Despite an already strong run, Beijing Bohui Science & Technology Co., Ltd (SHSE:688004) shares have been powering on, with a gain of 39% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

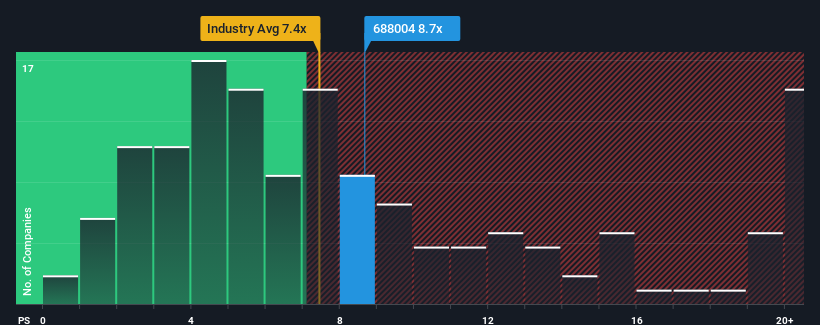

Even after such a large jump in price, it’s still not a stretch to say that Beijing Bohui Science & Technology’s price-to-sales (or “P/S”) ratio of 8.7x right now seems quite “middle-of-the-road” compared to the Software industry in China, where the median P/S ratio is around 7.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Beijing Bohui Science & Technology

How Beijing Bohui Science & Technology Has Been Performing

For instance, Beijing Bohui Science & Technology’s receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Beijing Bohui Science & Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Some Revenue Growth Forecasted For Beijing Bohui Science & Technology?

There’s an inherent assumption that a company should be matching the industry for P/S ratios like Beijing Bohui Science & Technology’s to be considered reasonable.

Taking a look back first, the company’s revenue growth last year wasn’t something to get excited about as it posted a disappointing decline of 5.6%. The last three years don’t look nice either as the company has shrunk revenue by 41% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 33% over the next year, which really puts the company’s recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Beijing Bohui Science & Technology’s P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company’s business prospects. There’s a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Beijing Bohui Science & Technology’s P/S

Beijing Bohui Science & Technology’s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we’d caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Beijing Bohui Science & Technology currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it’d make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders’ investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Beijing Bohui Science & Technology that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we’re here to simplify it.

Discover if Beijing Bohui Science & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.