Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

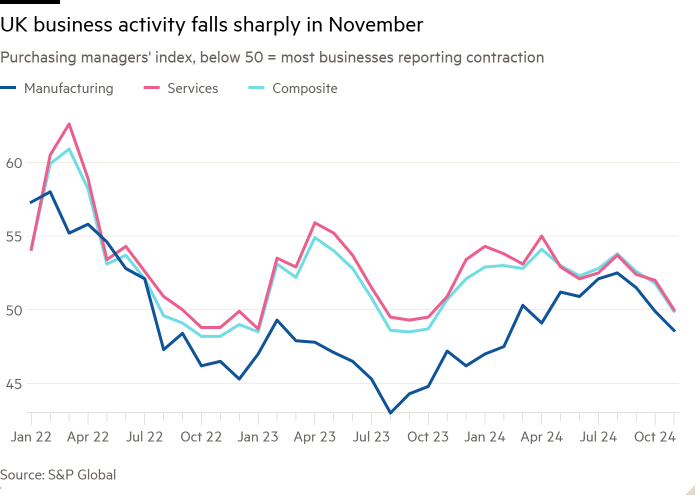

UK business activity shrank for the first time in more than a year, according to a closely watched survey, as the private sector warned that confidence in the Labour government has been badly hit by last month’s Budget.

The composite PMI index, a measure of the health of the UK’s manufacturing and services sectors, slid below the 50 mark, signifying that most groups are now reporting worsening conditions.

After the release of the data, which came on the heels of disappointing retail figures, the pound fell 0.5 per cent against the dollar to $1.252, its weakest level since May.

“Companies are giving a clear ‘thumbs down’ to the policies announced in the Budget, especially the planned increase in employers’ national insurance contributions,” said Chris Williamson, of S&P Global, in a reference to chancellor Rachel Reeves’ tax-raising plans.

The flash index, produced by S&P Global, slid to 49.9 in November from 51.8 last month, with businesses reporting falling output for the first time in just over a year.

The figure, the lowest since October 2023, contrasted with analysts’ expectations that the index would remain unchanged from the previous month.

Williamson said business optimism had slumped sharply since the UK’s July 4 general election. Many companies say the £25bn NIC increase, which Labour says is necessary to bolster public finances and invest in the NHS, will lead to job cuts and push up inflation.

Samuel Johar, chair of board advisory firm Buchanan Harvey, said that at a recent reception for CEOs, bankers and private equity executives, “the mood was surprisingly negative”. He added: “They seem to have lost confidence in the government just a few months in.”

A top City headhunter said that, while companies wanted a government that was “long-term, business aware, investor friendly . . . what they got is not long-term, not business aware, and not investor-friendly”.

The headhunter added that the government needed “to sort this out, or a short-term problem is going to become an insurmountable one”.

Last month’s Budget, which also included an increase to the national living wage, strained Labour’s relations with groups in sectors including retailing and hospitality, despite pledges from Reeves to work closely with business and lead Britain’s most “pro-growth” Treasury.

Elias Hilmer, economist at the consultancy Capital Economics, said the drop in PMIs suggested that GDP could now be shrinking after barely growing in the third quarter.

He added that the tax rises “seem to have restrained some private sector activity”, and that the prospect of new tariffs imposed by US president-elect Donald Trump “may have weighed on activity too”.

However, he said increased government spending announced in the Budget — a factor not likely to be captured in the PMI survey — could contribute to growth.

The Office for Budget Responsibility and the Bank of England have both forecast that provisions in the Budget — notably greater public spending — will in the short term boost GDP while raising inflation.

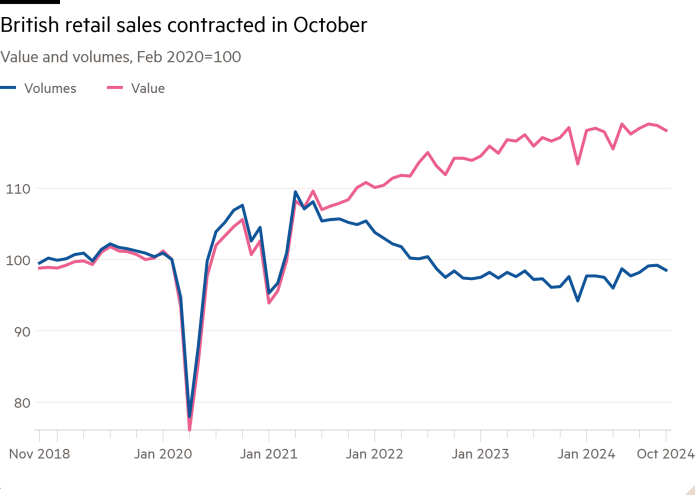

Separate data published by the Office for National Statistics on Friday showed the biggest monthly fall in retail sales since June, a monthly slide of 0.7 per cent in October.

This outstripped economists’ forecast of a 0.3 per cent fall and came as sales growth for September was revised down to 0.1 per cent.

“Retailers across the board reported consumers held back on spending ahead of the Budget,” said ONS senior statistician Hannah Finselbach, adding that October was “a notably poor month for clothing stores”.

The October 30 Budget came after months of warnings from the new government about painful tax rises.

Samantha Phillips, partner at the management consultancy McKinsey & Company, said that for many retailers it was a “disappointing start to the golden quarter”, with focus shifting to “how to build momentum” in the run-up to the festive period.

However data released on Friday by research company GfK indicated that consumer confidence had regained some ground since the Budget, rising 3 points in November to minus 18.

The composite PMI index for the Eurozone also dropped to a 10-month low on Friday of 48.1 as manufacturing sank into a deeper recession and the services sector struggled amid concerns over future US tariffs and a weakened German economy.

This story has been corrected to make clear that PMI figures show the rate of change in business activity