Introduction: House asking prices fall by £6,000 in November

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The chill in the UK housing market isn’t letting up, as high interest rates continue to cool demand from buyers.

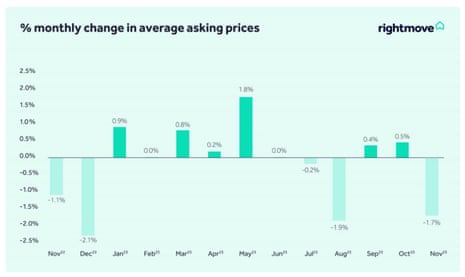

Asking prices for homes in Britain have fallen at their fastest pace in five years for the time of year, according to property website Rightmove this morning.

New seller asking prices dropped by 1.7%, or over £6,000, this month to an average of £362,143, Rightmove reported.

It’s common for asking prices to slip as Christmas approaches, as sellers price their homes more competitively to attract buyers.

But this month’s fall is the largest November drop since 2018, although they did drop by more in August and also last December.

Rightmove says 2023 has been challenging for the housing market, but more positive than predicted.

Its data shows that average asking prices are just 3% below May’s peak, while the number of sales being agreed has picked up in the last month, and more stock available than at the peak of the Covid-19 pandemic.

Tim Bannister, Rightmove’s director of property science, says:

Despite the turbulent end to 2022, the year to date has been better than many expected. Asking prices have eased from the unsustainably frothy heights seen during the pandemic markets, where many sales went to best and final bids.

However, new seller asking prices are now just 3% behind May’s peak and this relatively small fall in asking prices, coupled with stable numbers of new properties coming to the market each month, are strong indicators that forced sales are not widespread.

The number of sales being agreed is now 10% below the same period in 2019, improving from being 15% below 2019’s level last month. The pandemic-driven stock shortage also now appears to be over, with the number of available homes for sale now just 1% behind this time in 2019.

While there is certainly no glut of homes for sale, buyers across Great Britain are likely to see much more choice in their local area compared to a year ago.

The agenda

-

8.15am GMT: ECB vice-president Luis de Guindos speaks at the Opening Conference of the Euro Finance Week “The Future of Banking”

-

12pm GMT: Opec’s monthly oil market report

-

12pm GMT: India’s inflation rate for October

-

3pm GMT: IBD/TIPP index of US economic optimism

-

4.05pm GMT: Bank of England poliicymaker Catherine L Mann speaks at the University of Oxford Environmental Economics Seminar ‘Climate and monetary policy. In particular on transition policies and their macroeconomic effects and monetary policy’

Key events

Closing post

Time for a recap.

Asking prices for homes in Britain have fallen at their fastest pace in five years for the time of year, property website Rightmove reports.

Rightmove said the housing market was faring better than forecast this year, despite average asking prices for homes fell by 1.7% last month.

That pulled the average new asking price down by around £6,000, to £362,143, as high borrowing costs cooled the market.

Asking prices fell year-on-year in the Midlands and all Southern regions, but rose in Wales, Scotland and the North of England.

Rightmove predicted that new seller asking prices will keep dropping in the last couple of months of the year, while some experts suggested the market would bottom out in 2024.

Rising interest rates also hit the rental sector, where landlords are on target to have bought the fewest number of homes since 2010.

Higher interest rates have also knocked £200m off the property portfolio of British Land, although profits have been lifted by soaring rental rates and increasing demand for office and retail space.

In other news….

The Opec group has insisted that the fundamendals of the oil market remain strong, as it maintained its forecast for demand growth in 2024, and pushed up its 2023 forecast slightly.

In its latest monthly report, Opec said:

“Recent data confirms robust major global growth trends and healthy oil market fundamentals.”

Ikea’s parent company has bought its second UK shopping mall, in Brighton, for an estimated £145m as part of a push to bring its furniture stores into city centres.

Blackpool is more popular than Benidorm for British holidaymakers booking trips away next year as soaring air fares lead people to opt for stayactions, according to accommodation search website Trivago.

Avon, the beauty company famous for building a global business by making house-to-house visits, is to open its first physical UK stores in its 137-year history.

The UK government is looking to roll back powers to intervene in company takeovers less than two years after they were introduced, in an attempt to be “more business friendly”.

Royal Mail has been fined £5.6m by the regulator for missing its first- and second-class delivery targets by a “significant and unexplained margin”, causing “considerable harm” to its customers.

And…the boss of Co-op is calling on the government to take more action to tackle retail crime amid a warning it has reached record levels as criminal gangs are operating “exempt from consequences”.

City economists are increasingly confident that the Bank of England will start to cut interest rates from their current 15-year highs next year.

The money markets are currently predicting that rates will have been cut to 5%, from 5.25% today, by next June.

Btut some forecasters believe the cut will come in May 2024 (a month when the Bank is due to release one of its quarterly inflation reports).

The Wall Street firm Morgan Stanley anticipates that the #BoE will lower interest rates by May, offering relief to mortgage borrowers. According to a client note, the firm expects that a reduction in the prices of food and essential goods will lead to a decrease in rates to 4.25%… pic.twitter.com/fFP4CO5YcW

— Share_Talk ™ (@Share_Talk) November 13, 2023

The next inflation report, due on Wednesday, could influence the decision too. Economists predict the Consumer Prices Index will drop to around 5% for October, down from 6.7% in August and September, as price pressures ease.

The oil price has recovered from its early losses this morning, following Opec’s report.

Brent crude is now up 0.25% today at $81.69 per barrel, having fallen as low as $80.41 per barrel earlier this morning.

Craig Erlam, senior market analyst for UK & EMEA at OANDA, says:

Oil prices are a little higher at the start of the week after bouncing off their recent lows over the last couple of sessions. Brent and WTI fell to their lowest levels since July last week in a sign that traders are becoming increasingly concerned about the global economy next year and the risk-premium in the Middle East has subsided.

The OPEC monthly oil market report appeared to push back against demand concerns, referencing overblown negative sentiment around Chinese demand while raising demand growth forecasts for this year and leaving them unchanged for next. The question now is whether OPEC+ members Russia and Saudi Arabia will push back with cuts beyond December.

Opec: Concerns over China’s oil demand are overblown

Opec argue that concerns over China’s economy have been over-egged.

Today’s report says that recent data confirms “robust major global growth trends and healthy oil market fundamentals” adding:

On the global economic growth front, and as the US economy continues the very strong growth it experienced in 3Q23, the IMF has recently upgraded Chinese economic growth projection for 2023 to 5.4%. However, potential downside risk to current robust global economic growth forecasts, although minor, may include sustained restrictive monetary policies to fight inflation, and geopolitical developments.

With this, and despite the overblown negative sentiment in the market regarding China’s oil demand performance, and global oil market in general, the latest data shows Chinese crude imports increasing to 11.4 mb/d in October, and remaining on track to reach a new annual record high for this year, at around the same level.

Opec has let its forecast for world economic growth unchanged at 2.8% for 2023 and 2.6% for 2024.

But there are several tweaks to individual country forecasts, namely:

US economic growth is revised up to 2.3% for 2023 and 0.9% for 2024. Eurozone economic growth is revised down for both 2023 and 2024 to stand at 0.2% and 0.5%, respectively.

Japan’s economic growth forecast for 2023 is revised up to 1.9%, while growth in 2024 remains at 1.0%. The forecast for China remains unchanged at 5.2% for 2023 and 4.8% for 2024.

India’s growth forecast remains unchanged at 6.2% for 2023 and 5.9% for 2024. Brazil’s forecast also remains unchanged at 2.5% in 2023 and 1.2% in 2024. Russia’s economic growth forecast is revised up to 1.9% for 2023 and 1.2% for 2024.

Some early reaction to Opec’s monthly report, first from Amena Bakr of Energy Intelligence…..

Despite the negative sentiment around demand, OPEC’s numbers clearly state that demand is strong. In the latest Opec report: 2023 raised by 20k to 2.46mbpd and next year growth is unchanged at 2.25mbpd growth. #OOTT #Opec pic.twitter.com/qnZBYNzdEs

— Amena Bakr (@Amena__Bakr) November 13, 2023

… and Nader Itayim of Argus Media:

NEW: If there’s one message to take from the latest #Opec monthly oil market report, it’s that oil demand is looking good. 2023 demand growth forecast revised up 20k b/d to 2.46mn b/d; Q4 demand forecast by 150k b/d vs last month to 103.28mn b/d. #oott 🔓https://t.co/KKW3S4xrWr

— Nader Itayim | نادر ایتیّم (@ncitayim) November 13, 2023

OPEC says oil market remains strong.

Opec, the oil cartel, has insisted that fundamentals in the global market “remain strong despite exaggerated negative sentiments”.

In its latest monthly report, Opec has lifted its forecast for world oil demand growth this year, slightly. It now expects demand to rise by 2.46 million barrels per day, up from 2.44m b/d forecast previously.

Opec has left its 2024 forecast unchanged, at growth of 2.25m b/d, despite concerns that economic growth could weaken, hitting energy demand.

Opec says:

In 2024, solid global economic growth, amid continued improvements in China, is expected to support oil consumption. World oil demand is expected to rise by more than 2.2 mb/d y-o-y, with total world oil demand projected to average 104.3 mb/d.

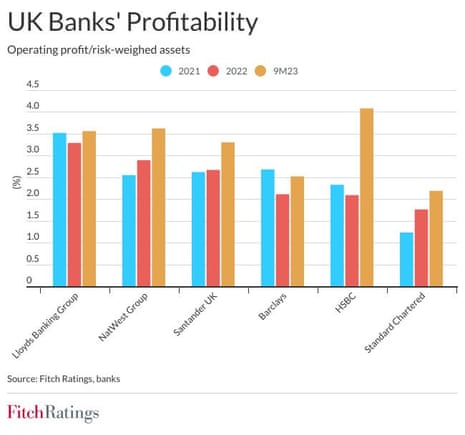

UK banks’ profit boost to end, Fitch predicts

The boost to UK bank profits from higher interest rates is coming to end, Fitch Ratings says.

In a new report, Fitch argues that profit margins will come under “growing pressure” as banks face rising deposit costs – offering better rates to savers – and increasing loan impairment charges (LICs) as borrowers struggle.

The banks’ “Net Interest Margins” have swelled since central banks started lifting interesrt rates. That’s because commercial lenders were quicker to lift costs for borrowers than to sweeten offerings for savers.

Fitch, though, says this trend is ending, as customers move their money to higher-yielding accounts.

NIMs appear to be peaking, and, in some cases, are already declining, driven by rising deposits costs and tighter margins on new mortgage loans due to strong competition among banks.

Higher interest rates have led to more customers switching accounts for better deposit rates, but deposit volumes since early 2023 have largely held up at the major banks, reflecting their strong franchises, and liquidity has remained sound. However, the mix of deposits is continuing to shift towards higher-paying deposits.

We expect this to continue in 2024, driving a modest decline in NIMs and increasing pressure on banks to improve their cost efficiency as they grapple with the effects of high inflation.

Last month, NatWest bank cut its forecast for NIM, saying it would be “greater than 3%” for the full year, down from a previous forecast of 3.15%.

Gas prices drop as Chevron restores production at Israeli gasfield

Wholesale gas prices have fallen today, after Chevron restored production at the Tamar offshore gasfield off the coast of Israel.

Chevron turned the taps back on after being told by Israel’s Energy Ministry to resume production, with production expected to reach full capacity within a few days.

The move comes a month after Chevron was instructed to shut the field, after Hamas’s attack on Israel on 7 October.

The day-ahead UK gas price has dropped by 9% this morning, to 94.5p per therm. The month-ahead price is 2.8% lower.

European gas prices are also weaker, with the benchmark month-ahead price down 2.5%.

Gas prices rose last month, early in the Israel-Hamas war, but had dipped back more recently.

Over in China, new bank lending has fallen – but by less than expected – as economic demand remained weak.

Chinese banks extended 738.4 billion yuan in new yuan loans in October, down from 2.31 trillion yuan in September, the People’s Bank of China reported on Monday.

The drop came despite policymakers increasing support for the economy, including cutting banks’ reserve requirement ratios to encourage them to lend.

Aggregate financing, a broad measure of credit, rose to 1.85 trillion yuan, roughly double the 913 billion yuan in credit extended in October last year before pandemic restrictions were lifted.

However, that’s beow the 1.95 trillion yuan which economists expected.

More reaction to this morning’s house price data:

Remember, ‘asking prices’ are not ‘house prices’.

Asking prices are a measure of confidence or optimism amongst agents & their clients & do not reflect value.

Do’t judge the success of your sale or purchase by reference to the asking price, it’s just a part of the marketing. pic.twitter.com/qV1BoMJcy0— Henry Pryor (@HenryPryor) November 13, 2023

New Asking Prices on RM drop £6,000 in one month.

Remember: Asking Prices are the VERY LAST THING to be publicly cut when house prices are falling.

“..the larger than usual drop this month signals that among the usual pricing seasonality, we are starting to see more new sellers…

— Moving Home with Charlie (@moving_charlie) November 13, 2023

Looking back at this morning’s house price data from Rightmove, this chart shows how asking prices have varied across the capital.

Asking prices have risen the most in the last year in Richmond upon Thames (+2.9%), while Merton (-8.9%) has seen the largest annual drop.

Latest @rightmove HPI: Asking prices trimmed as Xmas approaches. Year on year numbers are pretty good, considering.

But wait, look closer… the disparity in London value growth is schizophrenic! Hackney prices are DOWN 3.2% mom, whilst Lewisham is UP 2%.

Strange goings on. pic.twitter.com/XJ0EEGhnFm

— Russell Quirk (@russellquirk) November 13, 2023

There are now more tenants than ever; one in five of us in England and Wales is now a member of “generation rent”.

And its problems have never been more obvious – here’s a breakdown explaining the increasing pressures that renters have faced over the past few years.

FTSE 100 higher this morning

London’s stock market has opened higher, as investors cling onto hopes that global interest rates may have peaked.

The FTSE 100 index has gained 52 points, or 0.7%, to 7412 points, recovering more than half of Friday’s losses.

Pensions and retirement services firm Phoenix Group is the top riser, up almost 7%, after upgrading its guidance for cash generation this year.

Engineering firms Melrose (+2.5%) and Rolls-Royce (+2.4%) are also in the top risers.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, says:

‘’The FTSE 100 has found a dose of Monday motivation amid hopes that peak interest rates have been reached, despite warnings about America’s huge debt pile and ongoing geo-political fracture.

British Land has helped cement a more upbeat mood, helped by the performance of its retail parks portfolio, with shares rising 5% in early trade.

Results appear to have spread wider cheer about the resilience of the UK economy, with the company expecting rents for commercial property to rise next year.

Traders are shrugging off the news, on Friday night, that credit ratings agency Moody’s has cut its outlook on the US government from stable to negative.

British Land has seen its losses widen as property values have been further hit by higher borrowing costs.

Its pre-tax loss more than doubled from £20m to £49m in the six months to the end of September, compared with the same period last year.

Values across the group’s property portfolio were down 2.5% to £8.7bn over the half year – wiping nearly £200m off its portfolio value year on year.

The decline was driven by rising interest rates and market expectations that rates are set to stay higher for longer.

Its after-tax loss rose to £61m, from £32m a year earlier.

But underlying profits grew by 3.4%.

The property company said that it expects UK interest rates are approaching a peak.

CEO Simon Carter says:

Whilst in the past 18 months we have delivered good earnings growth, asset values have been impacted by the increase in interest rates.

The geopolitical and economic landscape remains uncertain; however, with our portfolio yield now over 6% and an increased likelihood we are approaching the peak in UK base rates we expect the strong occupational fundamentals of our submarkets, together with the differentiated quality of our assets, to reassert themselves as the primary drivers of performance.”

There’s no improvement in mortgage rates today.

Data provider Moneyfacts reports that the average 2-year fixed residential mortgage rate today is 6.22%, unchanged from Friday.

The average 5-year fixed residential mortgage rate was also unchanged, at 5.81%.