Jeremy Hunt says economy is more resilient than feared

Chancellor Jeremy Hunt says has warned that the UK economy is not out of the woods, after narrowly swerving a recession in the last quarter.

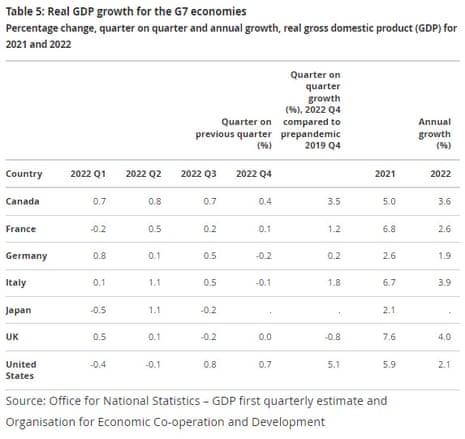

Hunt says the economy is showing more resilience than expected, pointing out that the UK’s 4% growth during 2022 is faster than other advaned economies.

He says:

“The fact the UK was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared.

“However, we are not out the woods yet, particularly when it comes to inflation.”

Key events

Filters BETA

Jeremy Hunt has said today he can’t afford ‘major’ new scheme to help people with energy bills from April, despite pressure to ditch plans for bills to jump this autumn.

Speaking to reporters this morning, Hunt implied that he was going to reject campaigner Martin Lewis’s call to shelve the planned increase, saying that he did not have the scope for a “major new initiative” on energy.

Asked if he was ruling out more support for households, he said:

We constantly keep the help we can give families under review.

But if you’re saying ‘do I think we’re going to have the headroom to make a major new initiative to help people?’, I don’t think the situation would have changed very significantly from the autumn statement, which was just three months ago.

Our Politics Live blog has all the details:

Julia Kollewe

All energy suppliers in the UK have pledged to end the installation of prepayment meters in the homes of vulnerable customers, after damaging reports on how they were forcibly installed against people’s wishes, the government has said.

The Guardian reported last month that leading energy suppliers including Scottish Power, Ova and E.ON had stopped reclaiming debts from some prepayment meter customers. The Department for Business, Energy and Industrial Strategy, which is being carved into three new departments, said that all energy firms had agreed to stop the practice.

As energy prices have soared, many people are struggling to pay their bills and have fallen into debt.

The department said it had asked all suppliers to set out how they were supporting their customers, how many warrants to forcefully enter people’s homes they had applied for and how they would make up for any wrongdoing.

Over in Moscow, the head of Russia’s central bank has said that the risks of a global recession have decreased.

Russian central bank governor Elvira Nabiullina told a press conerence that the Bank had improved its forecasts for Russia’s economy this year. It now believes growth will fall beween -1% and +1% in 2023.

Speaking after the Bank of Russia left interest rates unchanged at 7.5% today, Nabiullina said:

The opening of China’s economy after the removal of COVID-19 restrictions, the fact that central banks in advanced economies are close to the peak of their interest rate increases, falls in energy prices, primarily in Europe – all of this has a positive effect on developing economies, including Russia’s key trade partners.

However, the positive effects of this for Russia will be restrained by sanctions.”

Bloomberg reported this week that president Putin’s government has been pressuring Russia’s Central Bank to be “more upbeat” about the country’s economy amid the invasion of Ukraine and international sanctions.

Kalyeena Makortoff

The National Crime Agency has delivered what is likely to be disappointing news for campaigners who have alleged that UK banks took part in “industrial-scale forgery”, by faking customer signatures on loan and mortgage agreements to repossess homes and recover debts.

The NCA launched an investigation on the request of the Treasury Select Committee back in July 2019, to review claims by the Bank Signature Forgery Campaign (BSFC).

After two and a half years, the NCA has told MPs that it found no evidence of a conspiracy or organised criminal racket by lenders:

It says:

“After careful and thorough examination we have not found evidence of serious or organised crime, or conspiracy to commit fraud or forgery offences that warrant further review and investigation, so will not be taking any further action in relation to these allegations of bank misconduct.

“The breakdown of the material does not support the central allegations made by the BSFC, nor does the material identify dishonest intent and gain by UK financial institutions. We know this will come as a disappointment to many of the individuals who have taken the time to share their material with the BSFC.”

However, the NCA letter suggests it may have found cases where signatures were potentially reproduced, though it appears to claim this was for” administrative” purposes.

While the FCA found “instances where firms had issued communications to customers that had been signed with the same digital signature attributed to different teams and staff” there were no suggestions the practice was ongoing:

The NCA says:

“Although we find that the material supplied suggests that, to the extent that discrepancies have been identified, signatures were being used for administrative convenience rather than to commit any criminal offence, we do believe the BSFC material highlights matters relating to signatures that need to be addressed.”

Now, the NCA is calling for a new policy over how banks use digital signatures on loans and mortgages.

“The National Economic Crime Centre will be recommending to partners that a transparent policy position be put in place with regard to the use of digital signatures on customer facing correspondence originating from the banks and their representatives.

This should be supported with clear advice available to customers about who to contact if they have queries or complaints in relations to these signatures.”

The UK’s economic performance has been ‘calamitous’, despite avoiding two quarterly contractions in a row, says Sam Tombs of Pantheon Economics.

Here’s why:

No recession on the pedantic definition of two consecutive quarters of falling GDP, but a calamitous performance nonetheless. The U.K. still is the *only* G7 country in which GDP has not exceeded its pre-Covid peak yet: pic.twitter.com/gBnbJrAuVt

— Samuel Tombs (@samueltombs) February 10, 2023

The Queen’s funeral in September and the rollout of Covid booster jabs have boosted quarter-on-quarter GDP growth in Q4.

I calculate that “private-sector GDP” in Q4 was 0.3% below its average level in the first two months of Q3. This is a recession in all but name.

— Samuel Tombs (@samueltombs) February 10, 2023

Analysis: UK can expect year of stagnation after narrowest of escapes from recession

Phillip Inman

It was a recession in all but name: that is the conclusion of many economists who argue that while the official data shows the UK economy stood still in the last three months of 2022 rather than contracting, it is still in bad shape, my colleague Phillip Inman writes.

To be precise, the economy actually expanded by 0.01% in the fourth quarter, an increase so statistically insignificant that it is rounded down to zero. Had Britain not added just £77m to its £2.2tn gross domestic product (GDP) then it would have fallen into a technical recession, characterised by two consecutive quarters of negative growth.

Stagnation is not a good look when there is so much that needs to happen – investment in green infrastructure, for instance – to improve living standards and meet net zero targets.

Here’s the full piece:

UK escaped recession by £77m

Britain’s economy really did come close to dropping into recession in the final quarter of last year.

In the end, UK output in Q4 was just £77m away from a contraction, Paul Dales of Capital Economics says.

But, Dales also predicts high inflation and high interest rates will trigger a recession this year.

Strikes on the trains, in the NHS and at Royal Mail hit the economy, he points out:

Health output fell by 2.8% m/m, partly due to fewer GDP appointments during the strikes, transport output was down by 3.1% m/m and arts/entertainment fell by 7.8% m/m (some of which was due to the absence of Premier League football due to the World Cup).

But some of the weakening from the +0.1% m/m rise in GDP in November was probably due to some underlying weakness as a result of high inflation and high interest rates.

NIESR: It still feels like a recession to most households.

This morning’s news that Britain dodged a recession at the end of last year will be “little consolation to most households”, which have seen significant hits to their real incomes over the course of the last year.

So says the NIERS thinktank, which predicts today that the economy will shrink by 0.2% in January-March.

Paula Bejarano Carbo, associate economist at NIESR, explains:

“Today’s ONS figures suggest that monthly GDP fell by 0.5 per cent in December, driven by a 0.8 per cent fall in services which saw significant decreases in human health and social work activities resulting from strikes and a drop-off in vaccination activity.

Interestingly, monthly output in consumer-facing services fell by 1.2 per cent in December following growth of 0.4 per cent in November; the ONS associates this surprise with the gains to food and beverage activity from the FIFA World Cup being overtaken by a 17 per cent loss in sports activities, and amusement and recreation activities due to the break in the Premier League.

The monthly data suggest that GDP was flat in the fourth quarter of 2022.

While this means that the UK avoided a technical recession in 2022 – that is, two consecutive quarters of contracting growth – it is important to remember that it will have felt like a recession for most households as the cost-of-living crisis eroded living standards in the UK.”

The government’s energy price guarantee, which capped the unit cost of electricity and gas for households, probably helped the UK avoid falling into recession last quarter.

Investec analyst Philip Shaw points out that household consumption eked out a 0.1% gain in real terms in the final quarter of 2022.

The Energy Price Guarantee was “undoubtedly” a major support over the period, Shaw explains:

In the event, domestic gas and electricity prices rose by 27%. Without the EPG, the increase would actually have been 80%, which would have very probably resulted in a significant fall in consumer spending.

The EPG was announced by Liz Truss in September, and meant that typical household bills would rise by about £2,500 a year. Before that, they were on track to jump to £3,549 (although there was no limit on what a customer could pay).

Shaw adds:

Another point of interest was the 4.8% increase on the quarter in business investment, maintaining its upward trend over the year as a whole, most likely aided by the ‘super deduction’ capital allowances.

Modupe Adegbembo, G7 Economist at AXA Investment Managers, predicts the UK economy will contract in the current quarter.

That would mean nine months without growth.

Following today’s GDP report, showing the economy flatlined in Q4 but shrank 0.5% in December, Adegbembo says:

The UK economy has narrowly avoided falling into a technical recession in 2022 based on the first quarterly estimate, but growth momentum remains weak, and we expect Q1 growth of -0.3%…..

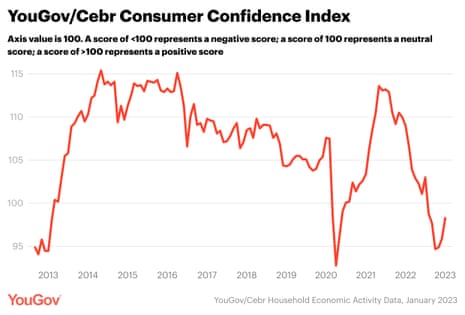

We don’t think this quarter’s stagnation is a precursor of an upcoming pickup in growth momentum; the UK economy remains weak as evidenced by recent deterioration consumer surveys and subdued business surveys, and we expect to see the economy decline further into 2023.

UK consumer confidence has picked up as people show more optimism about their household finances, polling firm YouGov has reported.

It latest survey of the public has found that optimism rose in January, suggesting the economy performed better than feared in the early weeks of 2023.

The report says:

-

Short-term (+5.7) and forward-looking (+10.5) household finance measures saw significant improvements

-

House value measures for the past 30 days (+3.7) and next 12 months (+5.8) also trended upwards

-

Business activity measures for the past 30 days fell by -2.2 points to 106.6, the lowest since February 2021

-

Confidence in job security fell further by 0.7 points

Oil price jumps as Russia announces output cut

There’s drama in the energy markets this morning.

The oil price has jumped by 2.5%, after Moscow announced it will cut oil production, in retaliate against Western sanctions following the invasion of Ukraine.

Russia will cut oil production by 500,000 barrels per day, or around 5% of output, in March, Deputy Prime Minister Alexander Novak has announced.

The move has been hinted at by the Kremlin, since the European Union and G-7 began discussing capping the price of Russian exports. At the end of December, president Putin banned the supply of crude oil and oil products to nations that impose the cap.

Novak says

“As of today, we are fully selling the entire volume of oil produced, however, as stated earlier, we will not sell oil to those who directly or indirectly adhere to the principles of the ‘price cap’.

“In this regard, Russia will voluntarily reduce production by 500,000 barrels per day in March. This will contribute to the restoration of market relations.”

This has pushed Brent crude up by $2 per barrel, to $86.60. That’s the highest since the end of January. Higher energy prices could undermine hopes of bringing inflation down sharply this year.

Russia will cut about 5% of its monthly oil output in March in response to the price cap.

This is 0.5% of the world supply.

Brent crude up 2.5%

Things continue to move quickly…

— Gold Telegraph

(@GoldTelegraph_) February 10, 2023

Analyst: No need to open the fizz after UK avoids recession

The sparkling wine can remain on ice after data this morning confirmed the UK avoided a recession at the end of 2022 by the narrowest of margins, cautions Craig Erlam, senior market analyst at OANDA.

There’s every chance that a tiny revision to the data over the next couple of months will confirm quite the opposite, Erlam adds:

Ultimately, this isn’t a story of whether the UK is in recession or not as that’s just a simple technical definition. It’s a story of zero growth – quite literally in the case of the fourth quarter – and the fact that this likely represents the recent past, present, and near-term future prospects for the UK economy. High but falling inflation and basically no growth for some time. It’s all a bit bleak really.

Of course, that’s better than where we expected to be at this point so that’s a positive. The data towards the end of the year is actually quite difficult to pick apart due to the impact of one-off or temporary events like the world cup, the loss of premier league football, and most importantly, the many, many public sector strikes that continued into the new year.