U.S. stocks ended mixed Wednesday, as another busy day of earnings gave investors a fresh sense of how companies are coping with an economic slowdown and higher interest rates.

Earnings season is in full swing this week, with investors getting fourth-quarter updates from some of the biggest names in markets.

on Tuesday afternoon was the first of the tech titans to report. Its results showed the company recorded its slowest sales growth in more than six years.

That sent

shares falling and—combined with gloomy forecasts from companies including

—weighed on markets Wednesday, market watchers said. Microsoft fell 0.6%, though it pared deeper losses earlier in the day.

dropped 0.5% and

Google’s parent, declined 2.5%.

“It’s a gut shot when you see Microsoft come out with a fundamental reason to negate the rally we’ve seen,” said

John Lynch,

chief investment officer for Comerica Wealth Management. “Suddenly people aren’t so confident in Tesla and Alphabet.”

Quarterly results released early Wednesday did little to assuage investors.

surprised markets with a quarterly loss, but shares recovered to gain 0.3% on the day.

stock lost 1.4% after its sales fell, dragged down by a drop in demand for the company’s Covid-19 testing kits.

“There’s been a little bit of a bias toward risk-off sentiment over the last 24 hours, thanks partly to some weaker-than-expected earnings releases that added to growing concerns about a potential U.S. recession,” said Jim Reid, a Deutsche Bank strategist, in a Wednesday note.

A bright spot was

AT&T,

whose stock gained 6.6%. The telecommunications company said it had added wireless subscribers in the latest quarter and plans to keep spending heavily on 5G.

The next few weeks of quarterly results are expected to heavily influence the direction of the U.S. stock market, which has kicked off 2023 with strong gains. The S&P 500 has rallied 4.6% this year, while the tech-focused Nasdaq Composite has jumped 8.1%.

Those gains have largely been driven by growing evidence that inflation may have peaked in the U.S. and expectations that the Federal Reserve will again slow the pace of its interest-rate increases at its meeting next week. That rally could be interrupted, however, if corporate results worsen, investors warned. Fourth-quarter profits for companies in the S&P 500 are expected to fall 4.9%, according to FactSet data that considers both actual and estimated results.

“Earnings are the first big test for markets this year,” said

Emmanuel Cau,

head of European equity strategy at Barclays, who noted that investors are particularly focused on guidance for the year ahead.

“The tone of the reporting is on the cautious side,” he said. While growth is slowing, the market is likely to care about the outlook more than fourth-quarter results, he said.

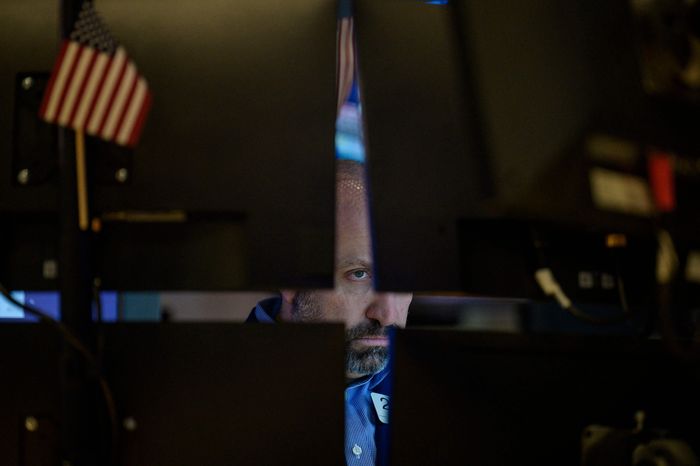

U.S. stock markets have gained to start 2023 despite concerns about the economy.

Photo:

angela weiss/Agence France-Presse/Getty Images

Elsewhere in markets, government bond yields retreated Wednesday. The yield on the 10-year U.S. Treasury note fell to 3.461%, from 3.467% Tuesday. Yields decline when bond prices rise.

Brent crude, the international benchmark, was roughly flat at $86.12 a barrel.

In Europe, the pan-continental Stoxx Europe 600 weakened, falling 0.3%.

Meanwhile, Asian indexes that were open for trading mostly rose. Japan’s Nikkei 225 gained about 0.4%, while South Korea’s Kospi Composite gained 1.4%. In India, the S&P BSE Sensex Index declined 1.3%, after the short-selling firm Hindenburg Research published a skeptical report about companies tied to India’s richest man,

Gautam Adani.

Indexes in Hong Kong and mainland China remained closed for Lunar New Year holidays.

Write to Caitlin McCabe at caitlin.mccabe@wsj.com and Justin Baer at justin.baer@wsj.com

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8