Introduction: World markets on track for biggest monthly loss since 2022

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Donald Trump’s trade war is alarming the global markets, sending shares sliding in their worst month in over two years.

Stock markets across the Asia-Pacific region are in retreat this morning, as investors fear Trump will announce swingeing new tariffs on Wednesday, which has been dubbed “Liberation Day” by the US president.

Japan’s Nikkei has lost 3.9%, down 1,457 points at 35,662 points today, while South Korea’s KOSPI is down 3%, Australia’s S&P/ASX 200 has fallen 1.7%. In China, which has already been hit by Trump tariffs this year. the CSI 300 is 0.9% lower.

These are just the latest losses in a bad month for the financial markets. MSCI’s index of global stocks had fallen around 4.5% since the start of March, even before today is priced in, which would be the worst month since September 2022.

Today’s selloff comes after Donald Trump told reporters that the reciprocal tariffs he is set to announce this week will include all nations.

He told reporters on Air Force One:

“You’d start with all countries. Essentially all of the countries that we’re talking about.”

That is a blow to hopes that the White House might only target countries with the largest trade imbalances against the US.

Investors have also been spooked by recent bad economic news from the US.

On Friday, core inflation rose by more than expected, while consumer sentiment weakened to its lowest level since 2022. That drove shares down on Wall Street on Friday, and captured the fears in the markets right now.

Kyle Rodda, senior financial market analyst at capital.com, explains:

The dynamic is a microcosm of the essential fear in the market right now. Trade policy and even merely the uncertainty generated by it is weakening growth but also contributing to sticky inflation, meaning the Fed is going to have marginally less capacity to cut interest rates if (or when) US economic activity starts to falter.

The problem was hammered home further by a revised University of Michigan Consumer Sentiment survey which revealed even higher 1-year inflation expectations of 5% and a greater deterioration in confidence.

The agenda

-

9.30am BST: Bank of England mortgage approvals and consumer credit

-

1pm BST: German inflation rate for March

-

3.30pm BST: Dallas Fed Manufacturing Index for March

Key events

Virgin Atlantic sees signals of slowing US demand

British airline Virgin Atlantic said it was starting to see some signals that demand was slowing in the United States after a strong start to 2025.

Speaking after the airline reported its latest financial results, chief financial officer Oli Byers said:

“I think we’ve seen very strong trading for the first quarter. In the last few weeks, we have started to see some signals that U.S. demand has been slowing.”

Virgin Atlantic also said it has returned to profitability for the first time since the pandemic last year.

For 2024, Virgin Atlantic posted pretax profit before exceptional items of £20m, up from a pre-tax loss of £139m last year.

Oil price rises as Trump threatens Russia and Iran with secondary tariffs

As well as hitting stocks, Donald Trump appears to have lifted the oil price.

Crude prices are up around 0.66% this morning, after the US president threatened to impose secondary tariffs on buyers of Russian oil.

Trump told NBC:

“If a deal isn’t made, and if I think it was Russia’s fault, I’m going to put secondary sanctions on Russia.”

Earlier this month Trump appeared to invent the idea of ‘secondary tariffs’, when he annouunced that anyone buying oil from Venezuela would face new tariffs on their sales to the US. Bloomberg have dubbed it “a new economic statecraft tactic”.

The possibility that buyers of Russian oil could be scared off by secondary tariffs, and seek supplies elsewhere, has pushed up the cost of a barrel of Brent crude as high as $74.47 today, a five-week high.

Trump’s warning of possible military action and secondary tariffs against Iran if it did not agree to a deal over its nuclear programme may also have lifted oil.

Demand for new mortgages has slowed in the UK a little.

New Bank of England data shows that the number of mortgage approvals for house purchases decreased by 600 to 65,500 in February, following a decrease of 400 in January.

Approvals for remortgaging decreased by 800 to 32,000.

There was also a drop in net mortgage lending – it fell by £900m to £3.3bn in February.

The first time buyer drive to make the stamp duty deadline, dropped down another gear in February. As a result, net mortgage approvals for house purchases decreased by 600 to 65,500 in February, following a decrease of 400 in January. This resulted in the net borrowing of… pic.twitter.com/CJCeH3e7dh

— Emma Fildes (@emmafildes) March 31, 2025

The tumbling markets this morning suggest tariffs are threatening to become “the flags the global economy dies under,” said Bill Blain, market strategist at Wind Shift Capital, adding:

Global trade wars look all but inevitable. Gold at a record high. Stocks are selling off on the growth implications of Trump’s tariff regime.

Good morning, traders!

📉 Markets having a Monday meltdown courtesy of Trump’s “Liberation Day” tariffs:Asia wakes up grumpy:

Nikkei 🔻4%

Kospi 🔻2.6%

Hang Seng 🔻1.7%Europe clearly didn’t have enough coffee:

FTSE 🔻1%

DAX 🔻1%

CAC 🔻1.2%US futures already sighing…

— Market Lense (@mrktlens) March 31, 2025

Goldman Sachs also caution against trying to call the bottom of the current market sell-off, saying:

We continue to recommend investors watch for an improvement in the growth outlook, more asymmetry in market pricing, or depressed positioning before trying to trade a market bottom.

Although our Sentiment Indicator has declined sharply during the last few weeks (to -1.2), it remains above levels reached at the troughs of other major sell-offs during recent years (-2.0 or lower).

Goldman Sachs lifts chances of US recession to 35%

In a worrying sign, Goldman Sachs believes there’s more danger that the US economy falls into recession this year.

Goldman’s economists now estimate a 35% probability that the US economy enters a recession during the next 12 months, up from 20% previously.

They warned that earnings growth is likely to be weaker this year, and next, than expected, telling clients:

Higher tariffs, weaker economic growth, and greater inflation than we previously assumed lead us to cut our S&P 500 EPS growth forecasts to +3% in 2025 (from +7%) and +6% in 2026 (from +7%).

UBS cuts S&P 500 target due to tariff impact

Swiss bank UBS has cut its forecast for the US stock market’s gains this year.

Having previously forecast the S&P 500 shares index would end the year at 6,600 points (which would have been a 12% gain in 2025), UBS have now cut their end-year target to 6,400 points.

That would still represent quite a recovery after a poor start to the year, which has pulled the S&P 500 down to 5,581 points on Friday night.

Mark Haefele, chief investment officer at UBS Global Wealth Management, explains:

“After considering the effects of tariffs and slower growth data so far in 2025, we now expect 6% earnings per share growth, and we have accordingly reduced our year-end target for the index to 6,400 (from 6,600).

But this also means that there is still meaningful upside for broad US equities by year-end, in our view.”

UBS weren’t alone in forecasting gains on Wall Street this year most brokerages predicted US stocks would have risen by December.

With one trading day left of the quarter, risk sentiment has drained from Asian and European stock markets, says Kathleen Brooks, research director at XTB.

She explains:

The Nikkei closed down 4%, while European indices are a sea of red. The sell off is broad based, with more than 550 of the Eurostoxx 600 stocks lower as investors take fright ahead of President Trump’s tarrif announcement that is due on Wednesday.

The flight to safe havens has sent the gold price higher by $36 per ounce, and gold is now above $3,122 per ounce. ‘Liberation Day’ for America is bad news for global stocks, and US futures are also pointing to a sharp decline for the S&P 500 later today.

‘A bleak atmosphere on trading floors worldwide’

Europe’s main stock indices are a sea of red, as investors react to Donald Trump’s declaration that the reciprocal tariffs he is set to announce this week will include all nations.

Italy’s FTSE MIB index has dropped 1.4%, France’s CAC is down 1%, and Germany’s DAX has lost 0.95%.

Jochen Stanzl, chief market analyst at CMC Markets, says “a selling wave is sweeping across global markets”, adding:

The tariffs imposed by the U.S. government and the fear of new announcements as early as Wednesday are creating a bleak atmosphere on trading floors worldwide. Just last Wednesday, the DAX was above 23,000 points, but it now appears that the index may soon test the 22,000 mark.

The risk appetite seen in the initial weeks of the year has dissipated as investors and asset managers pull back, reduce positions, and refrain from taking on large new ones. The inclination to buy the dips has nearly vanished.

Stoxx 600 hits seven-week low

European stock markets are on the slide, dragging the pan-European Stoxx 600 index down to a seven-week low.

FTSE 100 falls at the open

The London stock market is open, and shares are sliding.

The FTSE 100 index of blue-chip shares has dropped to a two-week low in early trading, down 72 points or 0.85% at 8585 points.

British Airways parent company, IAG, are among the top fallers, down nearly 3%, along with Associated British Foods (-4%) after it announced that the boss of its Primark division had quit after an “error of judgment”.

Mining stocks are also weaker.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, says:

“The last day of March is spring-loaded with uncertainty on financial markets. Unease about the effect of Trump’s tariffs has been amplified, causing sharp moves at the start of the week. London-listed stocks will not be immune to the tariff fall out, with the FTSE 100 set for a difficult start to the week as investors brace for the debilitating effect of widespread tariffs.

There have been steep falls on indices in Asia as hopes for a more targeted set of fresh duties have evaporated. The President’s comments over the weekend appeared to indicate that blanket new tariffs would be unleashed on Wednesday, a day he’s dubbed ‘Liberation’ day but one which is likely to ensnare many more countries in his punishing trade policies.

While the implications of his comments are still far from clear, he appears determined to target countries which are competitive in a whole range of sectors, to try spark a revival of home-grown industries. But building new manufacturing bases will take years, and much higher costs in the meantime, look set to raise prices and depress economic activity.

Primark boss admits ‘error of judgment’ and resigns after woman’s allegation

The boss of Primark has admitted an “error of judgment” and resigned following an allegation made by a woman about his behaviour towards her in a social environment.

City investors are growing more confident that the Bank of England may cut interest rates as soon as its next meeting.

A UK interest rate cut in May is now seen as a 66% likelihood, according to the money markets, up from roughly evens last week.

Investors are also more confident that the BoE will cut rates two more times this year. The money markets are now pricing in 53 basis points of cuts, meaning two quarter-point cuts are fully priced in, which they weren’t last week.

Gold hits another record high

The gold price has hit a new all-time high today, as Donald Trump’s threat of imposing reciprocal tariffs on all countries sparks a rush into save-haven assets.

Gold is up 1% today at $3,116 per ounce, having earlier traded as high as $3,128/oz, adding to its strong gains already this year.

KCM Trade chief market analyst Tim Waterer says:

“Markets’ anxiety levels have been ramping up ahead of the reciprocal U.S. tariff announcements, which is keeping gold in high demand as a defensive play.

“If the tariff announcements this week are not as severe as feared, then the gold price could start to backtrack as profit-taking from the highs may be triggered.”

Gold has gained around 9% during March, which Reuters has calculated would be its best month in a year.

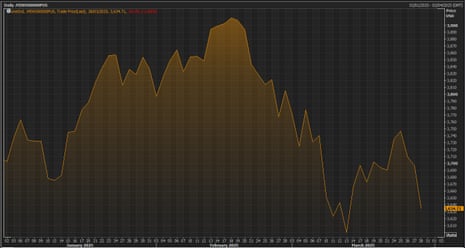

Dollar index on track for worst month since November 2022

March has also been a grim month for the US dollar.

By my calculations, the dollar is on track for its largest monthly fall against a basket of major currencies since November 2022.

The dollar index has lost around 3.5% so far this month, as anxiety over looming tariffs against America’s trading partners.

New tariffs are likely to disrupt global trade, especially if other countries retaliate against Washington.

But the economic worries run deeper, as Stephen Innes, managing partner at SPI Asset Management, explains:

This isn’t just about trade—it’s about consumer behaviour, capex hesitation, and inflation stickiness all colliding at once.

So far this month, the pound has gained 3% against the dollar to $1.2760.

The euro is up 4.4% against the dollar, to $1.083.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, says:

In summary, the euro is looking stronger than sterling and the dollar, while the US dollar has become the weakest link among the three.

Introduction: World markets on track for biggest monthly loss since 2022

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Donald Trump’s trade war is alarming the global markets, sending shares sliding in their worst month in over two years.

Stock markets across the Asia-Pacific region are in retreat this morning, as investors fear Trump will announce swingeing new tariffs on Wednesday, which has been dubbed “Liberation Day” by the US president.

Japan’s Nikkei has lost 3.9%, down 1,457 points at 35,662 points today, while South Korea’s KOSPI is down 3%, Australia’s S&P/ASX 200 has fallen 1.7%. In China, which has already been hit by Trump tariffs this year. the CSI 300 is 0.9% lower.

These are just the latest losses in a bad month for the financial markets. MSCI’s index of global stocks had fallen around 4.5% since the start of March, even before today is priced in, which would be the worst month since September 2022.

Today’s selloff comes after Donald Trump told reporters that the reciprocal tariffs he is set to announce this week will include all nations.

He told reporters on Air Force One:

“You’d start with all countries. Essentially all of the countries that we’re talking about.”

That is a blow to hopes that the White House might only target countries with the largest trade imbalances against the US.

Investors have also been spooked by recent bad economic news from the US.

On Friday, core inflation rose by more than expected, while consumer sentiment weakened to its lowest level since 2022. That drove shares down on Wall Street on Friday, and captured the fears in the markets right now.

Kyle Rodda, senior financial market analyst at capital.com, explains:

The dynamic is a microcosm of the essential fear in the market right now. Trade policy and even merely the uncertainty generated by it is weakening growth but also contributing to sticky inflation, meaning the Fed is going to have marginally less capacity to cut interest rates if (or when) US economic activity starts to falter.

The problem was hammered home further by a revised University of Michigan Consumer Sentiment survey which revealed even higher 1-year inflation expectations of 5% and a greater deterioration in confidence.

The agenda

-

9.30am BST: Bank of England mortgage approvals and consumer credit

-

1pm BST: German inflation rate for March

-

3.30pm BST: Dallas Fed Manufacturing Index for March