Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

UK house prices unexpectedly stalled in March, according to the lender Nationwide, reflecting some weakness in the market as the stamp duty tax break comes to an end.

The average UK house price registered no growth between February and March, leaving the average cost of a home at £271,316, data showed on Tuesday.

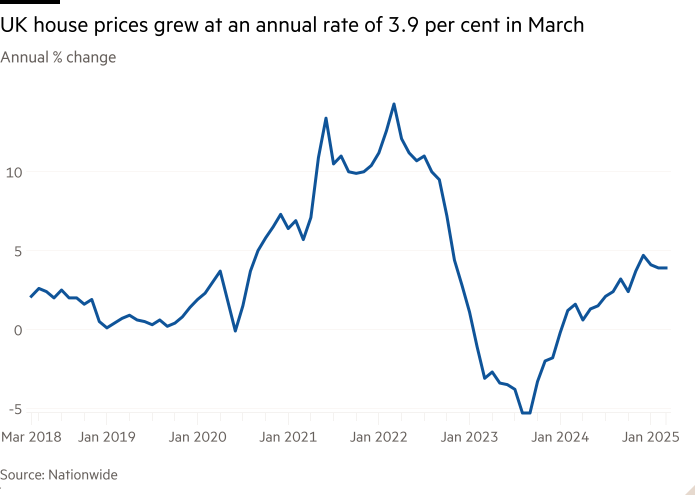

House prices were up 3.9 per cent from March last year, unchanged from the annual rate in February.

Economists polled by Reuters had forecast a 0.2 per cent month-on-month rise and a 4.1 per cent annual increase.

Robert Gardner, Nationwide’s chief economist, said the price trends were “unsurprising, given the end of the stamp duty holiday at the end of March”. Transactions associated with mortgage approvals made in March, especially towards the end of the month, would be unlikely to be completed before the deadline, he explained.

“Indeed, the market is likely to remain a little soft in the coming months since activity will have been brought forward to avoid the additional tax obligations — a pattern typically observed in the wake of the end of stamp duty holidays,” said Gardner.

The pause of the levy introduced in September 2022, when mortgage rates were rapidly rising, ended in March. House purchases for first-time buyers completed from April 1 will start paying the levy on properties of £300,000 or more, rather than £425,000 at present, with similar changes for non-first-time buyers.

Alice Haine, analyst at the wealth management company Evelyn Partners, said: “As well as rising transaction costs, [homebuyers] must contend with uncertainty about the wider economy as the country braces for the fallout from the triple hit to businesses this month from rising national insurance costs, business rates and the minimum wage.”

The rise of several household bills from April 1, including energy, water and council tax will also add pressure to household budgets.

However, Gardner expects activity “to pick up steadily as the summer progresses” despite wider economic uncertainties in the global economy. This is because the unemployment rate remains low, earnings are rising at a healthy pace in real terms, and borrowing costs are likely to moderate.

Markets are pricing that the Bank of England will cut interest rates two more times this year having lowered borrowing costs three times since the summer.

Separate data published on Monday by the Bank of England showed that mortgage approvals marginally declined in the first two months of this year. In February, however, the number of mortgage approvals was still 8.2 per cent higher than in the same month last year and at similar levels to 2019, before the pandemic, indicating how the property market has recovered from the lows seen in 2023 when mortgage rates peaked.

Nationwide data showed that semi-detached homes recorded the strongest price growth in the first quarter, rising 4.5 per cent year on year — nearly double the 2.3 per cent increase for flats.

Northern Ireland posted the fastest regional growth, with prices up 13.5 per cent over the same period. At the other end of the scale, London saw the weakest growth at 1.9 per cent. Despite this, the capital remains the most expensive region, with average prices at £529,369.