- XRP could reach $6.5 or more by 2030, dependent on Ripple’s adoption.

- Sustained demand for BTC and XRP could push XRP to a new all-time high.

Ripple [XRP] was up 10% over the past week, showing resilience as a large-cap altcoin that only Binance Coin [BNB] and Cardano [ADA] have matched over the same time.

The hype for Ripple as a platform has grown steadily, and this was reflected on the price chart.

The company’s stablecoin RLUSD has seen sustained growth since its launch, and its total supply reached $120 million. Its usage on the XRP Ledger has also increased due to the reduced transaction fees.

Data from CryptoQuant showed that the transaction count was much higher on XRPL than on the Ethereum [ETH] network.

With Ripple having lofty aims to enable secure, instant, low-cost global transactions, much of the industry’s eyes are on the company and its token. How high could the price go by 2030?

XRP price prediction: Is $10 a viable target?

The crypto market is a rapidly changing beast, and it is very hard to make predictions a few months down the line, let alone five years. Yet, based solely on the price action, a decent attempt is possible.

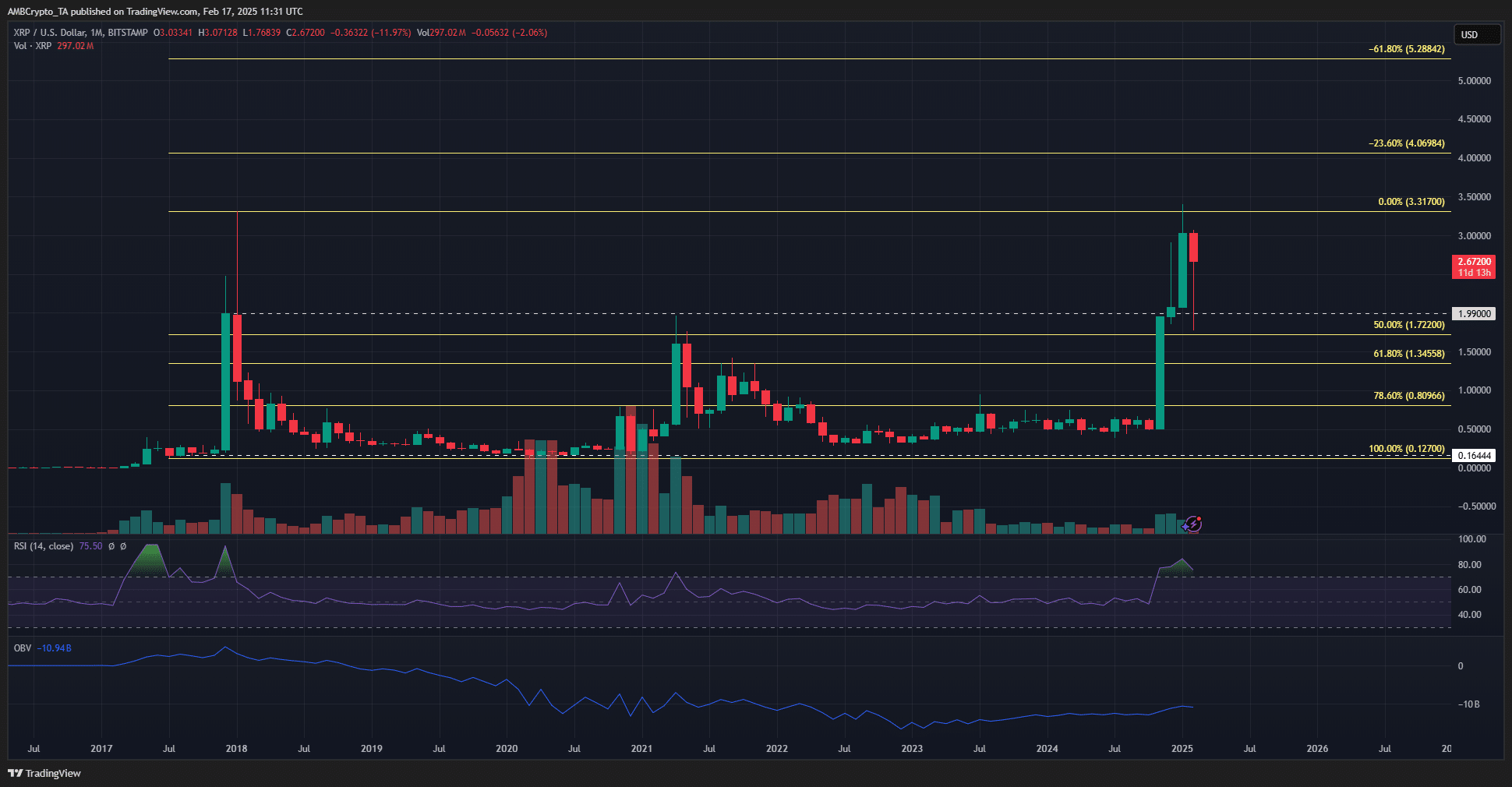

On the monthly chart, the swing structure has been bullish since 2017. The $0.1644 level marked the lows from the 2017 rally. The absence of a monthly session close below this level was a sign of long-term bullishness.

Now, the previous session close at $1.99, which marked a key level, has been flipped to support. The early February selling pressure saw the level retested.

According to this chart, a new all-time high was set, but Coingecko data disagrees. This could be due to price data from different exchanges.

In either scenario, the strong move higher in recent months and a test of the 2017 highs meant that a breakout is likely at hand.

The Fibonacci extension levels showed that $4.06 and $5.28 were possible targets for this cycle.

The latter target would take the token’s market cap to $305 billion, which is roughly $30 billion shy of the current ETH market cap.

From a technical standpoint, the bullish structure of XRP on the monthly chart meant that the 61.8% and 100% extension levels at $5.28 and $6.5 were achievable.

Whether this actually materializes would be wholly in the hands of the market as a whole, and would depend on XRP adoption and also on Bitcoin’s performance.

A rising tide lifts all boats, and altcoins would certainly benefit from greater BTC demand.

Coming back to the XRP price chart, a weekly session close below the $2.08 level would be the first sign of a market structure shift, and could serve as a warning for a deeper retracement.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion