In the race to unite the UK’s sprawling local government pension funds, Simon Radford is a frontrunner.

As chair of Barnet’s £1.4bn council pension scheme, he is willing to cede investment control of the London borough’s retirement pool in order to boost returns.

“It’s natural as a local councillor when you get elected and have a big pot of money to run to pump your chest and get very excited about what you do,” he says. “But there’s a question mark: are four or five local councillors really the best people to invest billions of pounds of money?”

But Radford is in the minority. The UK’s £354bn local government pension scheme — which would be the size of Canada’s public sector scheme if united — is currently split across 86 council pension funds.

Around half of the assets in these schemes are run across eight “pools”, according to a government consultation last year, and some councils have resisted handing over their assets at all.

The last government gave a deadline of March next year for them to hand over their holdings, or explain why not. The hope is that pooled assets can deliver better returns at a lower cost, while driving more investment into productive British assets.

This week, chancellor Rachel Reeves is expected to announce plans to accelerate the consolidation of LGPS assets, and encourage more pension investment in the UK in her Mansion House speech.

With the savings of more than 6mn planning officers, librarians, teaching assistants and other council workers, the LGPS is the closest thing the UK has to a sovereign wealth fund.

Experts believe that more efficient pooling could strip out costs and boost returns that currently lag those of rival nations — reducing the amount that cash-strapped councils have to pour into the schemes — as well as triggering an investment drive of up to £40bn into infrastructure projects such as green energy or transport networks.

The current fragmented structure has bred inefficiency. Canada’s Pension Plan, which has C$632bn (£352bn) under management, has delivered nominal annual returns of 9.2 per cent over the last decade, compared with around 7 per cent for LGPS.

“It really matters to the taxpayer — it’s jaw dropping” said Tracy Blackwell, chief executive at Pension Insurance Corporation, a specialist UK insurer. But there are significant vested interests who are against the move, she warned.

“I think the government is serious about consolidating but there are a lot of people [pushing] not to do it,” said Blackwell. “Asset managers stand to lose an enormous amount in fees. It really can be a powerhouse for the future”.

Reeves is not the first to attempt such a move. In 2015, then-chancellor George Osborne announced a plan to consolidate the scheme into six “British Wealth Funds”.

But progress has been slow, in part because the government gave little guidance on how the funds should work.

Ahead of her speech this week, Reeves has endorsed a “Canadian-style” model, and threatened legislation to force local councils to pool all of their assets in order to “unleash the full investment might” of LGPS to make it “an engine for UK growth”.

The government has estimated that current LGPS pooling had delivered net savings of over £380mn by 2022, and that is forecast to be over £1bn by 2025.

But some pools look more aligned with a Canadian model than others. Border to Coast, a Leeds-based pool with £52bn of assets, and Local Pensions Partnership Investments, a fiduciary manager to three council funds, both have internal investment management and private market capabilities.

At the other end of the spectrum, three of the eight pools are not regulated by the Financial Conduct Authority, with one operating in effect as a joint procurement platform when councils agree on assets they want to buy.

Edi Truell, former chair of one of the eight pools now known as LPPI, said that pooling had not gone far enough.

“Each LGPS has kept a team in place to allocate the bulk of its assets but not all assets to the pool — in many ways it adds just another layer of management which is inefficient,” he said.

Truell suggested consolidation into two “super pools” managing all of the LGPS assets — which would generate “at least £1.3bn” in additional cost savings as the 86 individual funds would be wound down.

These “super pools” would also have greater heft to get access to the best deals in private markets while also driving more investment into British infrastructure.

An alternative would be to merge the underlying council funds. While Wandsworth and Richmond pension funds in London have voluntarily merged, as have Northumberland and Tyne & Wear in the north-east of England, forced mergers would take years and could be fraught with legal challenges.

Canada’s pension schemes, often used as a benchmark for the UK’s LGPS, invest around a third of their assets in private markets, of which 12 per cent is directly invested in infrastructure projects.

Apeing this model could lead the UK’s scheme to boost infrastructure investment by £40bn, the PIC has calculated.

But others are sceptical. Robbie McInroy, head of LGPS consulting at Hymans Robertson, said inadequate scale was not holding back LGPS investment in UK infrastructure — rather a lack of suitable opportunities, supply-side issues and policy instability.

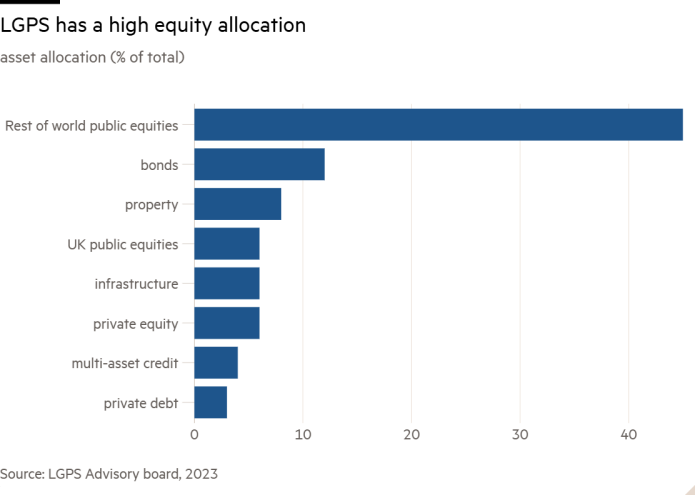

Around half of LGPS assets are currently invested in public equities, but only 6 per cent of those are listed in the UK. Allocation to private markets has improved since pooling gained traction, but it remains relatively low at 7 per cent — with a similar amount allocated to private equity.

John Ralfe, an independent pensions consultant, calculates that the average management cost of underlying LGPS funds is around 0.5 per cent, which is “much higher” than the cost of corporate defined benefit pensions, owing to their high allocation of actively managed equity and bonds funds.

“With the current asset allocation, costs could be cut to less than half if active equities and bonds were moved to passive,” he said.

The path to pooling has also been met with resistance among funds that think they can invest better on their own. The London borough of Kensington and Chelsea’s pension fund, which has yet to hand over any of its assets to a pool, has had the best performance across the 86 funds over one, five and 10 years, according to a league table by shareholder advisory firm Pirc.

Quentin Marshall, chair of the fund, believes that active managers rarely add value. If private markets were commercially attractive he would invest in them anyway: “When you look at the numbers for investing in global infrastructure — it’s just not very attractive.”

While performance of LGPS has lagged Canada’s Pension Plan, it has been in line with some schemes operated in the country’s so-called “Maple 8” megafunds over the past ten years, including the Ontario Teachers’ Pension Plan and Ontario Municipal Employees Retirement System.

Still, ministers have been clear that LGPS should invest more in British companies and infrastructure.

At a conference last week, Jim McMahon, minister of housing, communities and local government, said the government did not see the need for one single LGPS super-fund, but that some had not done enough to pool their assets and that action would be taken.

To make a success of consolidating LGPS assets, several investors said the salaries offered by the pools needed to be higher, with investment managers able to fly around the world — similar to the way Canadian managers operate — to get access to the best deals.

“If you can track brilliant people who will come and run the pools for you and you can pay them enough to do it then it makes a difference,” said Barnet’s Radford, adding that at the moment the best private equity funds “don’t need to take our money”.