- XRP could drop by 39% to reach its support level at $1.15 if it fails to hold $1.95 or $1.90 levels.

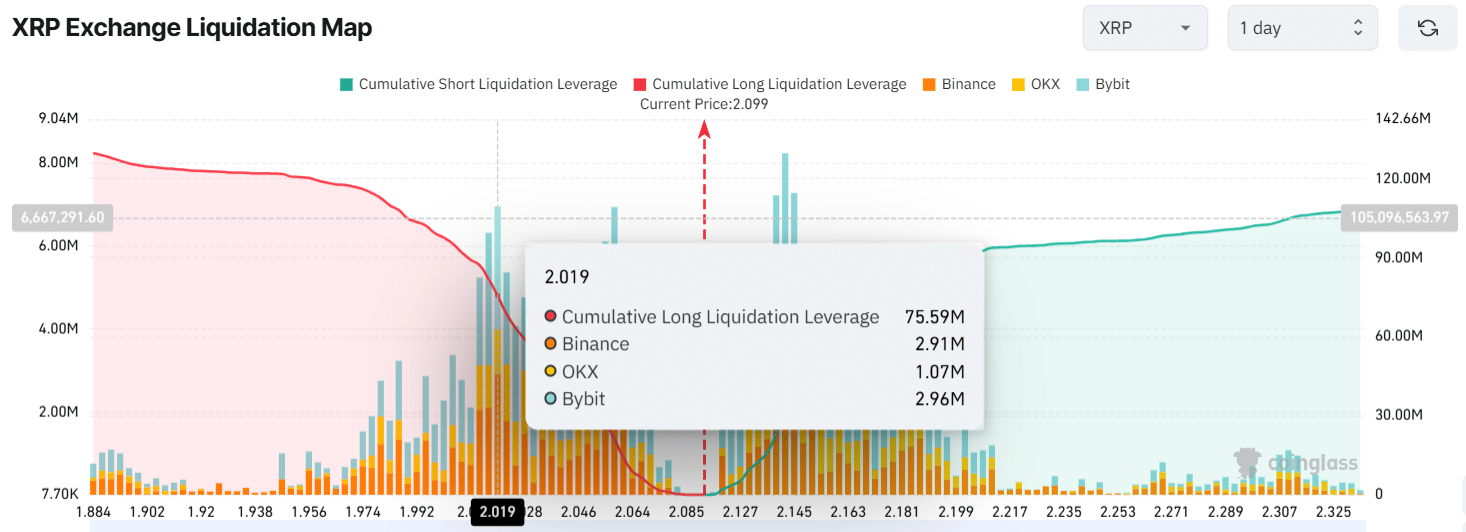

- Traders are over-leveraged at the $2.019 level on the lower side and $2.142 on the upper side.

Amid ongoing market uncertainty, XRP, Ripple Labs’ native token, has lost significant value and reached a key level of bearish price action pattern.

Currently, sentiment across the crypto landscape is bearish, with major assets like Bitcoin [BTC] and Ethereum [ETH] struggling to gain momentum.

Bearish head-and-shoulders pattern

The asset’s daily chart suggests that this level is a make-or-break point that will determine XRP’s next move.

According to AMBCrypto’s analysis, XRP has successfully formed a textbook-style bearish head-and-shoulders pattern, reaching the neckline at $2 and nearing a breakdown.

Historically, this level has always acted as a crucial support before forming this bearish pattern, with XRP rebounding multiple times after testing it.

XRP price prediction: Crash or rebound?

If XRP continues to decline and closes a daily candle below the $1.95 or $1.90 level, there is a strong possibility that the asset could drop by 39% to reach its support level at $1.15.

On the other hand, if the asset holds above $2, there is a possibility that history will repeat, and the price may recover or rebound in the future.

Despite these factors, XRP’s price has maintained itself above the 200-day Exponential Moving Average (EMA), indicating that the asset remains in an uptrend despite continuous price drops and retains bullish strength.

In addition, a prominent crypto expert recently shared a post on X (formerly Twitter), highlighting that XRP’s MVRC Ratio has fallen below the 200 EMA, indicating a potential shift in the long-term market trend.

Given the current market sentiment, this could present an ideal buy-the-dip opportunity, with the possibility of a price rebound as long as XRP holds above the $2 level. Otherwise, a massive crash could be on the horizon.

Bullish on-chain signal

Besides price predictions and rising participation, on-chain metrics indicate that bulls are currently in control, as reported by the on-chain analytics firm Coinglass.

Data reveals that traders are over-leveraged at the $2.019 level, which appears to be a key support, with $76 million worth of long positions built in the hope that the price won’t drop below this level.

On the other hand, $2.142 is another over-leveraged level, where traders have built $31.54 million worth of short positions, anticipating that the price won’t surpass this level.

However, since long bets exceed short positions, it clearly indicates that bulls are currently dominating the asset.

$1.55 million worth of XRP outflow

Meanwhile, long-term holders are also accumulating XRP tokens, as reported by Coinglass data.

Spot inflow/outflow data revealed that exchanges have witnessed an outflow of an impressive $1.55 million worth of XRP in the past 24 hours, indicating potential accumulation.

When combining these on-chain metrics with traders holding significant long positions and exchanges continuing to see outflows, it indicates potential buying pressure and upside momentum in the coming days.