Would you rather have £80 or £100?

That’s not a trick question; the obvious answer is the right one. It is also the key to why you need a cash Isa.

If you save in a Isa rather than a normal savings account, your interest isn’t taxed.

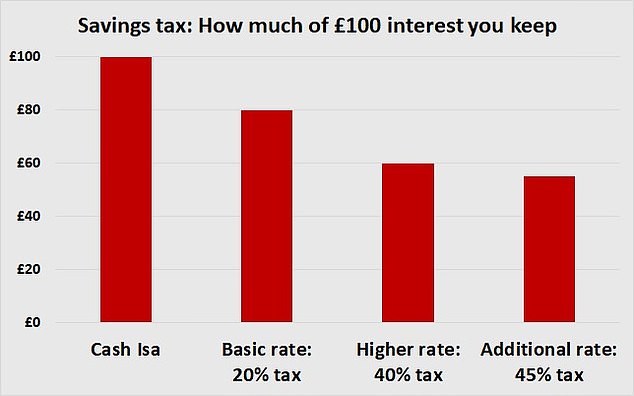

This means that if you’re a 20 per cent basic rate taxpayer and earn £100 of interest on money saved in a cash Isa, you get to keep it all.

Save outside of one and you run the risk of only ending up with £80.

More importantly, for an increasing number of people the question is would you rather have £60 or £100?

That’s the difference for higher rate taxpayers between earning interest in a cash Isa and being taxed on it.

> Best cash Isa rates: Check the top deals in our savings tables

If you save in a cash Isa you keep all your interest. Outside of one, tax can eat into it

What is a cash Isa?

A cash Isa is exactly like a normal savings account, except it has a special tax-free wrapper.

The catch is that in return for that protection, you can only pay up to £20,000 per year into Isas.

You can opt for an easy access cash Isa, which you can remove money from whenever you like but where the rate can go up or down.

Alternatively, you could choose a fixed rate cash Isa, where your rate is guaranteed but you can’t withdraw money for a set time period.

Tax on savings

To reiterate, the simple reason for using a cash Isa over a standard savings account is that all your interest is guaranteed to be tax-free.

Outside of an Isa, interest above the annual personal savings allowance is taxed at someone’s income tax rate.

For 20 per cent basic rate taxpayers, those earning up to £50,270 a year, this savings allowance is set at £1,000 of interest per year.

A basic rate taxpayer would need to have £20,000 in a savings account paying 5 per cent to breach that annual interest limit.

That’s a sizeable amount of cash saved but there are many people out there with more than that held across various savings accounts.

Where the problem really kicks in though is for those who pay 40 per cent higher rate tax, a number that had swollen to 5.1million due to frozen tax thresholds in the most recent HMRC figures for 2022 to 2023 and will almost certainly be higher now.

Higher rate taxpayers, those earning £50,271 to £125,140, see the personal savings allowance cut to just £500 of annual interest.

They would need £10,000 in a savings account paying 5 per cent to breach this.

Meanwhile, 45 per cent additional rate taxpayers get no savings allowance at all, so all their interest is taxed.

Tax on interest from savings above the personal savings allowance

Protect your pot from tax in the future

Saving in an Isa makes sense, because not only are you protecting yourself from tax on your interest now, but you are also sheltering the pot that you are building up from tax in the future.

The fact that the personal savings allowance thresholds haven’t budged since they were introduced in April 2016, while income tax thresholds have been frozen since 2021, emphasises the importance of this.

There have been rumours that Rachel Reeves will cut the cash element of the annual Isa allowance, to try to force more people to invest through stocks and shares Isas if they want tax benefits.

This would be hugely unpopular and even if she did limit the amount that could go into cash Isas, she would be highly unlikely to remove tax-free benefits from existing Isa savings.

This means that it may make even more sense to load up an Isa as much as possible now.

Get a flexible Isa for everyday savings

My tip for higher rate and additional rate taxpayers is to use a flexible easy access cash Isa for as much of your cash savings as possible, even your emergency pot and day-to-day savings.

A flexible Isa allows you to take money out and pay it back in during the same tax year, without using up any of your Isa allowance.

The best offer unlimited withdrawals with no effect on rate. They can be used as a tax-beating pot to dip in and out of as you choose.

Rates are better: a cash Isa is a no-brainer

If your savings aren’t in a cash Isa, get as much of them as possible into one before you lose this year’s £20,000 Isa allowance at the end of the tax year on 5 April.

You can check the best deals in our independent best cash Isa rate tables.

And there’s an added bonus at the moment: the top easy access cash Isa deals pay higher rates than standard savings accounts.

Many of you reading this will, of course, have cash Isas, but you may know relatives or friends who don’t and could do with a helping hand.

This is my attempt to explain them in the simplest possible way, so send this column on to anyone you think would be interested.

Get a cash Isa, it’s a no brainer.

> What you need to know every week: Sign up to the This is Money newsletter

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.