Stay informed with free updates

Simply sign up to the Pensions industry myFT Digest — delivered directly to your inbox.

The UK Treasury is on course for a windfall of more than £40bn over the next 20 years, new estimates show, as thousands of heirs of people who converted pension promises into a cash lump sum following “pension freedoms” in 2015 face inheritance tax bills.

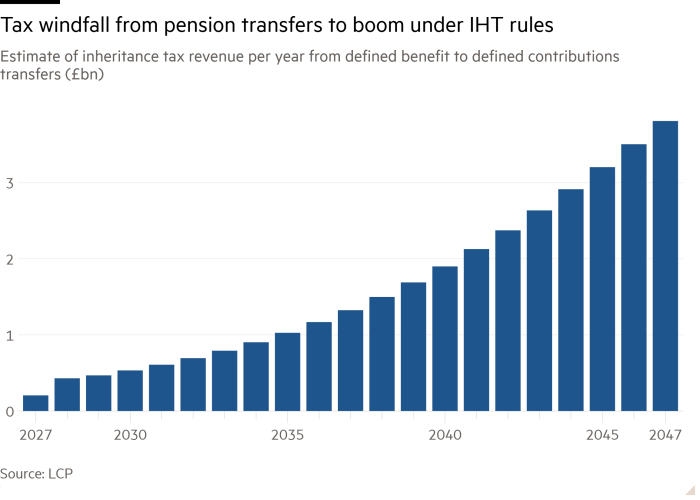

The government estimates that pension tax changes will raise £1.46bn a year by 2029-30, but consultants at Lane Clark & Peacock, an actuarial adviser, estimate that revenue raised from UK-wide transfers out of defined benefit to defined contribution schemes will surge from £470mn in 2029-30 to more than £3bn a year by the mid 2040s.

“The figures in the red book [Budget documents] don’t do justice to the long-term scale of the tax increase which could easily be over £40bn over the next two decades,” said Sir Steve Webb, partner at LCP and former pensions minister.

Revenue is set to rise sharply because of a surge in pension transfer activity several years ago. In 2015, the then chancellor George Osborne introduced rights allowing individuals to move their defined benefit pension scheme to a defined contribution pot.

More than 100,000 transfers were undertaken in the five years after that, according to LCP, and six-figure transfer values were the norm. In many cases these transfers were undertaken specifically so the value of those pension pots could be passed on when the member died.

In last year’s Budget, chancellor Rachel Reeves announced that unused pension funds will be included within IHT from April 2027.

“Applying inheritance tax to pension balances could prove to be a real gold mine for the government for many years to come,” said Tim Camfield, senior consultant at LCP, who carried out the analysis.

While he acknowledged that some retirees may react to tax changes by drawing down on pension assets faster, the changes will still generate significant tax revenue because such withdrawals will be subject to income tax, he said.

“Either way, as the DB transfer generation gets older, the government will start to see a multibillion pound revenue stream from the income tax or IHT on their pension pots,” Camfield added.

According to a freedom of information request from investment platform Interactive Investor to the Office for Budget Responsibility, an estimated 31,200 more estates will be subject to IHT in the three years from the 2027-28 tax year than if pensions had not been included in estates.

The OBR estimates that 66,600 people will pay inheritance tax in 2029-30, up from 40,100 in the current tax year.

LCP calculates that these numbers should continue to surge because the peak in transfer activity from DB schemes to DC schemes was in 2017-18, after which tighter rules around financial advice followed by a fall in transfer values led to a dramatic reduction in the volume of transfers.

Will you spend your pension before Rachel Reeves does?

The typical person who transferred was in their late fifties, according to LCP. As these people gradually die over the coming years, any unspent balances in their transferred pension fund will be potentially liable to IHT.

Rob Morgan, chief analyst at wealth manager Charles Stanley, said that enhanced death benefits tended to be “the overriding factor” for people choosing to transfer out of DB into DC.

“On the basis that people will mostly have only done this where there is ample income and assets elsewhere, we can infer that there will be IHT consequences in many cases,” Morgan said.

Data from the Financial Conduct Authority shows that between April 2015 and September 2018, more than 170,000 people who received advice transferred their DB scheme to a DC pot, with an average transfer value of over £350,000. This suggests the total amount transferred in this period was over £50bn.

Shaun Moore, tax and financial planning expert at Quilter, a wealth manager, said a freeze in the inheritance tax threshold — which is set to last until 2030 — plus the inclusion of pensions from 2027 would enable the government to “cash in on an ever-expanding pool of taxpayers”.

The IHT tax-free threshold has been set at £325,000 since 2009. The impact of the frozen threshold alongside inflation and rising asset values means more people have been dragged into paying inheritance tax, with the trend likely to continue.