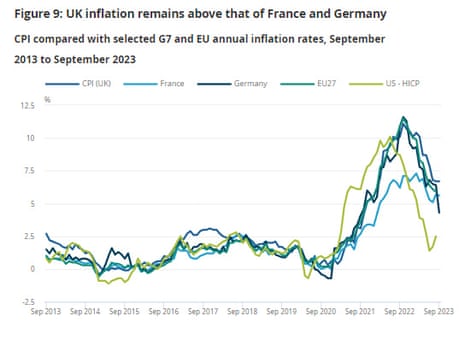

UK has higher inflation in G7

Today’s inflation report confirms that the UK has the highest inflation rate of any G7 country.

Prices are rising slower in other major advanced economies, as this table of the latest CPI inflation rates shows:

-

US: 3.7% in September

-

Canada: 3.8% in September

-

Germany: 4.5% in September

-

France: +4.9% in September

-

Italy: +5.3% in September

-

Japan: +3.2% in August (we get September’s inflation report on Friday)

Some economists have warned that the UK economy suffered a double-whammy. Like the US it has struggled with labour shortages after Covid-19, while it was also hit by the surge in European energy costs after the invasion of Ukraine last year.

Brexit has also been blamed, for creating worker shortgages that pushed up firms’ costs and adding to trade friction at the border, making food more expensive.

Another factor is the UK’s energy price cap, which means bills fall (or rise) on a quarterly basis, with the next drop due in October’s inflation data.

TUC General Secretary Paul Nowak says:

“Bills and prices are still going up – just a bit more slowly than they were a year ago.

“While other countries have acted decisively to reduce cost of living pressures, working families and businesses here remain seriously under the cosh.

“Let’s not lose sight of the bigger picture. The UK is teetering on the brink of recession, with employment falling as companies scramble to cut costs.

“The Conservatives’ lack of a credible economic plan is costing us dear. Britain cannot afford the Tories.”

Key events

Today’s UK inflation report hasn’t had much impact on City expectations for next month’s interest rate decision.

The money markets currently indicate a 78.5% chance that the Bank of England leaves its benchmark rate at 5.25% in November, up from 76% last night.

Stephen Payne, portfolio manager at Janus Henderson Investors, explains why investors don’t expect a hike next month:

“UK CPI came in at 6.7% this morning, flat on the month compared to August, so a pause in the downtrend. Economists’ forecasts were for 6.6%, so the number was marginally ahead of expectations.

However, it is still below the Bank of England’s forecast and so unlikely to push the MPC into a hike at their next meeting. Market reaction has been minimal with rate expectations unchanged, whilst 2-year gilt yields briefly moved a little higher before unwinding that move. Petrol prices were the key driver of the higher number but interestingly food and beverage prices actually fell month-on-month.

The October print will be notable, as the spike in energy bills last year drop out of the comparison base, so a sharp fall in inflation can be expected in October to somewhere around 5%.”

The NIESR research institute says the UK’s food inflation rate of 12.1%, down from 13.6% in August, is concerning.

They say:

“There is no government support to help households (especially lower income households, who spend a greater part of their incomes on food) offset this cost.”

NIESR also warns that underlying inflationary pressures “remain elevated”, and are generating “persistence” in the headline rate of inflation.

Analysts at RBC Capital Markets predict the Bank of England’s monetary policy committee (MPC) will not raise UK interest rates higher, despite inflation failing to drop last month.

They told clients this morning:

Since the MPC’s decision to hold rates in September we have argued that it would take a significant upside surprise in the data for them to restart their hiking cycle.

Today’s data doesn’t represent that ‘significant upside surprise’ to our minds. Indeed we’d argue that compared with the MPC’s expectations it doesn’t really represent a ‘surprise’. We continue to see the MPC holding Bank Rate from here.

Back in the UK, we are just “one wrong move” away from a recession, warns Michael Field, senior equity strategist at Morningstar, after this morning’s inflation report.

“The news that UK CPI didn’t fall in September will disappoint the market today. At 6.7%, inflation in the UK remains high, much higher in fact than the Bank of England’s target rate of 2%. The good news in the release

was that core inflationfell by 0.1% to 6.1%, so some relief for consumers, but not much.“Optimists will point to the large fall that should come next month, when we come to the one-year marker of the Ofgem cap on energy prices. This should knock a good 1% off headline inflation, but again if we focus on that core component, it likely won’t shift. Further, the danger is that getting core inflation down from here to anywhere near 2% may take years, not just months.

Why is this a problem? Well, it poses a dilemma to the Bank of England, stubbornly high inflation means that they will likely keep interest rates high. Running high interest rates with a weak economy is a tight-rope act, one wrong move and we are in a potentially damaging recession.

We also have confirmation today that inflation across the eurozone fell last month.

Consumer prices in the single currency bloc rose by 4.3% in the year to September, statistics body Eurostat says, down from 5.2% in August.

In the Netherlands, prices actually fell by 0.3% year-on-year, while they only rose by 0.6% in Denmark and 0.7% in Belgium.

The highest annual rates were recorded in Hungary (12.2%), Romania (9.2%) and Slovakia (9.0%).

Food, alcohol & tobacco price across the eurozone rose by 8.8% over the last year, slower than the 12.1% increase in UK Food and non-alcoholic beverage prices.

With our latest CPI inflation figures released this morning, Matt Corder, Deputy Director of Prices Division at ONS, explains what the figures mean for food prices, fuel and more.

Watch to find out, and you can explore the data here

https://t.co/0N7k3O1qRN pic.twitter.com/tgDk7yl9lj

— Office for National Statistics (ONS) (@ONS) October 18, 2023

Rishi Sunak has insisted the government will meet his target of halving inflation, despite CPI sticking at 6.7% in September.

Sunak says:

“Tackling inflation remains my number one priority as Prime Minister.

“We will stick to our plan and get it done.”

UK rents rise again

UK tenants continue to be squeezed by rising rents.

The ONS reports that private rental prices paid by tenants in the UK rose by 5.7% in the 12 months to September, up from a revised 5.6% in the year to August.

That is the largest percentage increase since the ONS started collecting this data in January 2016.

It adds:

-

Annual private rental prices increased by 5.6% in England, 6.9% in Wales, and 6.0% in Scotland in the 12 months to September 2023.

-

Within England, London had the highest annual percentage change in private rental prices in the 12 months to September 2023 at 6.2%, while the North East saw the lowest at 4.7%.

-

London’s annual percentage change in private rental prices was at its highest annual rate since the London data series began in January 2006.

The jump in interest rates, making house purchases unaffortable for many, has added to the pressure on the rental market.

ONS: House price inflation lowest since 2012

The latest house price inflation data is out, showing prices rose by the smallest amount in a decade in August.

The Office for National Statistics reports that average UK house prices rose by 0.2% per year in August, the smallest rise since April 2012.

At first glance, it’s surprising to see that house prices rose at all – as lender Nationwide reported they fell by 5.3% in the year to August.

But, the ONS data includes cash buyers, as well as those taking out a mortgage.

The ONS says the average UK house price was £291,000 in August 2023.

That’s £9,000 above the recent low point in March 2023, but below the record high of £292,000 last November.

It adds:

-

Average house prices over the 12 months to August 2023 remained little changed in England to £310,000 (0.0%), decreased in Wales to £217,000 (negative 0.1%) and increased in Scotland to £194,000 (1.1%).

-

Average house prices increased by 2.7% to £174,000 in the year to Quarter 2 (Apr to June) 2023 in Northern Ireland.

-

The North East saw the highest annual percentage change of all English regions in the 12 months to August 2023 (3.6%), while the East of England saw the lowest (negative 1.6%).

June 23 summer slowdown in property transactions varies depending on the country. England being hit the hardest by affordability issues & uncertainty – Transactions volumes dec’ing – 5.6% in Eng, + 8.7% in Scotland, + 8.7% in Wales, -17.6% to Q2 in Northern @ONS pic.twitter.com/WaCGndsu1h

— Emma Fildes (@emmafildes) October 18, 2023

One interesting nugget in today’s inflation data, is that fish inflation has risen.

The ONS says that pricier prawns were to blame:

The only class [within Food and non-alcoholic beverages] to provide an upward contribution was fish, where the largest upward effect came from frozen prawns.

This led to the annual rate for fish increasing to 8.7%, up from 6.8% in August.

September’s inflation could push up business rates by almost £2bn

UK firms are bracing for a jump in costs next year, if the government uses today’s inflation data to set business rates.

Commercial real estate intelligence firm Altus Group has calculaed that the business rates bills will rise by £1.95bn in England next April, if ministers stick to their plan of using September’s CPI rate to set the rise.

Of that, £415m will be shouldered by “the embattled retail sector”, Altus warns.

Jacqui Baker, head of retail at RSM UK, warns that some businesses won’t be able to meet higher rates, saying:

‘The current business rates regime is already crippling retailers, so the prospect of a £1.95bn jump in rates next April will be impossible for some retailers to find.

The Chancellor needs to extend the current relief measures for another year whilst delivering real reform that is fit for purpose to allow the high street to not only survive, but to thrive.’

Trade body UKHospitality has calculated that hospitality businesses would face an additional £234m in business rates.

They also warn that hospitality firms could face an extra £630m of costs if the government ends the current business rates relief for the sector in April.

The UK’s FTSE 100 share index has dipped this morning, after inflation came in above expectations in September.

Housebuilders are leading the fallers, after Barratt Development (-2.7%) told shareholders that “the trading environment remains difficult, with potential homebuyers still facing mortgage challenges”.

Rival Taylor Wimpey are down 2.3%, with kitchen maker Howden Joinery losing 2%.

That’s left the FTSE 100 down 0.1% at 7667, down 7 points.

The Unite union are warning that workers and families need help to get through another winter of rising bills.

Unite general secretary Sharon Graham is calling for action from the Government, saying:

“As the cost-of-living crisis nears its second winter, millions of people face the prospect – yet again – of choosing between heating and eating.

“Headline inflation is still painfully high. In the real world, prices are still rising at a punishing rate.

“For all his talk about ‘tough choices’, the Prime Minister has failed to make the obvious one – it is time to help out ordinary people by taxing the excess profits of the businesses lining their pockets at our expense.”

Professor Costas Milas, of the University of Liverpool’s Management School, argues that the Bank of England could cut interest rates if geopolitical risks worsen.

He tells us:

Today’s inflation reading of 6.7%, unchanged from last month, indicates inflation stickiness which should, in theory, worry the Bank’s policymakers. This is not necessarily the case.

The war in Gaza and the rising geopolitical risk do matter for UK inflation. As I have shown in my piece for The Conversation (link here), what really matters for UK inflation today is both oil price rises and geopolitical risk.

In fact, a model which considers both oil and geopolitical risk is able to predict UK inflation better than alternatives in the current circumstances.

Rising oil prices might keep UK inflation high in the short term but fast-rising geopolitical risk will suppress inflation mainly via the recessionary channel. As things stand, we should, at best, expect no change in interest rates. Unless, of course, the war in Gaza gets out of control, in which case, Central Banks, including the Bank of England, will be cutting interest rates next time an interest rate meeting takes place…