ONS: Strikes held back growth

Strikes by civil servants and teachers held back growth in the economy in February, says Darren Morgan, director of economic statistics at the Office for National Statistics.

The PCS union, which represents civil servants, held the largest civil service strike for many years in February, as it stepped up a month of strikes over pay, pensions, redundancy terms and job security.

Tens of thousands of teachers in England, Scotland and Wales held strike action at the end of the month.

Morgan says this led to the flatlining in economic activity in February.

“The economy saw no growth in February overall.

“Construction grew strongly after a poor January, with increased repair work taking place.

“There was also a boost from retailing, with many shops having a buoyant month.

“These were offset by the effects of Civil Service and teachers’ strike action, which impacted the public sector, and unseasonably mild weather led to falls in the use of electricity and gas.”

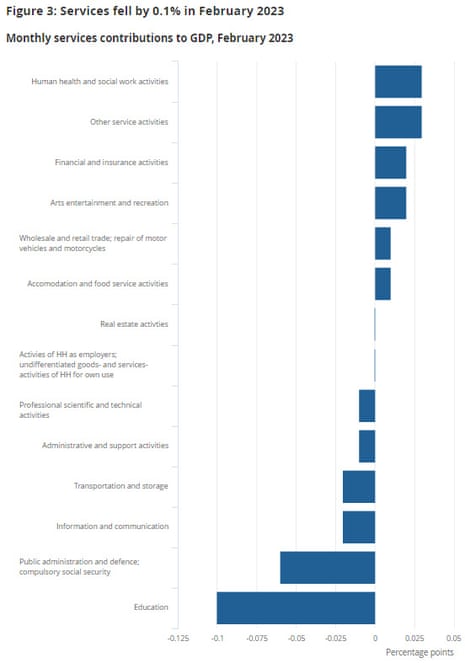

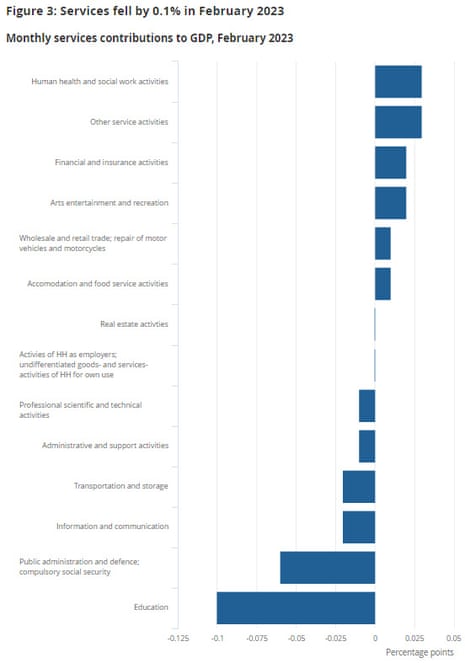

The largest contributor to the negative growth in services in February 2023 was education, which fell 1.7% in the month, today’s GDP report shows.

This decline follows growth of 2.5% in January 2023. On the three months to February 2023, compared with the three months to November 2022, education fell by 1.9%.

Key events

FTSE 100 dips

The London stock market has opened quietly this morning, as traders digest today’s UK GDP report.

The FTSE 100 index has dipped by 3 points to 7821, having closed at a one-month high yesterday.

Housebuilders Taylor Wimpey (+2.2%) and Barratt (+2.2%) are leading the risers, after HSBC lifted its price targets on their stock, followed by Tesco (+2%) despite its drop in profits last year.

Victoria Scholar, head of investment at interactive investor, explains:

Investors are weighing up an improving picture for US inflation with the latest data falling to 5%, a two-year low versus fears of a recession stateside after minutes from the Fed’s latest meeting indicated that US central bank policymakers are concerned about the negative economic fallout from the recent turmoil in the banking sector.

US weekly jobless claims and producer price inflation data are in focus today as well as Wall Street earnings which kick off tomorrow with some of the biggest US banks due to report.”

Tesco profits halve amid ‘incredibly tough year for customers’

Sarah Butler

Profits at Tesco halved last year to £753m in what the grocer called an “incredibly tough year for customers” as it battled “significant operating cost inflation” and wrote down the value of some properties.

The UK’s biggest retailer said sales rose 7.2% to £65.7bn in the year to 25 February, including a 3.3% increase at its UK supermarkets, but it had sold fewer items as shoppers chose carefully, to manage budgets under pressure from price rises.

Sales of food in the UK rose 4.6% in the year, led by the group’s own-label ranges, with sales of its premium Finest range up nearly 7% and its cheapest “Exclusively at Tesco” range up 6%.

However, the retailer said the volume of items sold had fallen, partly as its customers adjusted behaviour amid easing Covid restrictions, buying less to eat at home because they were visiting restaurants and cafes more often.

Sales of homewares and clothing also fell in the UK after strong lockdown-linked sales in the first part of the previous year. Online sales were down 5.4% as shoppers returned to stores as the pandemic eased. However, Tesco said its Whoosh fast-track grocery service was proving popular and now operated from 1,000 stores, 200 more than previously planned.

Sales in convenience stores and large supermarkets rose, with small shops in central London seeing the fastest growth – at 9.4% – reflecting the return to office-working in the capital.

Profits were hit by a £982m write-down on the value of properties and the £138m cost of restructuring, which included hundreds of job cuts when the retailer shut down its fresh food counters in stores.

Ken Murphy, the chief executive of Tesco, which owns the Booker grocery wholesaler and runs stores in eastern Europe and Ireland as well as the UK, said:

“It’s been an incredibly tough year for many of our customers, and we have been determined to do everything we can to help.

LVMH shares hit record as Chinese demand rebounds

Over in Paris, shares in LVMH, the world’s largest luxury company, have hit a record hihh after it smashed analysts’ expectations thanks to a rebound in demand in China.

Last night LVMH, which owns the Louis Vuitton and Dior fashion houses, as well as Hennessy cognac and U.S. jeweler Tiffany, reported a 17% rise in sales to €21.04bn for the first three months of this year.

Demand in China rebounded sharply after COVID-19 lockdowns.

LVMH said it had enjoyed “an excellent start to the year”, within an “uncertain” geopolitical and economic environment.

It said:

Europe and Japan, which enjoyed strong growth momentum, benefited from robust demand from local customers and international travelers; the United States, a market which continues to grow, had a steady performance.

Asia experienced a significant rebound following the lifting of health restrictions.

LVMH’s shares have jumped almost 5% this morning, while other luxury goods makers such as Burberry (+2%) are getting a lift too.

LVMH’s strong performance is an early snapshot of the scale of the Chinese recovery since president Xi JinPing ended the country’s lockdowns.

Peter Garnry, head of equity strategy at Saxo, says:

The European luxury retailer reported a strong surge in Q1 sales, led by fashion and leather goods rising 18%, nearly twice the pace of growth expected from analysts.

The company reported strong growth in sales in Asia after China lifted Covid restrictions.

The pound has nudged up against the US dollar this morning, despite the disappointing UK GDP report for February.

Sterling has gained 0.15% to hit $1.25, the highest in over a week, approaching a 10-month high even though the economy recorded no growth in February.

William Marsters, senior sales trader at investment platform Saxo, says:

“The lack of positive growth will disappoint both the UK Chancellor and the UK PM as the former attempts to defend weak growth projections from the International Monetary Fund, while the latter has promised growth to constituents as one of his five key priorities for 2023.

“Strikes across public services are cited to be the main contributor to the stalled economy in Feb. Pound Sterling moved slightly stronger after the data was published.

The dollar weakened yesterday after US inflation dropped to its lowest in almost two years, boosting hopes that the Federal Reserve might stop raising US interest rates soon.

The UK economy would probably have grown in February, without the strike action by civil servants and teachers, predicts Daniel Mahoney, UK economist at Handelsbanken.

Mahoney says:

Monthly GDP (m-o-m) saw no growth in February by registering at 0%. This was roughly in line with consensus (0.1%). The services sector saw a marginal fall in growth of 0.1% after showing more promising expansion in January of 0.7%.

Teacher strikes in February saw output from the education sector fall by 1.7%, which was the largest contributor to services showing a negative print. Were it not for industrial action, February probably would have posted a marginally positive GDP monthly figure. The disappointing services numbers were offset by more encouraging news elsewhere: for example, the construction sector grew by 2.4% in February, driven by growth in both repair and maintenance and new work.

There’s a danger that the UK economy shrank over the first quarter of this year, Mahoney adds.

But that wouldn’t be a technical recession (two quarters of negative growth in a row), as GDP rose by 0.1% in October-December.

He explains:

The underlying lackluster growth performance of the UK in February could signal that Q1’s quarterly GDP figure comes in marginally negative.

Even if this were to happen, the UK would not be in a technical recession as Q4 2022’s growth figure was not in negative territory. Looking ahead to the rest of 2023, there are reasons to suggest that the growth outlook has somewhat improved in recent months.

One encouraging line in today’s GDP report is that customer-facing firms kept growing in February, despite the cost of living squeeze.

As flagged in our 7am post, output in consumer-facing services grew by 0.4% in February 2023, an acceleration on January’s growth of 0.3%.

As ITV’s Joel Hills points out here, activity has proved more resilient than economists predicted….

Recession avoided but big picture is unheroic.

The UK economy did not grow at all in February and grew by only 0.1% between December and February.

Strike action by teachers + civil servants in Feb had material impact although – perhaps wisely – the @ONS doesn’t hasard an… pic.twitter.com/hZ5fzmS284

— Joel Hills (@ITVJoel) April 13, 2023

…estimate and – perhaps wisely – the chancellor doesn’t refer to it in the statement he has just issued.

“The economic outlook is looking brighter than expected” – is Jeremy Hunt’s assessment.

Quite so, but the UK economy is currently stuck in low-gear. pic.twitter.com/KjlgLKgpNF

— Joel Hills (@ITVJoel) April 13, 2023

…the encouraging news is despite extraordinary squeeze on living standard from inflation and higher interest rates private sector output strengthened in Feb.

“Consumer facing services” (retail, hotels, pubs restaurants, travel, entertainment) grew again.

Six months ago the… pic.twitter.com/jCcyDzBduG

— Joel Hills (@ITVJoel) April 13, 2023

…even the chancellor was expecting the UK to enter a recession, one he said would be “made in Russia”.

Activity has proved more resilient than economists predicted for reasons which aren’t entirely clear.

— Joel Hills (@ITVJoel) April 13, 2023

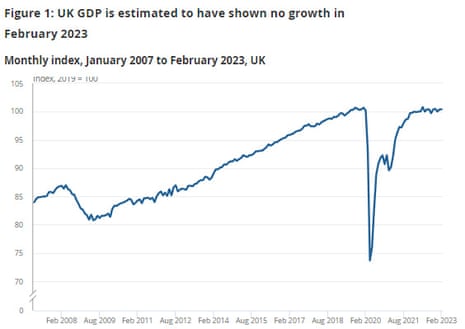

The broader picture is that the economy has been “pretty much flat since last Spring”, the ONS director of economic statistics Darren Morgan told the Today Programme.

On the upside, though, construction has performed well over the last year, Morgan says, and is well above its pre-pandemic levels.

Construction got back on track quickly in February after a blip in January, although firms do report problems recruiting staff.

NIESR, the economic think tank, says the UK economic outlook for the first quarters of this year “appears to be more resilient than previously though”, despite the flatlining of growth in February.

Today’s @ONS figure suggests that monthly #GDP remained flat in February following growth of 0.4 per cent in January, as a boost in construction was offset by contractions in the services and production sectors. Encouragingly, GDP grew by 0.1 per cent in

1/3

— National Institute of Economic and Social Research (@NIESRorg) April 13, 2023

the three months to February compared to the three months to November. Paired with optimistic #PMI balances and higher-frequency spending data, the UK economic #outlook for the first quarters of this year appears to be more resilient than previously thought, though

2/3

— National Institute of Economic and Social Research (@NIESRorg) April 13, 2023

Fidelity: UK is the weak link among developed economies

Tom Stevenson, investment director for Personal Investing at Fidelity International, also predicts the UK will suffer a year of stagnation in 2023…. before a modest rebound next year.

He fears the UK is the ‘weak link’ among developed economies (as shown by the IMF’s latest forecasts, which Jeremy Hunt has vowed to beat).

Stevenson says:

The British economy failed to grow at all in February, confirming that, while the UK may avoid recession, it is the weak link among the developed world’s economies. The UK’s growth is slower than in other rich countries and its inflation higher. We face a year of stagnation in 2023 before a modest rebound next year.

‘Although January’s growth was revised up slightly to 0.4%, February’s flat line reflects the impact of the UK’s winter of discontent. Strike action took the shine off a modest increase in retail sales, while falling production in the month offset better construction activity.

‘The latest data, and the improving trend elsewhere (such as better than forecast inflation numbers in America) confirm the International Monetary Fund’s gloomy assessment this week that put Britain at the bottom of the league table of leading economies. Only Germany is also expected by the IMF to contract this year.

The UK economy is likely to escape recession, as Jeremy Hunt predicted this morning, says Yael Selfin, Chief Economist at KPMG UK.

But rather than sparking growth, Selfin believes a period of stagnation awaits us, saying:

“A combination of upward revisions in GDP data and an improvement in global economic conditions could help the UK economy avoid a recession this year. While this will provide relief for policymakers, the outlook for growth in the medium-term remains relatively weak by historical standards.

“Economic activity will remain subdued in the near term as households continue to be squeezed by elevated prices and the cumulative impact of past interest rate increases. Although business sentiment continues to improve, bolstered in part by the fall in wholesale energy prices, we expect investment to be constrained this year amidst the tightening in credit conditions and uncertainty about future policy direction.

“UK GDP was flat in February, after growing by 0.4 per cent in January, as growth in construction was offset by falls in services and production.”

Labour: Britain is still lagging behind on the global stage

Rachel Reeves MP, Labour’s Shadow Chancellor of the Exchequer, says:

“Despite our enormous promise and potential as a country, Britain is still lagging behind on the global stage with growth on the floor.

“The reality of growth inching along is families worse off, high streets in decline and a weaker economy that leaves us vulnerable to shocks.

“These results are exactly why Labour’s mission to secure the highest sustained growth in the G7 is so important – it’s that level of ambition that we need to strengthen our economy, get our high streets thriving again and make families across every part of Britain better off.”

Yesterday, Labour launched its five-point plan to support UK high streets, which included cutting business rates and energy bills, stamping out late payments, and vouchers for energy efficiency measures including “double glazing at a local cinema, a new heat pump in a cafe or an electric vehicle for a takeaway”.

Hunt: economic outlook is looking brighter than expected

Jeremy Hunt has taken a glass-half-full approach to the news that the UK economy flatlined in February – pointing out that it did grow (by just 0.1%) in the last quarter.

The chancellor says that the UK is now going to avoid recession:

“The economic outlook is looking brighter than expected – GDP grew in the three months to February and we are set to avoid recession thanks to the steps we have taken through a massive package of cost-of-living support for families and radical reforms to boost the jobs market and business investment.”

ONS: Strikes held back growth

Strikes by civil servants and teachers held back growth in the economy in February, says Darren Morgan, director of economic statistics at the Office for National Statistics.

The PCS union, which represents civil servants, held the largest civil service strike for many years in February, as it stepped up a month of strikes over pay, pensions, redundancy terms and job security.

Tens of thousands of teachers in England, Scotland and Wales held strike action at the end of the month.

Morgan says this led to the flatlining in economic activity in February.

“The economy saw no growth in February overall.

“Construction grew strongly after a poor January, with increased repair work taking place.

“There was also a boost from retailing, with many shops having a buoyant month.

“These were offset by the effects of Civil Service and teachers’ strike action, which impacted the public sector, and unseasonably mild weather led to falls in the use of electricity and gas.”

The largest contributor to the negative growth in services in February 2023 was education, which fell 1.7% in the month, today’s GDP report shows.

This decline follows growth of 2.5% in January 2023. On the three months to February 2023, compared with the three months to November 2022, education fell by 1.9%.

On a monthly basis, the UK economy is now estimated to be 0.3% above its pre-Covid-19 levels in February 2020.

UK economy stagnated in February

Newsflash: UK economy growth has flatlined.

UK GDP was unchanged in February, new data from the Office for National Statistics shows, weaker than the forecast for 0.1% growth.

The ONS reports that the services sector output fell by 0.1%, while production fell 0.2% and construction grew 2.4%.

This follows growth of 0.4% in January, which has been revised up from growth of 0.3% in the previous publication.

And the broader picture is that GDP grew by 0.1% in the three months to February 2023.

The ONS says:

-

The services sector fell by 0.1% in February 2023, after growing by 0.7% in January 2023, revised up from 0.5% in the previous publication.

-

The largest contributions to the fall in services output in February 2023 came from education and public administration and defence; compulsory social security, industrial action took place in both of these industries in February 2023.

-

Output in consumer-facing services grew by 0.4% in February 2023, this follows growth of 0.3% in January 2023 (unrevised from our previous publication); the largest contributor to this growth came from retail trade, except for motor vehicles and motorcycles.

-

Production output fell by 0.2% in February 2023, following a fall of 0.5% in January 2023, revised from a fall of 0.3% in the previous publication.

-

The construction sector grew by 2.4% in February 2023, after falling by 1.7% in January 2023 (unrevised from the previous publication).

UK will beat IMF’s dismal growth forecasts, chancellor Hunt Say

UK chancellor Jeremy Hunt has insisted that the International Monetary Fund is wrong about Britain’s economic prospects.

Hunt has pledged that the UK economy will do “significantly better” than the International Monetary Fund’s bleak outlook over the coming 24 months.

He pushed back against the IMF’s forecast for the UK will shrink 0.3% this year and expand just 1% in 2024.

Speaking to Bloomberg News on the sidelines of the IMF’s spring meeting in Washington, Mr Hunt said:

“We will do better than that. Our forecasts are significantly better.”

Sanjay Raja, chief UK economist at Deutsche Bank, predicts the UK economy will stagnate this year.

Raja told clients this week that Deutsche expects UK GDP growth to have slowed down in Februaryto +0.1%, after January GDP came in slightly stronger at 0.3% month-on-month.

He explained:

We expect broad-based growth in February, driven by services activity (0.1% m-o-m), industrial production (0.2% m-o-m), and construction output (0.7% m-o-m).

Where does this leave us? We still expect Q1-23 GDP to flatline, and Q2-23 GDP to contract (albeit marginally at -0.2% q-o-q). Risks to our H1-23 forecasts are tilted marginally to the upside, however. Big picture, as we recently noted, we no longer see a technical recession on the horizon. Instead, we see the UK in stagnation this year, before expanding in 2024.

Introduction: UK February GDP report coming up

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Although a recession has been avoided, for now at least, the UK economy remains in a troubling state. The International Monetary Fund predicts it will shrink this year, the worst performance among the G20 nations.

High interest rates, energy costs, and the ongoing cost of living crisis are all hitting growth.

And today, we’ll learn how the economy fared in February when the Office for National Statistics releases its first estimate of GDP that month, at 7am.

Economists predict that growth slowed in February, to around 0.1%, after a 0.3% rise in GDP in January. Any growth would be welcome, and help avoid the economy shrinking in the first quarter of this year.

Having seen the UK economy revised up to 0.1% GDP growth in Q4, thus avoiding the ignominy of a technical recession, the economic data since the end of last year has shown much greater resilience than many had feared at the end of last year.

So says Michael Hewson of CMC Markets, who explains:

This has been particularly notable in the services sector, which after a weak Q4 has seen recent monthly PMI numbers recover strongly in February and March. Consumer spending has also picked up sharply with a lot of the recent retail updates showing that while consumers do have money to spend, they are spending it more judiciously. In January the UK economy grew by 0.3%, despite sky-high inflation, as consumer spending rebounded with retail sales gaining 0.9%.

This was followed by a 1.2% gain in February, although sales volumes have lagged due to higher prices. Against such a backdrop, another positive GDP number for February could well go some way to increasing the odds of a positive Q1 GDP print for 2023, with expectations of a 0.1% gain, although index of services could act as a drag after a strong January of 0.5%.

Construction output is also expected to rebound by 1% in February after a sharp -1.7% decline in January.

Minutes from the US central bank’s last monetary policy meeting showed that its policymakers fear that the fallout from the US banking crisis is likely to tilt America’s economy into recession later this year.

Also coming up today

Supermarket giant Tesco will report its preliminary results for 2022/23 at 7am.

The IMF and World Bank’s Spring Meeting continues in Washington, as top policymakers discuss the state of the world economy.

The latest US PPI data will show how fast US goods and services producers lifted their prices last month. In January this key inflation measure fell dramatically.

We’ll also hear from the Bank of England’s chief economist, Huw Pill, on the state of the UK economy this afternoon.

Yesterday the governor of the Bank of England, Andrew Bailey, played down the risks of a system-wide banking crisis, paving the way for further interest rate increases to combat the UK’s high inflation levels.

The agenda

-

7am BST: UK GDP report for February

-

7am BST: UK goods trade balance for February

-

10am BST: Eurozone industrial production report for February

-

1.30pm BST: US PPI index of producer price inflation for March

-

1.30pm BST: US initial jobless claims

-

2pm BST: Bank of England chief economist Huw Pill speaks on “Developments in the UK Economy and Monetary Policy”