Mobile money has revolutionized e-commerce, but it comes with serious security challenges. From identity theft to legal gaps, these risks can compromise your financial data and transactions. Here’s a quick overview of the main threats and how to protect yourself:

- Identity Theft: Phishing, fake apps, and social engineering scams target your personal information.

- Mobile Malware: Malicious apps and keyloggers can steal payment data.

- SIM Card Attacks: SIM swapping gives criminals access to your accounts.

- Public Network Risks: Unsecured Wi-Fi exposes your transactions to hackers.

- Data Protection Flaws: Weak encryption and poor storage practices put your financial data at risk.

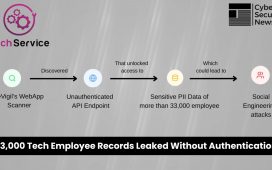

- Internal Security Breaches: Employees with excessive access can misuse sensitive information.

- Legal Framework Gaps: Inconsistent regulations leave users vulnerable to fraud.

Quick Tips to Stay Safe:

- Use multi-factor authentication and strong, unique passwords.

- Only download apps from trusted sources.

- Avoid public Wi-Fi for financial transactions; use a VPN if necessary.

- Regularly update your devices and apps.

- Monitor your accounts for suspicious activity.

- Report any incidents immediately to your provider and authorities.

By staying vigilant and following these practices, you can reduce your risk and protect your digital assets. Keep reading for detailed strategies to secure your mobile payments.

Biggest Mobile Money Scam ( Some Active ways used in …

1. Identity Theft

Mobile money identity theft is becoming more sophisticated, with criminals employing advanced methods to steal personal data and carry out unauthorized transactions. Here’s what you need to know to stay ahead.

Common Tactics

- Phishing SMS messages pretending to be from legitimate payment providers

- Fake mobile payment apps designed to look like real ones

- Fraudulent checkout pages

- Social engineering scams targeting customer service representatives

These methods exploit weaknesses in mobile payment systems, making it crucial to stay alert.

Signs of a Problem

- Charges you don’t recognize

- Alerts about login attempts you didn’t make

- Changes to your account details without your knowledge

- Notifications of failed login attempts

What to Do Right Away

-

Secure Your Account

- Contact your provider to freeze your account.

- Reset your login credentials.

- Enable biometric verification for added security.

-

Document Everything

- Keep records of suspicious transactions.

- Save all communications with your provider.

- Take screenshots of any unauthorized activity.

-

Report the Incident

- File a report with your local police department.

- Notify the Federal Trade Commission (FTC).

- Contact your state’s consumer protection office.

Tips for Prevention

- Enable multi-factor authentication on your accounts.

- Use strong, unique passwords.

- Avoid using public Wi-Fi for financial transactions.

- Regularly update your device’s security software.

These steps are your first defense against identity theft. The next sections will cover additional risks and strategies to help you build a more secure approach.

2. Mobile Malware Threats

Mobile malware poses a serious risk to the security of mobile payment systems. These threats often target e-commerce payment apps, putting financial information at risk.

Types of Mobile Payment Malware

One common type is mobile banking trojans, which intercept payment data and login credentials. These threats often disguise themselves as legitimate apps or hide within harmless-looking applications.

Common Attack Methods

- Overlay Attacks: Malware creates a fake screen that mimics your payment app’s interface, tricking you into entering your login details.

- Keyloggers: These record sensitive information like PINs and passwords as you type.

- Permission Abuse: Malicious apps request unnecessary permissions to access sensitive data.

Warning Signs of Malware Infection

- Unusual Battery Drain: Malware running in the background can quickly deplete your battery.

- Unexpected Pop-ups: If pop-ups appear while using your payment app, malware could be the cause.

- Performance Issues: A slow or lagging device during payment transactions might indicate interference from malware.

Protection Strategies

1. App Security

Always download payment apps from trusted sources like:

2. Regular Updates

Keep your operating system and payment apps updated. Outdated software is more vulnerable to attacks.

3. Anti-Malware Protection

Install reliable mobile security software that can:

- Detect and remove malware targeting payment apps

- Alert you to suspicious app behavior

- Scan new downloads before installation

- Monitor system changes in real time

Critical Security Settings

Activate these key protections for added security:

- App verification

- Play Protect (for Android devices)

- App Transport Security (for iOS devices)

- Restrict app permissions to only what’s necessary

These steps, combined with other measures discussed in later sections, help strengthen your mobile payment defenses.

3. SIM Card Attacks

SIM card attacks, like SIM swapping or SIM jacking, are a growing concern in mobile money and e-commerce security. These attacks let criminals take control of a victim’s phone number, allowing them to intercept mobile payments and authentication codes.

How SIM Swapping Works

Attackers collect personal information from social media or data breaches, then impersonate you to your mobile carrier. Once they convince the carrier, they transfer your phone number to a new SIM card, giving them control of your account.

Signs of a SIM Card Attack

- Sudden loss of cellular service

- Messages like “SIM card not provisioned”

- Alerts about account activity you didn’t authorize

- Login issues with banking or payment apps

- Texts about account changes you didn’t request

Strengthening Authentication

Advanced Security Options

Take extra steps to secure your accounts beyond SMS-based verification:

- Use app-based authenticators like Google Authenticator or Authy

- Enable biometric features like fingerprint or facial recognition

- Set unique PINs for your mobile carrier account

Protecting Your Accounts

-

Carrier Security:

- Add a PIN to your carrier account

- Request port-freeze protection

- Enable notifications for number changes

- Require in-person verification for SIM updates

-

Payment App Security:

- Remove phone number recovery options

- Use hardware security keys when possible

- Turn on in-app security features

- Set up transaction alerts

What To Do If You’re Targeted

If you suspect a SIM card attack:

- Contact your mobile carrier immediately.

- Update passwords and review recent financial transactions.

- Check all accounts for unauthorized activity.

- File a report with the Federal Trade Commission (FTC).

How To Stay Safe

- Never share one-time passwords or account PINs.

- Use strong, unique passwords for all accounts.

- Regularly monitor account activity for anything unusual.

- Keep personal details off social media.

- Consider using a separate phone number for financial services.

Next, we’ll look at the risks tied to using insecure public networks.

sbb-itb-dd089af

4. Public Network Risks

Public Wi-Fi networks can be a serious threat to mobile money transactions, exposing sensitive data to cybercriminals. These risks open the door to various attacks that take advantage of unsecured connections.

Common Attack Methods

Man-in-the-Middle Attacks: Hackers position themselves between your device and the network to intercept sensitive data like login credentials and payment details.

Evil Twin Networks: Fake Wi-Fi networks are set up to look like legitimate ones, often using similar names. Connecting to these fake networks puts your transaction data at risk of being stolen.

How to Stay Protected

VPN Security: A Virtual Private Network (VPN) encrypts your data, making it much harder for attackers to intercept. Always activate your VPN before making mobile transactions.

Smart Network Practices:

- Double-check the network’s exact name before connecting.

- Set your device to automatically activate a VPN on unknown networks.

- Use cellular data instead of public Wi-Fi for financial transactions whenever possible.

Key Security Features

| Security Feature | Purpose | How to Enable |

|---|---|---|

| Two-Factor Authentication | Adds an extra layer of security | Enable it in your mobile money app |

| App Updates | Fixes potential vulnerabilities | Turn on automatic updates |

| HTTPS Verification | Ensures encrypted connections | Look for the padlock icon in your browser |

Tips for Using Public Wi-Fi Safely

- Turn Off Auto-Connect: Stop your device from automatically joining public networks.

- Keep Software Updated: Regularly update your device’s operating system to stay protected.

- Enable Transaction Alerts: Set up real-time notifications for all mobile money activities.

- Stick to Official Apps: Only use verified mobile banking or payment apps for transactions.

What to Do If Something Goes Wrong

If you think your transaction was compromised on public Wi-Fi:

- Disconnect from the network immediately.

- Check your account for unusual activity.

- Securely change your passwords.

- Notify your mobile money provider right away.

- Add extra security measures to your account.

Avoid using unsecured public networks for financial transactions whenever possible. If you’re unsure, wait until you’re on a trusted private network or switch to your mobile carrier’s data connection. It’s always better to be safe than sorry.

5. Data Protection Flaws

Data protection flaws can leave financial data open to unauthorized access. These issues often arise from weak encryption methods and insufficient security protocols.

Common Encryption Weaknesses

- Outdated Standards: Some platforms still rely on outdated encryption methods like SHA-1 or MD5, which are vulnerable to modern attacks. The National Institute of Standards and Technology (NIST) advises using AES-256 for encryption and SHA-256 or higher for hashing.

- Key Management Issues: Even strong encryption can fail if key management is poorly handled. Regularly rotating keys and securely storing them – such as with hardware security modules (HSMs) – is critical.

Data Storage Vulnerabilities

- Client-Side Storage: Storing sensitive data in device caches is risky. Instead, use secure enclaves or encrypted containers to safeguard this information.

- Server-Side Security: Protect data on servers by employing encryption at rest, enforcing strict access controls, and conducting regular security audits.

Properly securing stored data is essential to ensure the safety of transaction details.

Transaction Data Protection

To protect transaction data, mobile money platforms should implement:

- Tokenization during payment processing

- Multi-factor biometric authentication for user verification

- Automatic session timeouts to reduce exposure

- Encrypted audit logs to maintain a secure record of activities

Compliance Requirements

Technical safeguards alone aren’t enough. Mobile money platforms also need to adhere to legal and regulatory standards, such as:

- PCI DSS for payment data security

- GDPR compliance where applicable

- SOC 2 Type II certification for operational security

- Regular penetration testing

- Ongoing vulnerability assessments

Real-time Monitoring

To stay ahead of threats, use tools like automated vulnerability scanners, real-time threat detection systems, anomaly detection, and Security Information and Event Management (SIEM) solutions. These measures help quickly identify breaches and respond to security incidents, ensuring continuous protection of payment data.

6. Internal Security Breaches

Internal vulnerabilities can be just as dangerous as external threats when it comes to mobile money operations. Employees with too much access or poor security practices can put the entire system at risk.

Common Access Control Issues

Several internal access control issues can weaken security:

- Excessive Privileges: Employees having more access than their job requires.

- Shared Credentials: Multiple employees using the same login details.

- Inactive Accounts: Failing to disable access for former employees.

- Weak Password Policies: Allowing simple passwords or not enforcing regular updates.

Keeping Tabs on Employee Activity

Monitoring employee behavior is critical for spotting unusual or risky actions. Key strategies include:

- Transaction Logging: Keep a record of all employee actions within the system.

- Behavioral Analytics: Identify unusual access patterns or transaction behaviors.

- Access Monitoring: Limit system access to approved devices and standard working hours.

Steps to Reduce Risk

Here’s how to tighten internal security and reduce vulnerabilities:

1. Role-Based Access Control (RBAC)

Define clear roles and permissions for employees. Regularly review and update access, automate changes where possible, and document all updates.

2. Employee Training

Train employees on security protocols, recognizing social engineering tactics, proper data handling, and how to report incidents.

3. Regular Audits

Conduct routine checks, including reviewing access logs, monitoring transactions, and auditing security practices.

Technical Safeguards

Use these tools to address insider threats effectively:

- Multi-Factor Authentication (MFA): Add extra layers of security for system access.

- IP Restrictions: Limit access to specific, trusted networks.

- Session Management: Set automatic timeouts and restrict simultaneous logins.

- Encryption: Protect internal communications with end-to-end encryption.

Encouraging Whistleblowing

Make it safe and easy for employees to report suspicious activities:

- Provide anonymous reporting options.

- Set clear procedures for escalating reports.

- Offer protection for whistleblowers.

- Regularly review and act on reported concerns.

7. Legal Framework Gaps

Legal frameworks play a critical role in securing mobile money within e-commerce. However, the rapid growth of mobile payments has outpaced regulatory developments, leaving gaps that expose users to risks. Without consistent regulations across regions, security measures often fall short, leaving users vulnerable.

Regulatory Inconsistencies

Several issues arise from the lack of uniform regulations, compounding the technical vulnerabilities already discussed:

- Fragmented oversight: Multiple regulatory bodies with overlapping authority weaken enforcement efforts.

- Cross-border transactions: Rules for international transfers remain unclear, creating confusion.

- Consumer protection: Dispute resolution standards vary, making it harder for users to seek recourse.

- Data privacy: Different regions have varying requirements for protecting user information.

Key Regulatory Shortcomings

Existing regulations often fail to address critical areas, including:

- Real-time transaction monitoring

- Encryption and key management standards

- Clear guidelines for data retention

- Protocols for biometric and multi-factor authentication

- Device registration processes

- Controls for transaction limits

Impact on User Protection

Inconsistent legal standards directly affect users by creating several challenges:

- Limited recourse: Users may face difficulty recovering funds or resolving disputes due to unclear liability rules.

- Varied security standards: Protection levels differ widely among platforms, leaving some users more exposed.

- Privacy issues: Differing data protection laws lead to inconsistent handling of personal information.

Strengthening the Legal Framework

To address these gaps, the following steps are necessary:

- Implement unified security standards across regions.

- Define clear liability rules for unauthorized transactions.

- Require mandatory incident reporting for security breaches.

- Standardize authentication protocols to ensure stronger user verification.

- Set minimum encryption requirements for mobile payment platforms.

Closing these legal gaps is crucial to improving user safety and creating a more secure environment for mobile payments in e-commerce.

Conclusion

Mobile money in e-commerce faces pressing security challenges that require immediate and coordinated efforts. From identity theft to gaps in legal frameworks, the risks highlight the complexities of securing digital financial transactions.

To address these challenges, rising cyber threats call for layered security strategies. Organizations should:

- Use strong encryption to secure all transactions

- Train staff thoroughly on security protocols

- Create clear incident response plans to handle breaches effectively

These steps are essential to safeguard financial assets and retain user trust. Tech In Africa continues to report on mobile money security, covering both the challenges and potential solutions.

Key actions for stakeholders to secure mobile transactions include:

- Financial institutions, mobile network operators, and regulators working together to develop strong security systems

- Launching user education initiatives to teach consumers safe practices

- Regularly updating technology infrastructure to address vulnerabilities

- Aligning security standards across different regions

As digital payments continue to expand, tackling these security risks is critical to ensuring transaction reliability and maintaining user confidence. Proactive vigilance from all involved parties is essential for the future of mobile money.