- Since Pavel Durov’s arrest in France in August 2024, investors have sold over 890,000 TON.

- However, there are signs of TON’s price reversal from support, coupled with the OI Delta signal.

The arrest of Pavel Durov in August 2024 triggered a significant sell-off in Toncoin’s [TON]. In the aftermath, over 890,000 TON were sold, marking a distinct increase in market volatility.

Moreover, the recent transfer of over 240,000 Toncoin to exchanges in the past week has escalated selling pressure. This hints at investor apprehension, illustrating shifts in Toncoin’s price trajectory clearly declining following these events.

The number of Toncoin held dwindled sharply as these large quantities hit the market, leading to a noticeable dip in price.

This trend suggests that TON could face further declines if the selling pressure continues. However, it could also present a buying opportunity for those betting on a market recovery.

This precarious position underscores the broader impacts of geopolitical events on cryptocurrency markets, particularly for assets like Toncoin directly linked to high-profile individuals.

Open Interest Delta signals a potential reversal

Despite the sell-off, TON’s weekly Open Interest (OI) Delta showed increased volatility accompanied by growing OI. Historically, this pattern has often signaled an upcoming price surge.

The OI Delta climbed in mid-2024, Toncoin’s price rose sharply. Recently, similar increases in OI on the 25th of January 2025 suggested a potential reversal followed by a bullish trend soon.

If this correlation holds, monitoring the OI changes alongside price action could provide insights into TON’s short-term market dynamics.

Liquidity and position flow will be crucial in determining if the continued OI trend can trigger higher prices.

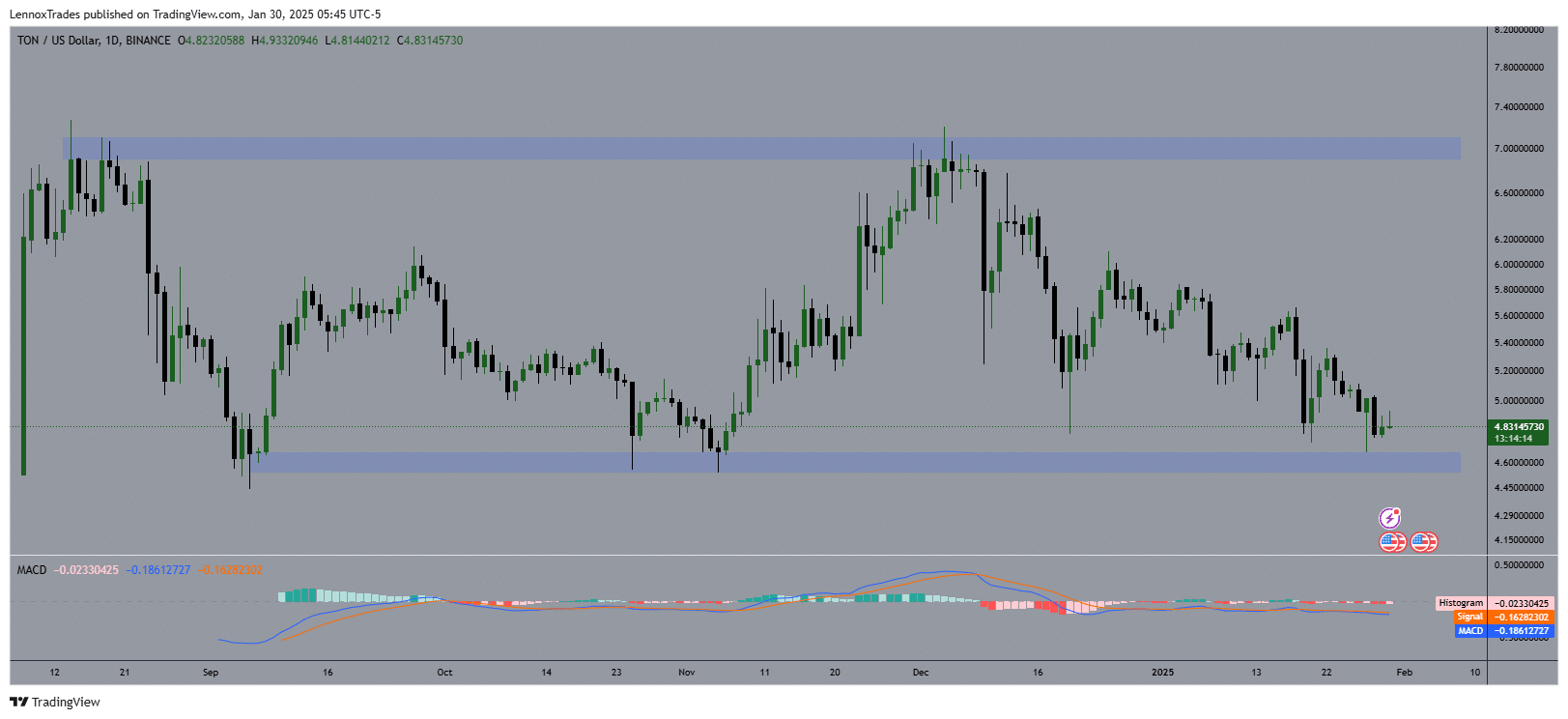

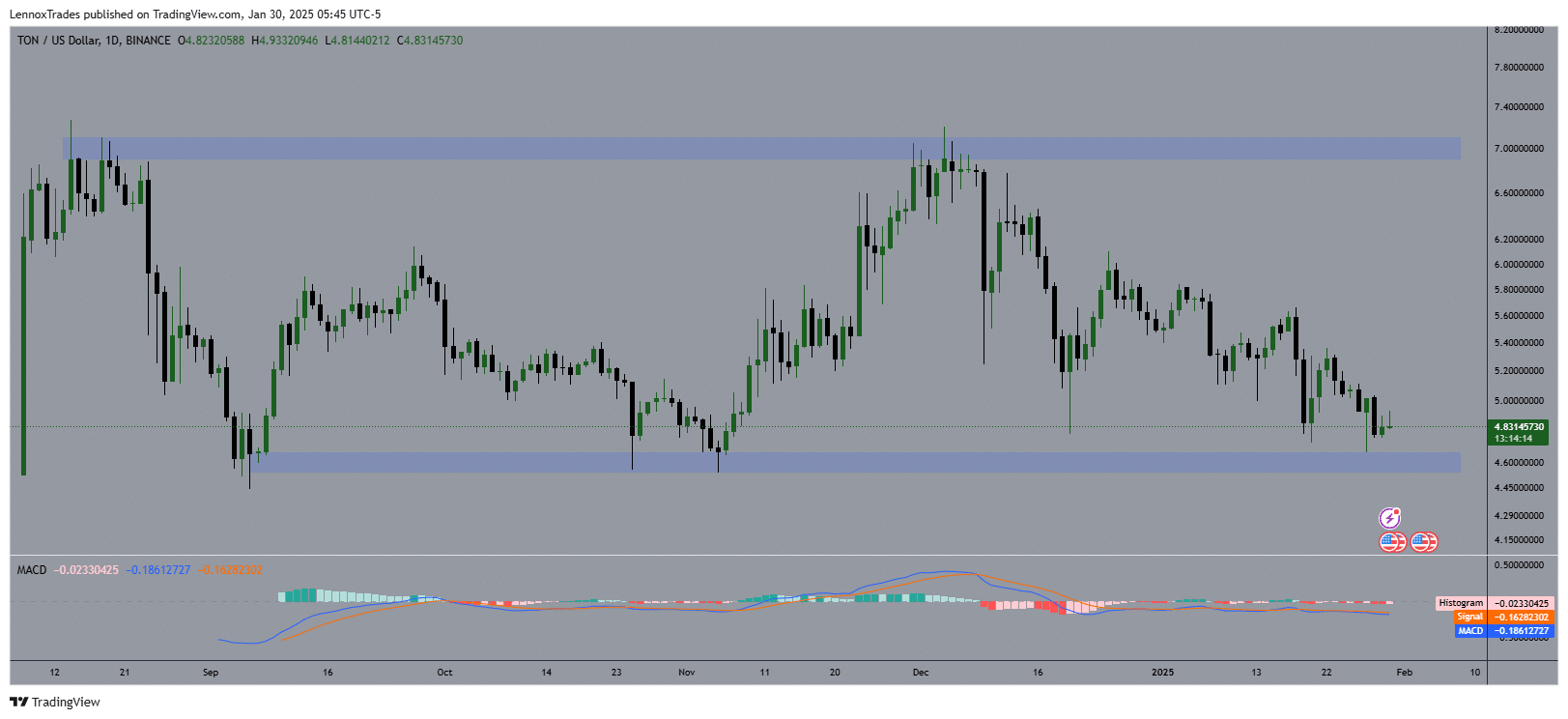

Additionally, TON’s price suggests a potential reversal as it gravitates towards a key support zone at $4.80. TON has repeatedly tested this level, showing resilience each time.

As TON nears this critical support area again, it suggests a potential bounce.

Past interactions with this zone have resulted in recoveries, suggesting that TON’s price may respond positively. The MACD shows convergence, hinting at upcoming positive momentum.

If history repeats, this could mean a price increase for TON, providing a buying opportunity for investors observing these levels.

Source: Trading View

Again, TON’s address count continued to steadily increase from 105 million addresses on the 22nd of October to 139 million by the 22nd of January.

This consistent growth represented a surge of over 32% in less than four months.

Read Toncoin’s [TON] Price Prediction 2025-26

The rise in unique addresses likely indicated heightened activity and interest in the TON network. This could bolster market confidence and potentially support a bullish scenario for Toncoin’s price in the future.

These metrics are crucial for tracking engagement and network health.