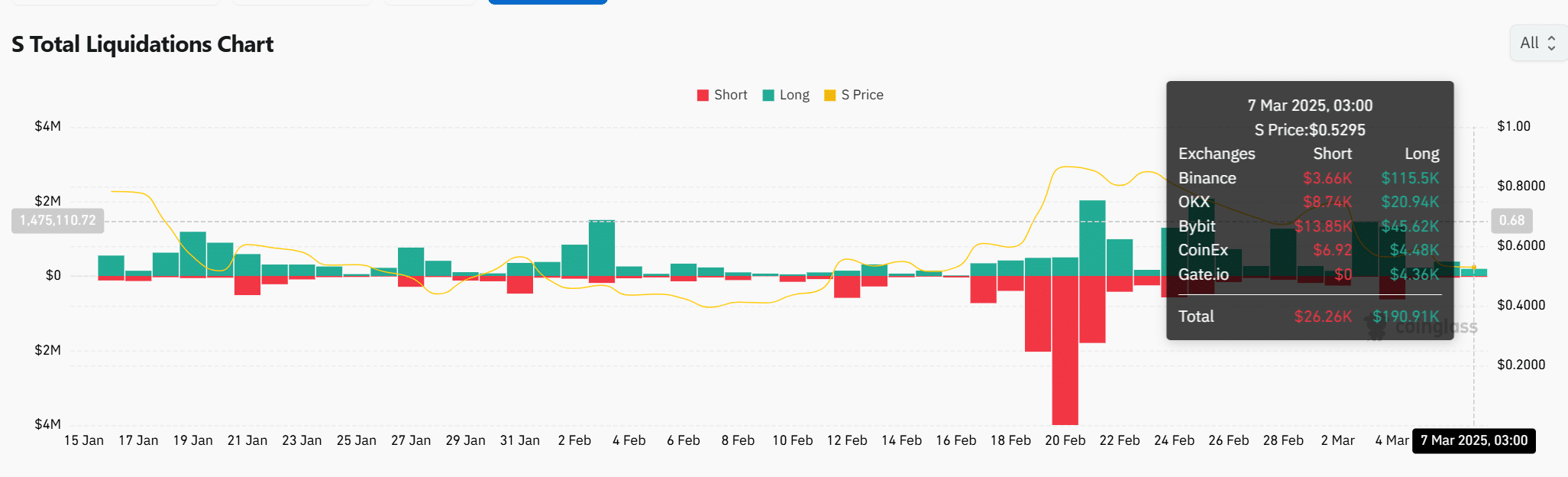

Liquidation data reveals hike in bearish pressure

Additionally, liquidation data showed that long positions have been taking a significant hit. On 7 March, $190.91k in long liquidations occurred, compared to just $26.26k in short liquidations. This imbalance meant that bullish traders may be getting squeezed as the price declines.

Among exchanges, Bybit recorded the highest long liquidations at $45.62k, followed by Binance at $115.5k. This data indicated that many traders were caught off guard by the bearish move. If long liquidations continue outpacing shorts, further downside may be inevitable.

Conclusion

Sonic’s bearish breakout, declining social interest, and heavy long liquidations suggested that more downside may be likely. Unless strong buying pressure emerges, the bearish momentum could push Sonic towards lower support levels.

Traders should watch for any shift in sentiment or an increase in buying volume that could stabilize the price. However, if current trends persist, Sonic is likely to see further declines in the coming days.