- The Total Value Locked (TVL) locked on Avalanche declined over the last few weeks.

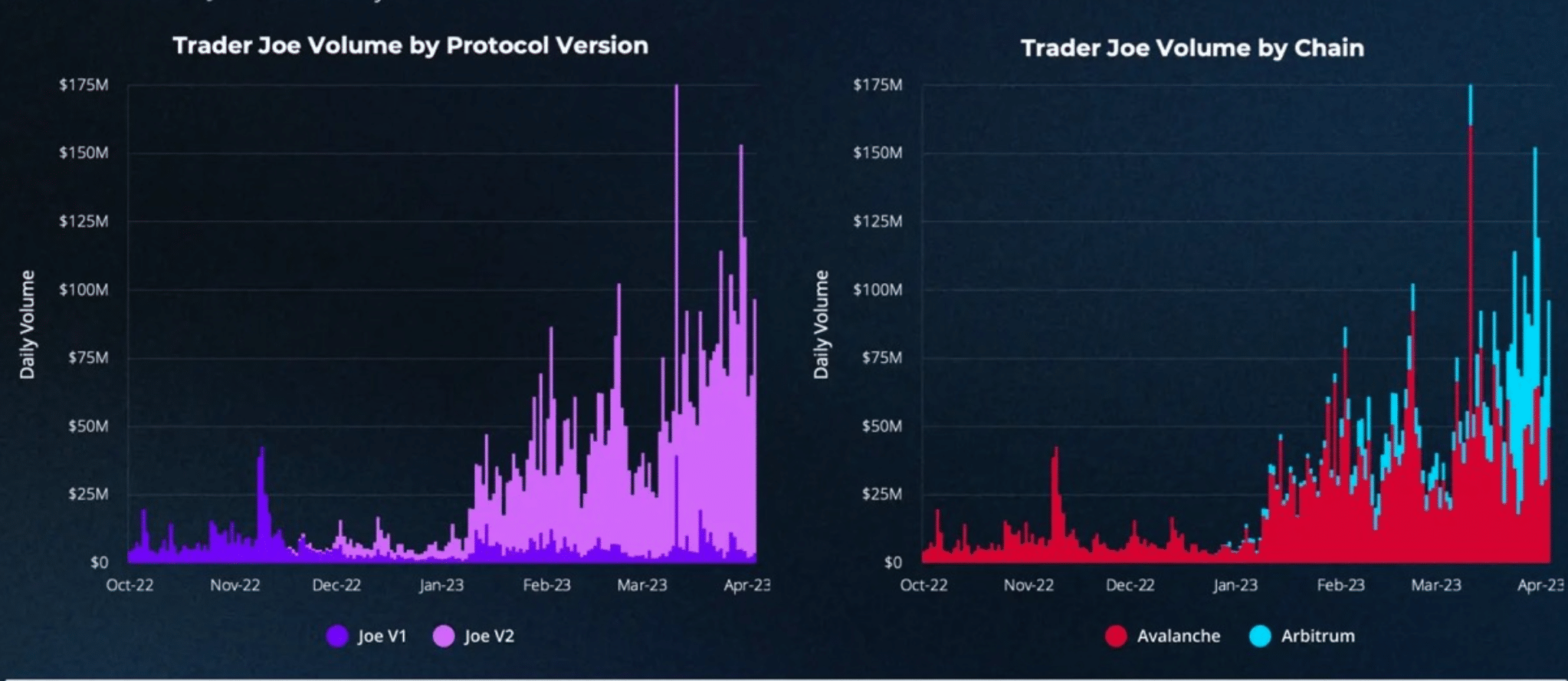

- However, Trader Joe, a DEX, witnessed a surge in activity.

Starting in 2022, the total value locked (TVL) on Avalanche has been experiencing a persistent downtrend. Despite numerous attempts to attract more users, the TVL did not show any significant improvement.

Is your portfolio green? Check out the Avalanche Profit Calculator

However, a DEX Trader Joe could, reportedly, help the Avalanche ecosystem in areas where it is facing challenges. As per Messari’s data, Trader Joe’s v2 has exhibited the fastest growth among decentralized exchanges (DEXs) in the last 180 days.

This can be attributed to the introduction of its Liquidity Book (LB), which implements a concentrated liquidity model which rivals that of Uniswap V3.

Notably, it was found that other dApps on the Avalanche network did not observe the same level of traction as Trader Joe.

According to Dapp Radar, popular dApps on Avalanche such as Benqi, CelerNetwork, and Beefy Finance, witnessed a decline in unique active wallets on the network over the last week.

Still a long way to go

Moreover, in the NFT market as well, the Avalanche network observed a decline in interest. AVAXNFTSTATS data indicated that the overall daily mint volume fell down materially for Avalanche over the last month. This implied that new NFTs were not being created very frequently on the Avalanche network.

Sadly, the interest in Avalanche’s blue-chip NFT collections such as Roostr and MadSkullz was also falling.

All of the above-mentioned factors impacted the overall NFT trades.

Well, one of the reasons for the waning interest in Avalanche NFTs could be the decline in the weighted sentiment metric.

The negative weighted sentiment implied that the overall outlook of the crypto community towards Avalanche wasn’t very favorable.

On the other hand, according to the token terminal’s data, the number of daily active users on the Avalanche network fell by 9% in the last week. Subsequently, the overall revenue generated also went down by 19.1%.

Realistic or not, here’s AVAX’s market cap in BTC terms

If Avalanche fails to generate interest from users for a prolonged period of time, it would be detrimental to the protocol’s success in the long run.