The stock market is back, the bulls are back on the rampage, the dip-buyers are in, and the US president has walked back on (most of) his astronomical tariffs.

Tariffgate might be on pause for now, but there’s still uncertainty ahead over whether it’s in 90 days’ time or sooner than that, given the incredible frequency with which he has changed tack so far.

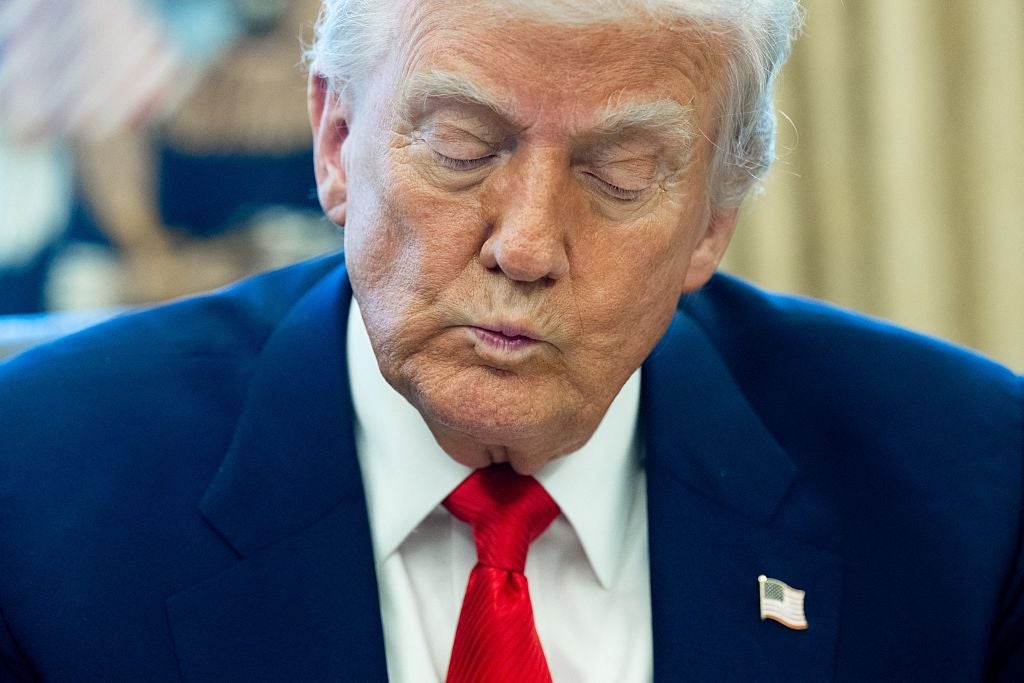

Here are three reasons outside the stock market that Donald Trump ultimately had to backtrack – two of them which applied pressure – but the third, once again, was the real deciding factor at play.

Oil

A falling price in oil isn’t, in isolation, a terrible or unwanted thing in the eyes of some nations. Cheaper fuel is good for consumers, of course, but it indicates a wider issue.

With the cost of doing business on the rise through the tariffs, industry production and demand would lower, which in turn means less economic growth.

In the US, falling oil prices would also cause shale producers to cut production, CNBC reported, as the price would be below the break-even level for them. Meanwhile, the Bank of America estimated an oversupply of more than a million barrels per day as a result of a trade war, which would again lower the price further.

Actual economics?

Obvious, yet notable: perhaps actual economics played a part here. Much has been made of the outrageously simplistic formula used to calculate the tariff amounts in the first place, which we won’t go into here, but perhaps the “economic bullying” (as China called it) has had to sit up and take notice when bigger potential bullies stood up.

Donald Trump is a rich man, but nowhere near the richest. His $5bn (£3.9bn) fortune isn’t large enough to crack Bloomberg’s Billionaires Index, a composite of the 500 richest people on the planet – but several notable figures have spoken out in opposition to his tariff policies who are on that list.

Bill Ackman, for example, is worth more than $7.5bn. While he backed tariffs as a reasonable measure, he took aim at this iteration and extent of them and said they’d cause “economic nuclear war on every country in the world”, repeatedly calling for a pause before it came.

Jamie Dimon is one of the biggest voices in the financial sphere, and the JPMorgan CEO voiced concern over the long-term effects of the tariff, as well as saying they would likely contribute to a recession.

Elon Musk, meanwhile, might not be a direct opponent to the US president, but losing more than $100bn from his personal fortune so far in 2025 can’t be an easy sell for the richest person on the planet.

“Trump is gaining a reputation now for flip-flopping on tariffs and not having a consistent economic policy. Even with this latest announcement, we still have the uncertainty from the fact this is just a 90-day pause,” added Marcus Brookes, chief investment officer at Quilter Investors today.

Bonds

Finally, but absolutely most importantly, this is almost certainly what really forced the turnaround.

Usually, when stock markets drop, bond prices rise. It’s the safe haven, the assurance that when companies’ share prices won’t pay, then countries will: bonds are government debt, which pay interest and return the initial capital on maturity.

Except, this time, US Treasuries (what they call bonds) took a steep drop.

You can buy Treasuries over different time frames. The yield – the amount of payout – has an inverse relation to the price, so when the price goes down, the yield goes up. Yield for ten-year US Treasury bonds (the safe haven, traditionally) rose from 4.0 per cent to more than 4.5 per cent in the space of around three days, which is a very large increase in relative terms across a short space of time.

Those numbers sound small in isolation, but they are enormous indicators of the predicted economic stability of the US and the amounts they have to pay on their debt – which is in the trillions of dollars.

Hedge funds are mostly suspected to be behind the bond market turmoil, selling off government debt and, in turn, raising 30-year borrowing costs to a five-year high.

“Notably yields on long-term US government debt – a surge in which may have helped concentrate minds in the White House – remain elevated even if they have come back from their highs,” said AJ Bell investment director Russ Mould.

“This shows there is still lingering concern about US trade policy, and while the 90-day pause is welcome news for stocks, the lack of long-term clarity may become more of an issue as time goes on.”

Raising inflation is one thing but placing that burden on the American public is quite another, and a battle Trump – as with others before him – simply could not win. So a pause is in place, the ten-year bills yield is retracing to around 4.3 per cent… and the wider uncertainty of what comes next is back.

But at least it’s not an immediate total collapse of all markets anymore.